There's Reason For Concern Over IPG Photonics Corporation's (NASDAQ:IPGP) Massive 27% Price Jump

IPG Photonics Corporation (NASDAQ:IPGP) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

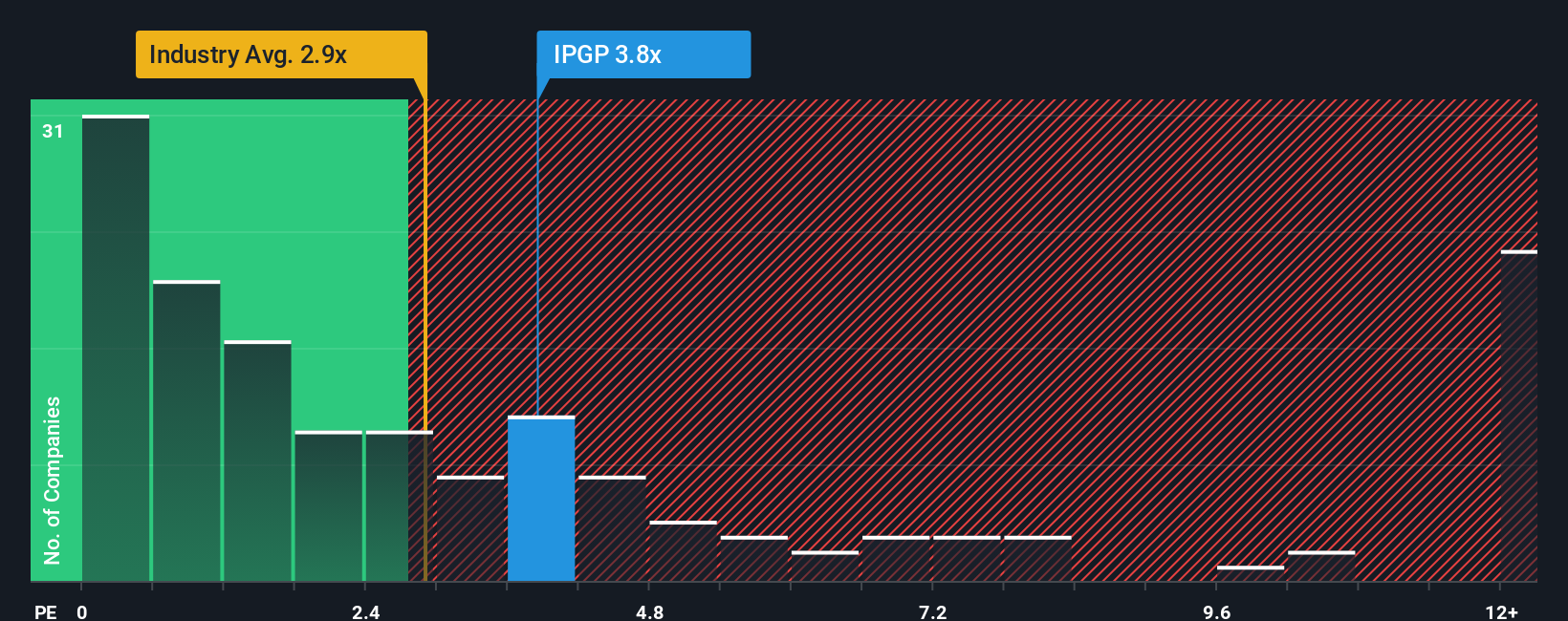

After such a large jump in price, you could be forgiven for thinking IPG Photonics is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 2.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for IPG Photonics

What Does IPG Photonics' Recent Performance Look Like?

While the industry has experienced revenue growth lately, IPG Photonics' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think IPG Photonics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like IPG Photonics' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 7.5% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 34% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 9.8% per annum over the next three years. That's shaping up to be materially lower than the 14% per year growth forecast for the broader industry.

In light of this, it's alarming that IPG Photonics' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does IPG Photonics' P/S Mean For Investors?

IPG Photonics shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for IPG Photonics, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for IPG Photonics with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English