Assessing Hesai Group (HSAI) Valuation After Rapid Revenue Growth And Rising Investor Optimism

Recent revenue trends and market reaction

Hesai Group (HSAI) has caught investor attention after reporting revenue growth of 43% over the past year and 160% over the last three years, along with a recent 28% share price gain over the past month.

See our latest analysis for Hesai Group.

The recent 24.1% 30 day share price return and 17.1% 90 day share price return, alongside a 1 year total shareholder return of 80.3%, suggest momentum has been building around Hesai Group as investors react to its revenue trajectory and reassess potential risks and rewards at the current US$27.94 share price.

If this kind of move in LiDAR and automation gets you thinking about wider opportunities, it could be a good time to scan high growth tech and AI stocks for other ideas in related areas.

With Hesai Group trading at US$27.94 and metrics like its value score of 1 and a modest intrinsic discount of about 7%, the real question is whether the recent surge leaves upside on the table or whether markets are already pricing in future growth.

Most Popular Narrative: 9.6% Undervalued

With Hesai Group last closing at $27.94 against a most-followed fair value estimate of $30.91, the key question is how that gap is being justified.

The projection of 2025 LiDAR shipments reaching 1.2 million to 1.5 million units, with nearly 200,000 high-margin robotic LiDAR units, is expected to significantly boost revenue. Anticipated net revenues of RMB 3 billion to RMB 3.5 billion for 2025, driven by strong demand and mass market adoption, indicate potential growth in revenue.

Want to see what sits behind that revenue build up and fair value gap? The narrative leans on aggressive unit volumes, richer mix, and a future earnings multiple that assumes sustained momentum. Curious how all those moving parts tie together into $30.91 per share?

Result: Fair Value of $30.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, it is worth keeping in mind that heavy reliance on a few major clients and ambitious capacity expansion plans could quickly challenge those optimistic earnings and valuation assumptions.

Find out about the key risks to this Hesai Group narrative.

Another way to look at valuation

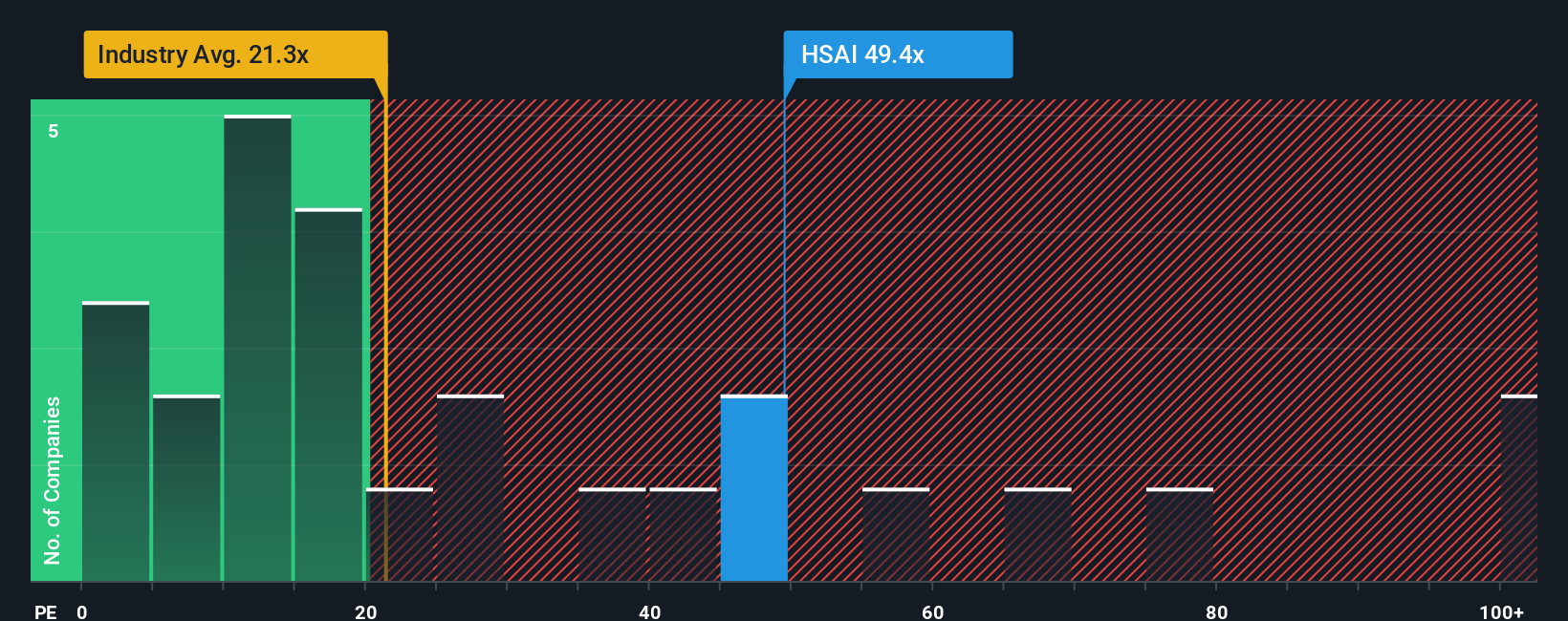

While our DCF work suggests Hesai Group is about 7.5% below fair value, the current P/E of 71.2x paints a tighter picture. That is well above the US Auto Components average of 24.5x, peers at 30.1x, and even the 45.5x fair ratio our model points to.

In practice, that kind of gap can mean more room for sentiment swings if growth or margins fall short of expectations. The real question is whether you think earnings can grow fast enough, for long enough, for the market P/E to stay this far above that fair ratio.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hesai Group Narrative

If you look at the numbers and come to a different conclusion, or simply want to test your own view, you can build a custom thesis in minutes with Do it your way.

A great starting point for your Hesai Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Hesai Group has sharpened your focus, do not stop here. Use the Simply Wall St Screener to spot fresh ideas before they slip past you.

- Target dependable income and shortlist companies offering attractive yields using these 13 dividend stocks with yields > 3% as a starting point for your watchlist.

- Capitalize on market mispricing by scanning these 872 undervalued stocks based on cash flows and highlight businesses where prices differ from their cash flow potential.

- Position yourself early in emerging themes by reviewing these 18 cryptocurrency and blockchain stocks that are tied to cryptocurrency and blockchain developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English