Vision Values Holdings (HKG:862) Might Have The Makings Of A Multi-Bagger

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So on that note, Vision Values Holdings (HKG:862) looks quite promising in regards to its trends of return on capital.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Vision Values Holdings is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.016 = HK$6.4m ÷ (HK$587m - HK$173m) (Based on the trailing twelve months to June 2025).

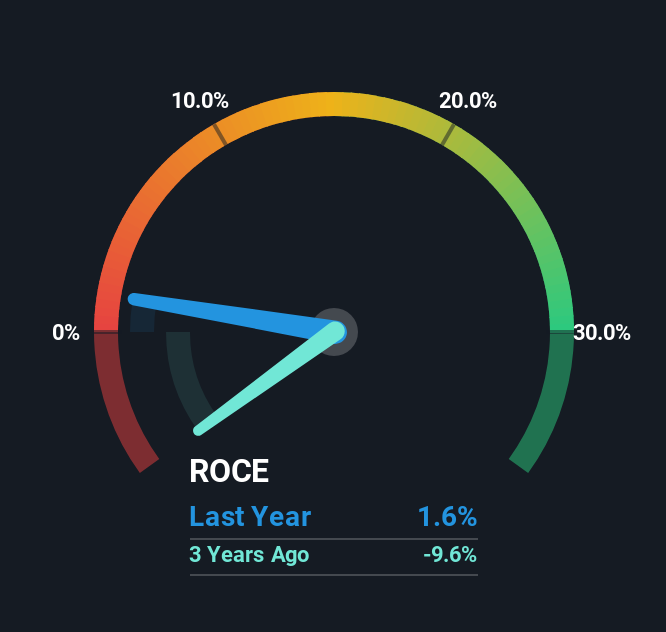

Therefore, Vision Values Holdings has an ROCE of 1.6%. Ultimately, that's a low return and it under-performs the IT industry average of 6.3%.

See our latest analysis for Vision Values Holdings

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Vision Values Holdings has performed in the past in other metrics, you can view this free graph of Vision Values Holdings' past earnings, revenue and cash flow.

How Are Returns Trending?

We're delighted to see that Vision Values Holdings is reaping rewards from its investments and has now broken into profitability. While the business was unprofitable in the past, it's now turned things around and is earning 1.6% on its capital. On top of that, what's interesting is that the amount of capital being employed has remained steady, so the business hasn't needed to put any additional money to work to generate these higher returns. That being said, while an increase in efficiency is no doubt appealing, it'd be helpful to know if the company does have any investment plans going forward. So if you're looking for high growth, you'll want to see a business's capital employed also increasing.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. Effectively this means that suppliers or short-term creditors are now funding 30% of the business, which is more than it was five years ago. Keep an eye out for future increases because when the ratio of current liabilities to total assets gets particularly high, this can introduce some new risks for the business.

What We Can Learn From Vision Values Holdings' ROCE

In summary, we're delighted to see that Vision Values Holdings has been able to increase efficiencies and earn higher rates of return on the same amount of capital. Although the company may be facing some issues elsewhere since the stock has plunged 79% in the last five years. Still, it's worth doing some further research to see if the trends will continue into the future.

Vision Values Holdings does have some risks though, and we've spotted 1 warning sign for Vision Values Holdings that you might be interested in.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English