Littelfuse (LFUS) Q4 EPS Loss Of US$9.72 Tests Earnings Recovery Narratives

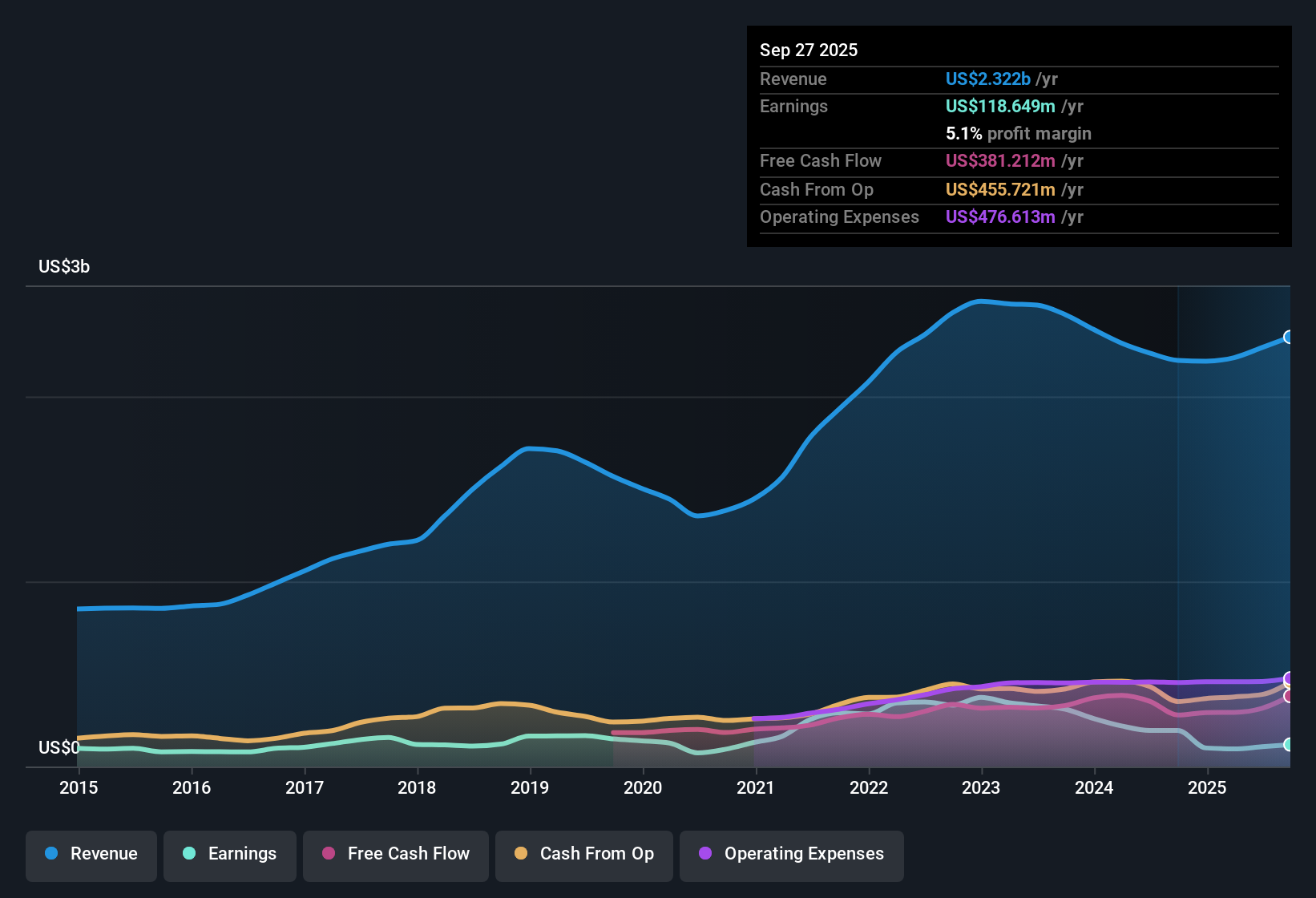

Littelfuse (LFUS) capped FY 2025 with fourth quarter revenue of US$593.9 million and a basic EPS loss of US$9.72, alongside a full year trailing twelve month revenue base of about US$2.4 billion and a TTM EPS loss of US$2.89. Over recent quarters the company has seen revenue move from US$529.5 million in Q4 2024 to US$593.9 million in Q4 2025. Quarterly basic EPS has ranged from a loss of US$2.09 in Q4 2024 to a profit of US$2.80 in Q3 2025 before the latest Q4 loss, leaving investors to weigh margin pressure against the potential for earnings recovery highlighted in recent forecasts.

See our full analysis for Littelfuse.With the headline numbers on the table, the next step is to see how this earnings profile lines up with the widely followed growth and risk narratives around Littelfuse and where those stories might need updating.

Curious how numbers become stories that shape markets? Explore Community Narratives

Trailing US$71.7 million loss alongside steady US$2.4b sales base

- On a trailing 12 month view, Littelfuse generated about US$2.4b of revenue with a net loss of US$71.7 million and TTM basic EPS of a US$2.89 loss, so this is a business with meaningful sales volume but no profit over the period.

- For a bullish view, one point that stands out is that quarterly net income moved from profits of US$43.6 million to US$69.5 million through the first three quarters of FY 2025, followed by a US$242.1 million loss in Q4. This supports the case that core operations can produce profit even though the full year TTM snapshot still shows a loss.

- Bulls pointing to earnings recovery potential can reference that Q1 to Q3 FY 2025 each showed positive net income between US$43.6 million and US$69.5 million, even as the latest 12 month line is held back by the single large Q4 loss.

- At the same time, the trailing loss growth rate of about 17.9% per year over five years challenges a simple bullish story because it indicates profit pressure over several years, not just one quarter.

Revenue trend near US$2.4b with 7.3% forecast growth

- The trailing revenue series in the data moves from about US$2.2b in the earlier quarters to US$2.4b at FY 2025, and the provided forecasts indicate revenue growth of roughly 7.3% per year, which is slower than the 10.6% per year figure cited for the wider US market.

