Assessing Teledyne Technologies (TDY) Valuation After Strong 2025 Results And Fresh 2026 Earnings Guidance

Teledyne Technologies (TDY) just paired a detailed full year 2025 earnings release with fresh 2026 guidance, giving you a clearer picture of how its defense, imaging, and commercial businesses are shaping current expectations.

See our latest analysis for Teledyne Technologies.

Those earnings, fresh 2026 guidance, recent buybacks, and the BlackCAT CubeSat win have arrived alongside firm momentum, with a 30 day share price return of 19.07% and a 1 year total shareholder return of 20.98%. The 5 year total shareholder return of 60.52% points to a longer term record that investors are weighing against today’s US$616.02 share price and current expectations.

If Teledyne’s recent move has you thinking about other defense exposed names, this could be a useful moment to scan aerospace and defense stocks for fresh ideas.

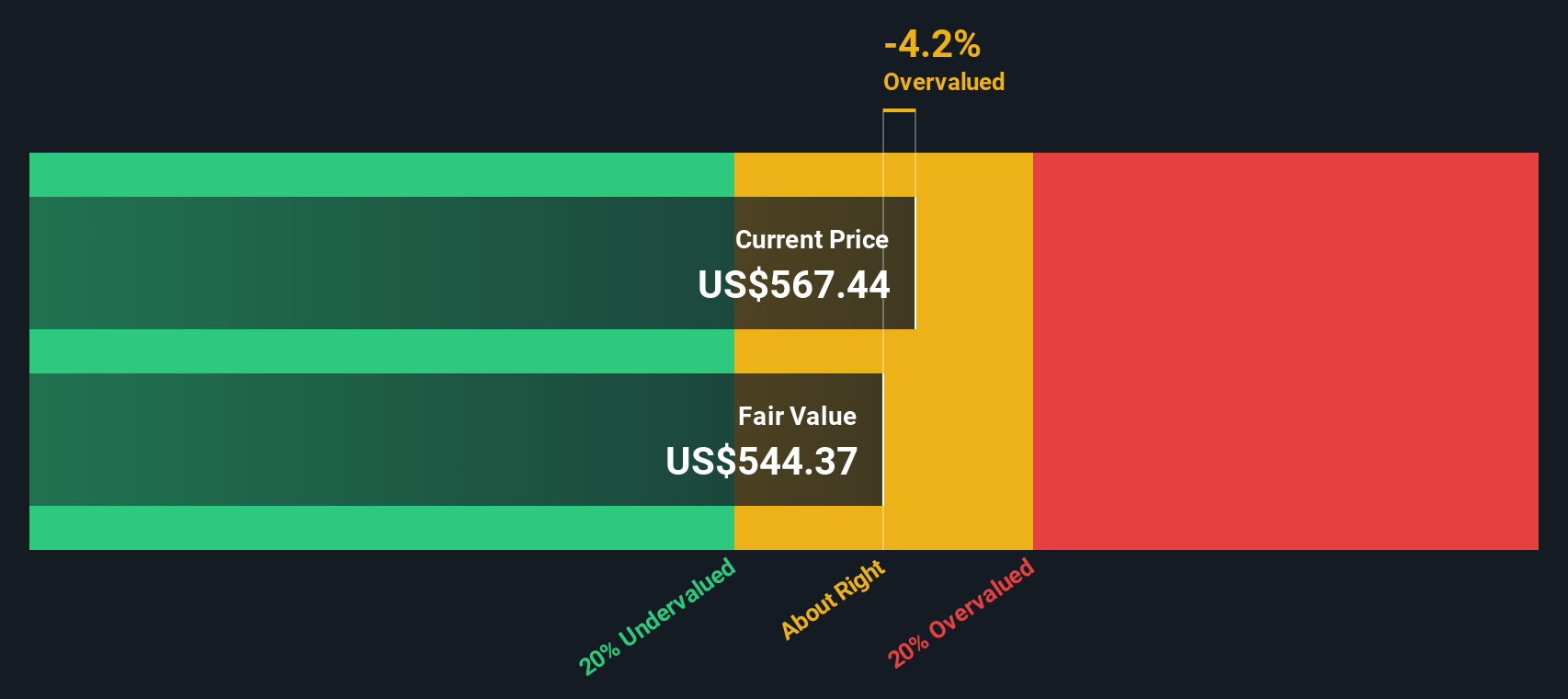

With Teledyne posting higher full year sales and net income in 2025, laying out fresh 2026 EPS guidance, and completing a US$400 million buyback, you have to ask: is there still an entry point here, or is the market already pricing in the future?

Most Popular Narrative: 8% Undervalued

Teledyne’s most followed narrative pegs fair value at $665.77 versus the recent $616.02 close, setting up a story built around measured growth and margin assumptions.

Consistent execution of a disciplined M&A strategy, combined with a focus on cost efficiencies and operational improvements in recent acquisitions, is enabling ongoing margin expansion, accretive earnings growth, and increased scale supporting both sustained EPS growth and potential share buybacks.

Want to see what is backing that higher fair value? The narrative leans on steady top line expansion, firmer margins, and a richer future earnings multiple. The exact mix of those levers may surprise you.

Result: Fair Value of $665.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still watchpoints here, including softer organic sales momentum and tariff-exposed supply chains that could pressure margins if conditions turn less friendly.

Find out about the key risks to this Teledyne Technologies narrative.

Another View: Full Cash Flow Model Flags Less Upside

Teledyne’s most followed narrative points to a fair value of $665.77, yet our DCF model comes out at $551.12, which is below the current $616.02 share price. If cash flows do not ramp as hoped, is the market already paying up for a bit too much optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Teledyne Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Teledyne Technologies Narrative

If you are not on board with this view or simply want to test your own assumptions against the numbers, you can build a fresh thesis in minutes using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Teledyne Technologies.

Ready for more investment ideas?

If Teledyne has sharpened your thinking, do not stop here. Use the Simply Wall St Screener to spot fresh ideas before they move without you.

- Spot potential value gaps by checking these 879 undervalued stocks based on cash flows that currently trade below their estimated cash flow based worth.

- Back emerging themes by scanning these 24 AI penny stocks that sit at the intersection of software, data and automation.

- Boost your income focus by reviewing these 13 dividend stocks with yields > 3% that offer yields above 3% with supporting fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English