Asian Market Stocks That May Be Priced Below Intrinsic Value Estimates

As Asian markets navigate a complex landscape of regulatory changes and economic shifts, investors are increasingly focused on identifying stocks that may be priced below their intrinsic value. In this environment, a good stock is often characterized by strong fundamentals and resilience to market fluctuations, making it an attractive option for those seeking potential opportunities in undervalued equities.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhongji Innolight (SZSE:300308) | CN¥581.90 | CN¥1151.94 | 49.5% |

| Wacom (TSE:6727) | ¥794.00 | ¥1547.14 | 48.7% |

| Suzhou Shihua New Material Technology (SHSE:688093) | CN¥39.65 | CN¥78.65 | 49.6% |

| Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990) | HK$429.40 | HK$840.69 | 48.9% |

| Shanghai MicroPort MedBot (Group) (SEHK:2252) | HK$30.92 | HK$61.38 | 49.6% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥2330.00 | ¥4645.31 | 49.8% |

| PharmaResearch (KOSDAQ:A214450) | ₩428000.00 | ₩846322.49 | 49.4% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.22 | CN¥26.04 | 49.2% |

| Komehyo HoldingsLtd (TSE:2780) | ¥3415.00 | ¥6750.42 | 49.4% |

| Chifeng Jilong Gold MiningLtd (SHSE:600988) | CN¥38.39 | CN¥76.15 | 49.6% |

Let's uncover some gems from our specialized screener.

Chow Tai Fook Jewellery Group (SEHK:1929)

Overview: Chow Tai Fook Jewellery Group Limited is an investment holding company that manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally with a market cap of HK$135.25 billion.

Operations: The company's revenue is primarily derived from Mainland China, contributing HK$73.75 billion, and from Hong Kong, Macau, and other markets with HK$16.58 billion.

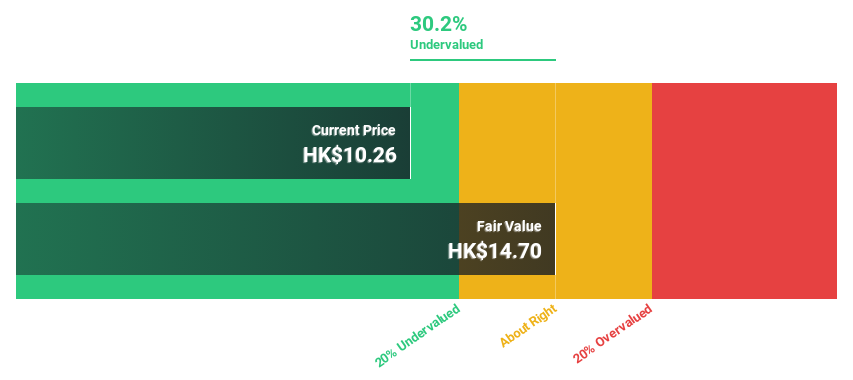

Estimated Discount To Fair Value: 34.1%

Chow Tai Fook Jewellery Group is trading at 34.1% below its estimated fair value, indicating it may be undervalued based on cash flows. Despite slower revenue growth forecasts compared to the Hong Kong market, earnings are expected to grow significantly over the next three years. Recent strategic expansions into Southeast Asia and brand transformation efforts underscore potential for sustainable growth, though current dividends are not well covered by earnings or free cash flows.

- Our comprehensive growth report raises the possibility that Chow Tai Fook Jewellery Group is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Chow Tai Fook Jewellery Group.

Shanghai MicroPort MedBot (Group) (SEHK:2252)

Overview: Shanghai MicroPort MedBot (Group) Co., Ltd. operates in the medical technology sector, focusing on the development and commercialization of surgical robots, with a market cap of HK$31.89 billion.

Operations: The company generates revenue from the sale of medical devices, amounting to CN¥333.70 million.