- For a bullish narrative that leans on growth potential, the tension is that revenue growth is expected to trail the broader market even as earnings are forecast to grow about 42.19% per year and move back into positive territory within three years.

- Supporters of a bullish stance could highlight that earnings projections in the data show a path to profitability despite only mid single digit revenue expansion, suggesting an emphasis on margin repair rather than top line acceleration.

- Critics of that bullish angle might point to the 7.3% revenue growth forecast versus a 10.6% market figure as a sign that Littelfuse may not keep up with broader revenue trends even if profits improve.

Mixed signals from P/S of 3.3x and DCF fair value of US$294.96

- The stock is referenced with a P/S of 3.3x against a US Electronic industry average of 2.9x and a peer average of 3.7x. The current share price of US$314.25 sits above a DCF fair value of about US$294.96, so valuation appears neither clearly cheap nor clearly stretched relative to the datasets provided.

- For a more bearish reading of these numbers, skeptics highlight that Littelfuse is unprofitable on a trailing 12 month basis and that the share price is above the DCF fair value, which together can be read as the market paying a premium while key profitability and insider activity flags remain in place.

- Bears can point to the trailing net loss of US$71.7 million and the multi year loss growth rate of about 17.9% per year as indications that the unprofitable status is not just a single period blip.

- They can also reference the gap between the US$314.25 share price and the US$294.96 DCF fair value, along with the note of significant insider selling in recent months, as reasons to be cautious about paying above that modelled value.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Littelfuse's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Littelfuse combines a trailing US$71.7 million loss, a large single quarter hit, and revenue growth forecasts below the wider US market.

If that mix of recent losses and only mid single digit growth feels uncomfortable, shift your focus to stable growth stocks screener (2168 results) to hunt for companies with steadier revenue and earnings trajectories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English