A Look At TE Connectivity (TEL) Valuation After Recent Short Term Share Price Weakness

Why TE Connectivity Is On Investors’ Radar Today

TE Connectivity (TEL) is drawing interest after recent share performance that shows a 3.2% decline over the past day, adding to weaker moves over the past week, month, and past 3 months.

With the stock last closing at $223.84 and a value score of 2, investors are weighing how this pricing lines up with the company’s current revenue of $18.095b and net income of $2.066b.

See our latest analysis for TE Connectivity.

The recent 1 day share price return of 3.25% decline adds to weaker short term momentum, yet the 1 year total shareholder return of 51.29% and 5 year total shareholder return of 94.91% point to a much stronger longer term picture.

If TE Connectivity’s move has you rethinking where opportunities might be, this could be a good moment to broaden your search with high growth tech and AI stocks.

So, with short-term returns under pressure but 1-year and 5-year gains still strong, is TE Connectivity quietly offering value today, or is the current share price already reflecting expectations for future growth?

Most Popular Narrative: 18.3% Undervalued

TE Connectivity’s most followed narrative pegs fair value at $274.06 versus the last close of $223.84. This frames today’s price against a higher long term view built on earnings power and cash generation.

Broad-based order growth, especially in Industrial and Energy markets, coupled with positive early signs of recovery in factory automation, creates a durable foundation for double-digit EPS growth and high free cash flow conversion (>100%), further strengthening the company's capacity to invest in secular tailwinds or execute value-accretive acquisitions.

Want to see what is behind that fair value gap? The narrative leans on steady revenue expansion, rising margins, and a future earnings multiple that assumes TE Connectivity keeps converting growth into cash at a high rate. Curious how those moving parts add up to that price tag and where buybacks fit into the story?

Result: Fair Value of $274.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story depends on AI, energy and Asian transport demand holding up, and on TE continuing to execute its footprint and acquisition plans without margin strain.

Find out about the key risks to this TE Connectivity narrative.

Another View On Valuation

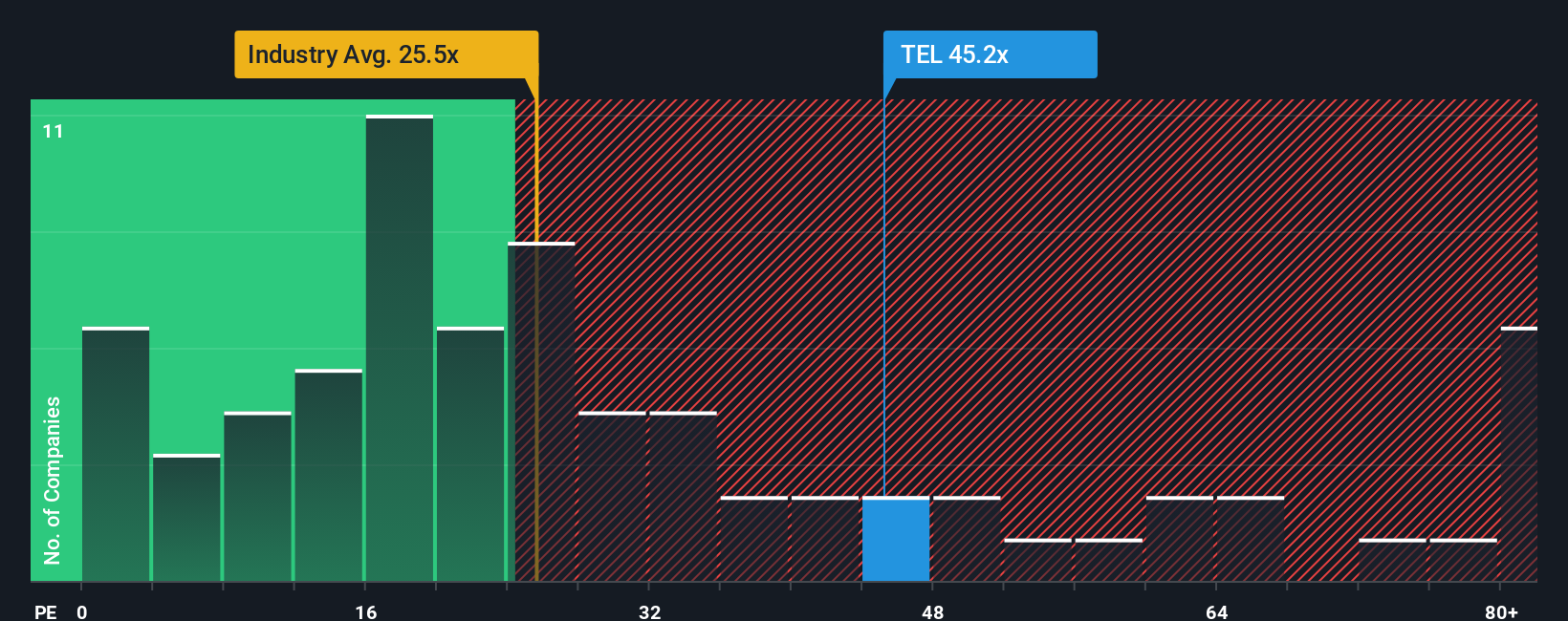

While the narrative suggests TE Connectivity is 18.3% undervalued, the P/E ratio tells a different story. At 31.8x, the stock trades above both the US Electronic industry at 26.9x and the fair ratio of 29.3x. This points to valuation risk if sentiment cools. Which signal do you trust more right now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TE Connectivity Narrative

If this view does not quite match how you see TE Connectivity, you can review the same data, develop your own perspective quickly, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TE Connectivity.

Ready For More Investment Ideas?

If TE Connectivity has sharpened your thinking, do not stop here. Broaden your watchlist with other angles the market might be overlooking right now.

- Spot potential turnaround candidates by scanning these 3519 penny stocks with strong financials that already show stronger financial footing than many expect at this size.

- Target long term themes in automation and digital infrastructure by checking out these 23 AI penny stocks shaping how data and computing power get used across industries.

- Hunt for possible mispricings by filtering for these 876 undervalued stocks based on cash flows that screens on cash flow based metrics rather than headlines alone.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English