Assessing IPG Photonics (IPGP) Valuation After New Laser Systems Showcase At Major Industry Event

IPG Photonics (IPGP) is showcasing a broad lineup of new laser systems at the 2026 SPIE Photonics West Exhibition, highlighting compact high power modules for cleaning, welding, micro machining, semiconductor work, and defense focused directed energy.

See our latest analysis for IPG Photonics.

The recent product showcase arrives as momentum in the shares has picked up, with a 30-day share price return of 17.01% and a year to date share price return of 17.54%. The 1-year total shareholder return of 24.57% contrasts with weaker 3 and 5 year total shareholder returns.

If this kind of specialist photonics story interests you, it could be a good time to see which other aerospace and defense stocks are starting to attract attention.

So with IPG Photonics trading at US$87.97, sitting about 9% below the average analyst price target and with a mixed track record over 3 and 5 years, is this renewed momentum a fresh entry point, or is the market already banking on future growth?

Most Popular Narrative: 8.4% Undervalued

The most followed narrative puts IPG Photonics' fair value at about $96.08, a touch above the $87.97 share price, and builds a detailed case around recovery and new applications.

New growth initiatives in medical (e.g., thulium lasers for urology), semiconductor, and micromachining end-markets are gaining early traction, diversifying revenue streams and supporting higher margins over time as these higher-value verticals scale. Recent product innovations like the CROSSBOW directed energy system, validated with multiple unit deliveries and key partnerships (e.g., Lockheed Martin), open up opportunities in defense and critical infrastructure, supporting both revenue acceleration and improved operating leverage.

Curious how this mix of medical, semiconductor, micromachining, and defense work translates into that fair value number, the narrative leans heavily on accelerating earnings, expanding margins, and a richer future earnings multiple that is not yet obvious just from the current share price.

Result: Fair Value of $96.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative can quickly be challenged if welding and micromachining demand weakens again, or if high R&D and CapEx fail to translate into stronger earnings.

Find out about the key risks to this IPG Photonics narrative.

Another View: High P/E Sends A Very Different Signal

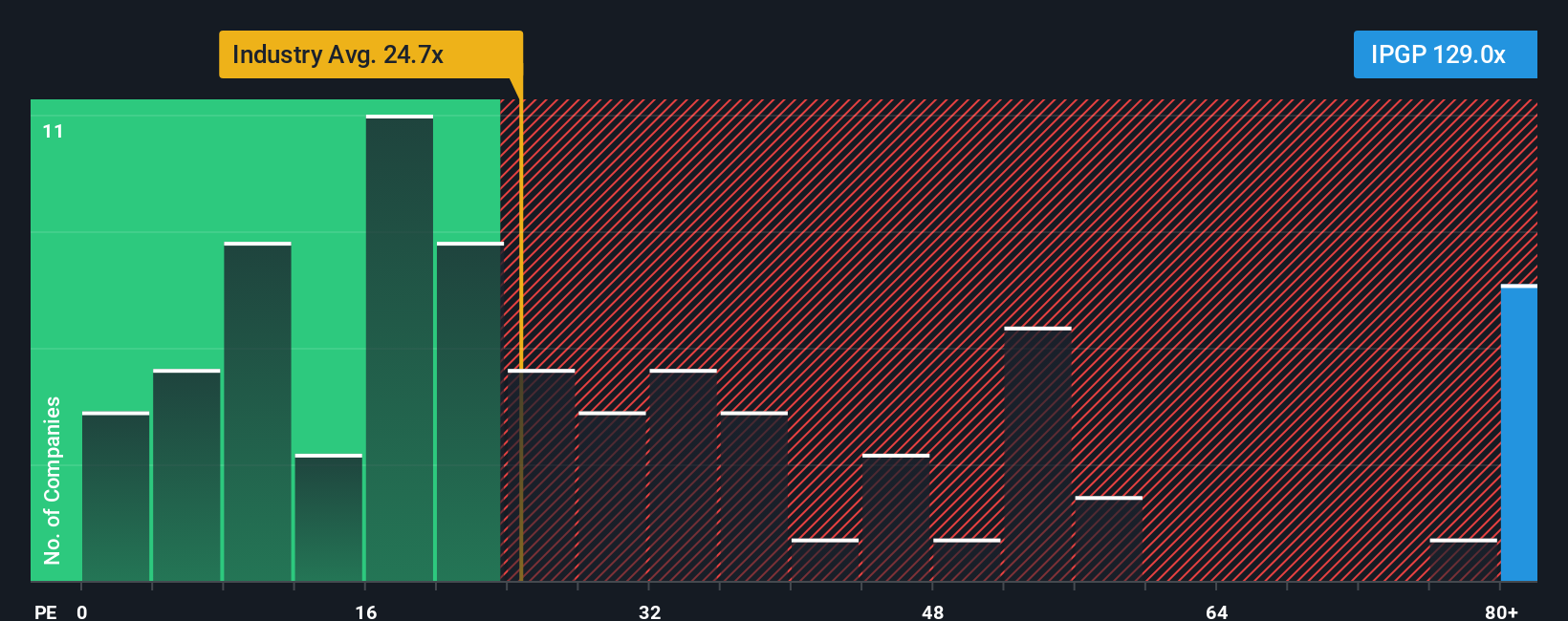

That 8.4% “undervalued” fair value sits uncomfortably beside IPG Photonics’ current P/E of 144.5x, compared with 26.9x for the US Electronic industry, 34.8x for peers, and a fair ratio of 37.5x. That gap points to richer expectations, so is the real risk that the shares are already priced for perfection?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IPG Photonics Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding IPG Photonics.

Looking for more investment ideas?

If you are serious about sharpening your stock list, the Simply Wall St Screener can help you quickly surface focused ideas without getting lost in noise or hype.

- Target potential mispricings by checking out these 888 undervalued stocks based on cash flows that may offer more attractive entry points based on their cash flows.

- Tap into long term technology shifts by reviewing these 23 quantum computing stocks that are working on next generation computing capabilities.

- Strengthen your income watchlist by scanning these 13 dividend stocks with yields > 3% that combine yield above 3% with stock market exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English