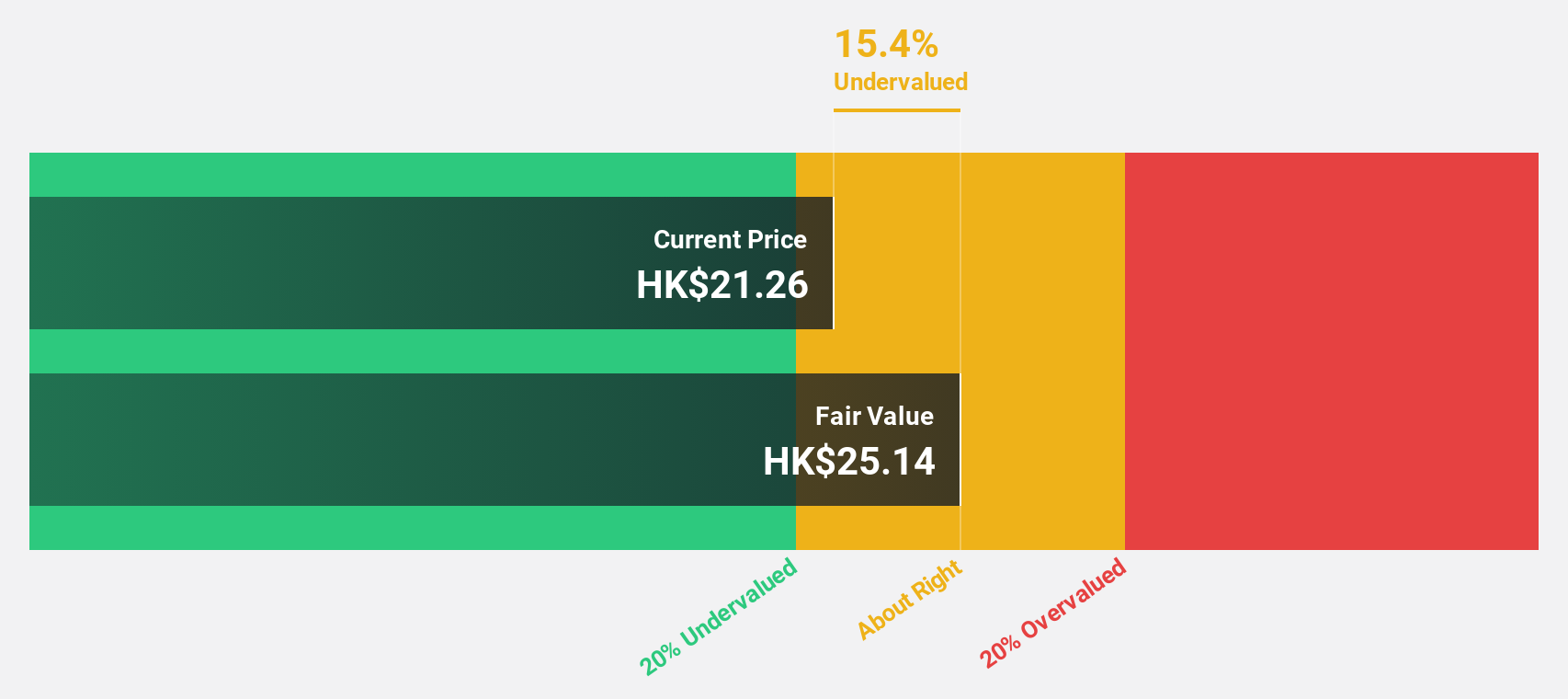

Estimated Discount To Fair Value: 49.6%

Shanghai MicroPort MedBot is trading at 49.6% below its estimated fair value, highlighting potential undervaluation based on cash flows. The company's revenue is projected to grow significantly faster than the Hong Kong market, with expectations of profitability within three years. Recent approval of the UniPath robotic system by China's NMPA and strong commercial performance of its Toumai surgical robot underscore robust product innovation and adoption, supporting future cash flow growth despite recent share price volatility.

- In light of our recent growth report, it seems possible that Shanghai MicroPort MedBot (Group)'s financial performance will exceed current levels.

- Get an in-depth perspective on Shanghai MicroPort MedBot (Group)'s balance sheet by reading our health report here.

Shanjin International Gold (SZSE:000975)

Overview: Shanjin International Gold Co., Ltd. engages in the exploration, mining, and trading of precious and non-ferrous metal ores in China with a market capitalization of CN¥96.54 billion.

Operations: Shanjin International Gold Co., Ltd. generates revenue through its operations in the exploration, mining, and trading of precious and non-ferrous metal ores within China.

Estimated Discount To Fair Value: 45.9%

Shanjin International Gold is trading at 45.9% below its estimated fair value, suggesting significant undervaluation based on cash flows. Despite earnings growth slower than the market, the company's revenue and net income have shown strong year-on-year increases, with revenue reaching CN¥14.99 billion for nine months in 2025. The company completed a share buyback of 1,834,929 shares worth CN¥34.09 million by December 2025, reflecting strategic capital management amidst its unstable dividend history.

- According our earnings growth report, there's an indication that Shanjin International Gold might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Shanjin International Gold.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 260 more companies for you to explore.Click here to unveil our expertly curated list of 263 Undervalued Asian Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English