Sea (NYSE:SE) Valuation Check As Growth Investments Weigh On Shopee Margins After Strong Quarterly Beat

Why Sea (NYSE:SE) is back in focus after its latest earnings

Sea (NYSE:SE) is in the spotlight after its September quarter results, where revenue growth of 38% and gross merchandise value growth of 28% topped expectations but coincided with a sequential drop in Shopee’s adjusted EBITDA margin.

See our latest analysis for Sea.

The share price has been choppy around the latest results, with a 7 day share price return of 4.47% contrasting with a 90 day share price return decline of 18.84%. At the same time, the 3 year total shareholder return of 83.54% stands in sharp contrast to the 5 year total shareholder return decline of 48.04%, suggesting longer term holders have seen very different outcomes depending on when they invested.

If Sea’s recent swings have you thinking about what else is moving in tech, it could be a good time to broaden your search with high growth tech and AI stocks.

With Sea’s shares down 18.84% over 90 days but still showing an 83.54% 3 year total return and trading below some intrinsic estimates, investors may ask whether this is a fresh entry point or whether potential future growth is already reflected in the price.

Most Popular Narrative: 33.4% Undervalued

Sea’s most followed valuation narrative places fair value at about $190 per share compared to the last close of $126.55, which is a wide gap to unpack.

Accelerating mobile internet adoption and rising youth digital literacy in Southeast Asia and Brazil are fueling user growth across Sea's e-commerce (Shopee), fintech (Monee), and gaming (Garena) businesses, which is supporting robust double-digit revenue growth and expanding the company's total addressable market for the long term.

Curious what kind of revenue trajectory, margin profile, and future earnings multiple are baked into that fair value? The full narrative lays out a detailed growth, profitability, and valuation path that goes well beyond the recent quarter.

Result: Fair Value of $190.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view could crack if competition squeezes Shopee’s growth or if Garena’s reliance on Free Fire leads to weaker gaming revenue and earnings.

Find out about the key risks to this Sea narrative.

Another angle on valuation

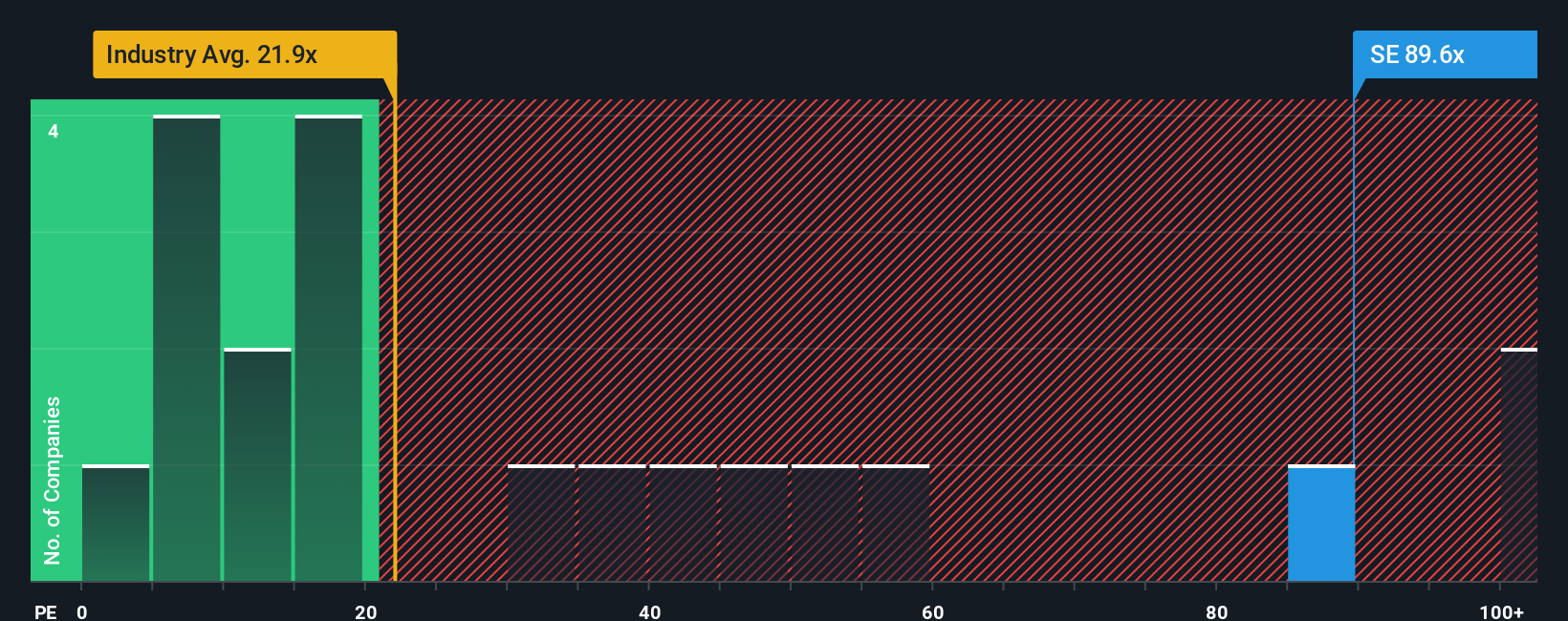

There is a catch. While the SWS model suggests Sea is trading 54.1% below its fair value of $275.47 based on future cash flows, the current P/E of 52.8x is well above the industry at 20x, peers at 44.9x, and even the fair ratio of 34.6x. Is this a margin of safety, or a premium that could unwind if expectations change?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sea Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a personalised Sea narrative yourself in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sea.

Looking for more investment ideas?

If you are serious about making your watchlist work harder, do not stop at one stock. Use the Screener to surface fresh, data driven ideas fast.

- Spot potential mispricings early by scanning these 877 undervalued stocks based on cash flows that may not yet be on everyone’s radar.

- Ride the AI momentum thoughtfully by checking out these 24 AI penny stocks that link real businesses to practical artificial intelligence use cases.

- Target higher income opportunities by reviewing these 14 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English