NetApp Earnings Preview: What to Expect

Valued at a market cap of $18.6 billion, NetApp, Inc. (NTAP) is a California-based technology company specializing in intelligent data infrastructure and data management solutions for enterprise and cloud environments. Founded in 1992, the company provides a suite of products and services that help organizations store, manage, protect and mobilize data across on-premises, hybrid cloud and public cloud platforms. Its offerings include unified data storage systems, data management software (notably the ONTAP operating system), all-flash and hybrid storage arrays, cloud data services, backup and disaster-recovery tools, and professional services to support deployment and optimization.

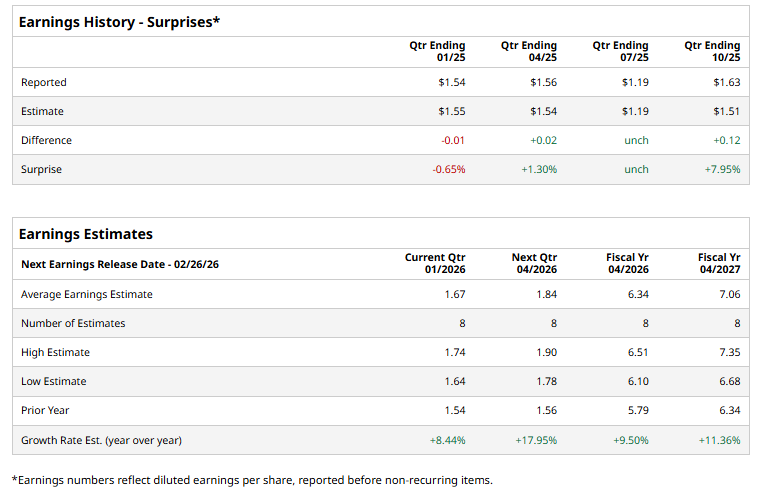

It is scheduled to announce its fiscal Q3 earnings for 2026 in the near future. Ahead of this event, analysts expect this tech company to report a profit of $1.67 per share, up 8.4% from $1.54 per share in the year-ago quarter. The company has met or surpassed Wall Street’s earnings estimates in three of the last four quarters, while missing on another occasion.

For fiscal 2026, analysts expect NTAP to report a profit of $6.34 per share, up 9.5% from $5.79 per share in fiscal 2025. Furthermore, its EPS is expected to grow 11.4% year over year to $7.06 in fiscal 2027.

NetApp has declined 21.5% over the past 52 weeks, considerably underperforming both the S&P 500 Index's ($SPX) 13.7% return and the Technology Select Sector SPDR Fund’s (XLK) 21.8% uptick over the same time frame.

On Jan. 20, shares of NetApp slid 7.9% in morning trading after Morgan Stanley (MS) downgraded the stock to “Underweight” from “Equal-weight” and sharply lowered its price target to $89 from $117. The brokerage cited concerns that consensus earnings and revenue expectations were overly optimistic, pointing to weakening enterprise spending on storage hardware and rising memory costs.

Wall Street analysts are moderately optimistic about NTAP’s stock, with an overall "Moderate Buy" rating. Among 19 analysts covering the stock, six recommend "Strong Buy," 12 suggest "Hold,” and one “Strong Sell.” The mean price target for NTAP is $124.69, indicating a 28.4% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English