Assessing CTS (CTS) Valuation After Trade Tariff Relief Lifts Investor Interest

The U.S. administration’s decision to call off planned tariffs on European allies, following talks in Davos, pulled trade tensions off center stage and lifted interest in technology names such as CTS (CTS).

See our latest analysis for CTS.

At a share price of US$50.18, CTS has recently seen a 1-day share price return of 0.90%, a 30-day share price return of 12.89%, and a 90-day share price return of 23.87%, while its 1-year total shareholder return of 1.35% decline contrasts with 3-year and 5-year total shareholder returns of 17.33% and 62.55%. This points to shorter term momentum building after a softer 12-month patch.

If trade relief and interest in industrial tech have your attention, it could be a good moment to size up aerospace and defense stocks as potential peers on your watchlist.

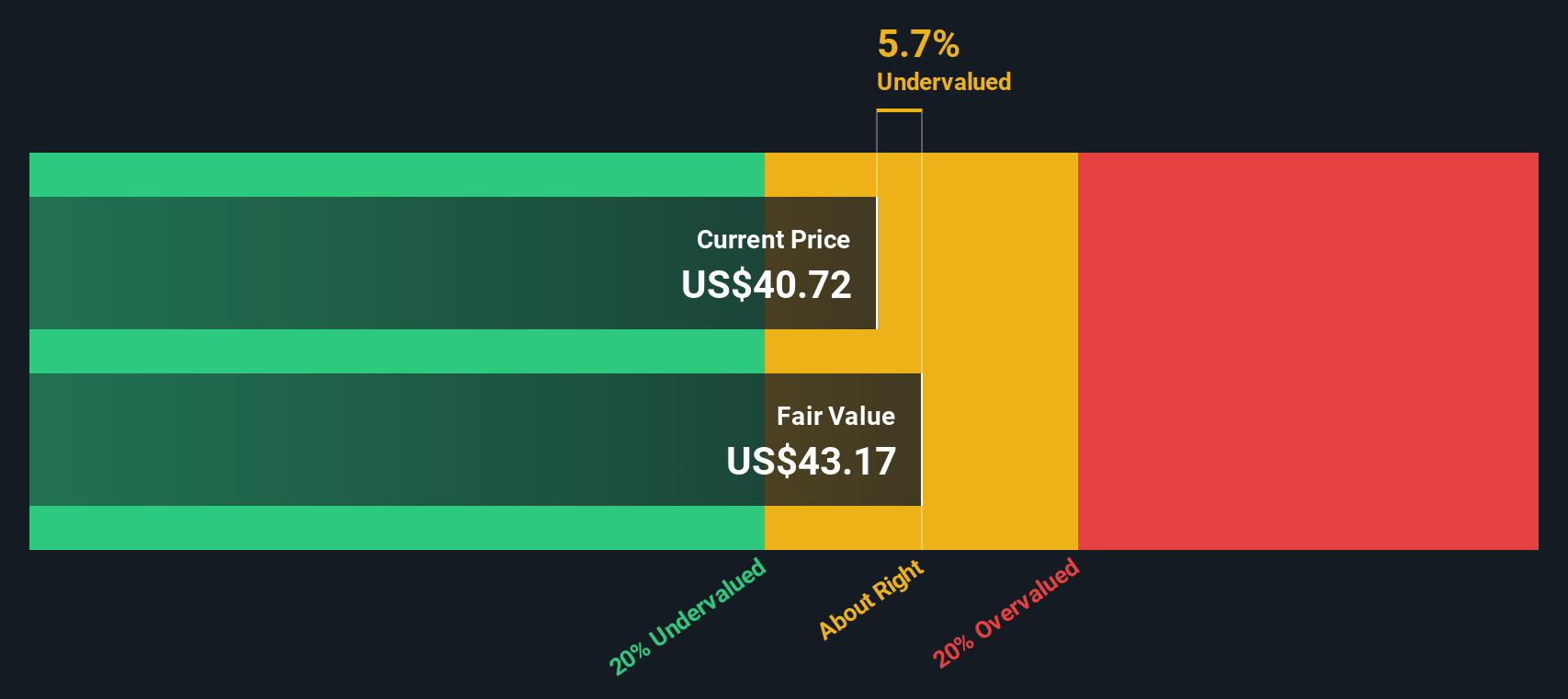

With the share price at US$50.18 and recent momentum following tariff relief, the key question is whether CTS still trades below its underlying potential or if the market is already pricing in future growth.

Most Popular Narrative: 6.8% Overvalued

The most followed narrative puts CTS’s fair value at $47, which sits below the current $50.18 share price and frames the latest rally in a different light.

Ongoing investment in next-generation sensor and actuator development, alongside the movement up the value chain from component supplier to solutions provider in areas like aerospace and defense, enables CTS to command premium pricing and supports gross margin expansion. Structural increases in automation, device connectivity, and industrial recovery, as reflected in bookings growth and new customer wins, support long term demand for CTS's advanced sensing and control technologies, providing a catalyst for both top line revenue expansion and margin improvement.

Want to see what kind of revenue path and margin profile sits behind that $47 fair value anchor, plus the earnings multiple it assumes by the late 2020s? The full narrative lays out a detailed earnings and buyback roadmap that you can compare against your own expectations.

Result: Fair Value of $47 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on transportation exposure and tariff or geopolitical pressures not worsening. Either factor could quickly challenge those margin and earnings assumptions.

Find out about the key risks to this CTS narrative.

Another Angle On Valuation

Our SWS DCF model points to a fair value of about $43.47 per share, which sits below the current $50.18 price and supports the view that CTS is trading on the expensive side. With two methods pointing in the same direction, how comfortable are you with what is already reflected in the price?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CTS Narrative

If you look at these numbers and come to a different conclusion, or just prefer to test your own assumptions against the data, you can build a complete view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding CTS.

Ready to hunt for more ideas?

If CTS has sparked your curiosity, do not stop here, the right mix of fresh ideas can be the difference between spotting potential and missing it.

- Spot potential value by checking out these 887 undervalued stocks based on cash flows that currently trade at prices some investors may see as below their cash flow estimates.

- Ride the next wave of automation and data by scanning these 23 AI penny stocks shaping how software, hardware, and services use artificial intelligence.

- Position your portfolio for future computing trends by reviewing these 23 quantum computing stocks working on real world quantum applications and tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English