Assessing Sonos (SONO) Valuation After Board Refresh Restructuring And Rising Competitive Pressures

Why Sonos stock is back in focus after board shake up and restructuring

Sonos (SONO) is drawing fresh investor attention after appointing three seasoned technology and finance executives to its Board of Directors, alongside recent restructuring moves, layoffs, and rising competitive pressure in home audio.

See our latest analysis for Sonos.

At a share price of $15.53, Sonos has seen a 13.19% 1 month share price decline and an 11.21% year to date share price fall. Its 10.14% 1 year total shareholder return points to earlier positive momentum that now appears to be cooling as investors weigh the board refresh, restructuring and rising competitive risks.

If Sonos’ recent moves have you thinking about where else change could reshape returns, this could be a good moment to scan high growth tech and AI stocks for other tech names catching attention.

With Sonos shares lower over the past month, a 6 month gain of 50% already on the table, and analysts’ targets sitting above today’s price, you have to ask: is this a fresh entry point, or is future growth already priced in?

Most Popular Narrative: 13% Undervalued

At $15.53, the most followed narrative sets Sonos’ fair value at $17.85, framing recent share weakness against expectations for better leverage and cash generation.

Sonos's structural cost base transformation, driven by reorganization and substantial operating expense reductions, is creating a pathway for sustainable margin expansion and stronger earnings even during weak industry cycles, with full realization of these savings expected in FY26.

Curious what kind of revenue growth, margin lift and future earnings multiple are needed to back that fair value? The narrative lays out a specific playbook, including expectations on profitability timing, share count and discount rate that you may want to stress test for yourself.

Result: Fair Value of $17.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, those assumptions could be knocked off course if tariff driven cost pressures squeeze margins further, or if a prolonged hardware lull weakens volumes and brand momentum.

Find out about the key risks to this Sonos narrative.

Another View on Sonos’ Pricing

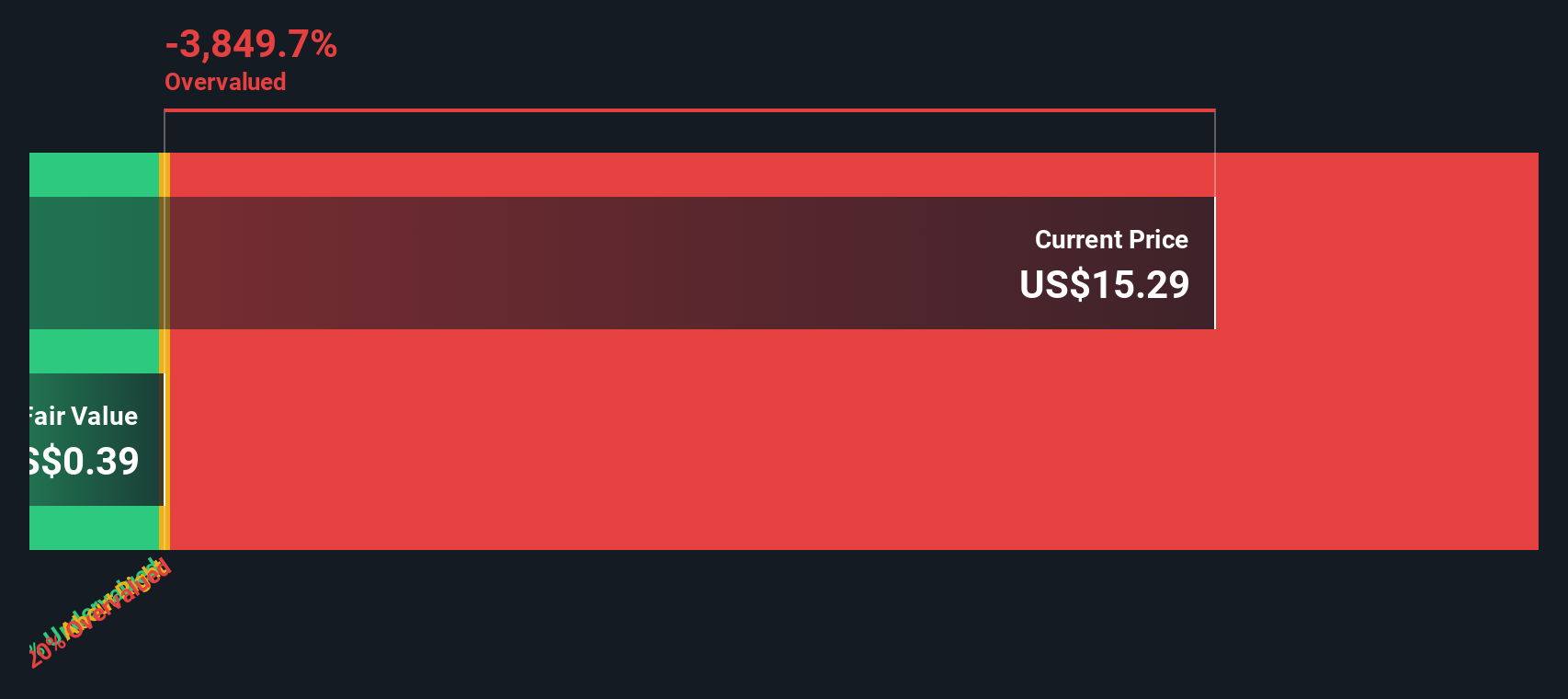

While the popular narrative sees Sonos as 13% undervalued at $17.85 per share, our DCF model points the other way, with an estimated future cash flow value of $6.15. That gap suggests investors should think carefully about which story they trust more and why.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sonos Narrative

If you are not fully on board with this view or prefer to run your own numbers, you can build a tailored thesis in minutes using Do it your way.

Prefer to form your own view? Our platform makes it easy to explore a stock's fundamentals and create your own narrative in minutes.

Looking for more investment ideas?

If Sonos has you thinking more broadly about where to put fresh capital to work, this can be a useful time to widen your search with a few targeted screens.

- Spot potential value candidates early by scanning these 875 undervalued stocks based on cash flows that the market may not be fully pricing in yet.

- Tap into AI driven growth themes by checking out these 24 AI penny stocks that are tied directly to real business use cases.

- Add a different return profile to your watchlist by reviewing these 12 dividend stocks with yields > 3% that focus on regular income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English