What Drove Republic Power Group's Massive Rally On Thursday?

Republic Power Group Ltd (NASDAQ:RPGL) jumped 50.78% to $1.33 in after-hours trading on Thursday following the disclosure of a securities offering.

The extended-hours gain followed a 173.86% increase in the regular session, which closed at $0.88, according to Benzinga Pro.

The company filed a prospectus on Tuesday, offering up to 50 million Class A ordinary shares at $0.20 each through a securities purchase agreement.

Best-Efforts Offering Structure

The offering has no minimum purchase requirement. According to the Securities and Exchange Commission filing, the company stated investors “will not receive a refund in the event that we do not sell a number of securities sufficient to pursue the business goals outlined in this prospectus.”

The company noted that this is a "best efforts" offering, with no minimum purchase requirement.

Dual-Class Voting Rights

The Singapore-based technology company has a dual-class share structure, with each Class A ordinary share carrying one vote and each Class B ordinary share carrying 30 votes.

The filing stated that Chairman Hao Feng Ng controls over 50% of the voting power of the company's outstanding shares through the workplace wellness entity True Sage International Limited.

Trading Metrics, Technical Analysis

Republic Power's Relative Strength Index (RSI) stands at 66.26.

The company has a market capitalization of $15.40 million, with a 52-week high of $5.19 and a 52-week low of $0.23.

The stock has declined 82.29% over the past 12 months.

Currently, RPGL is positioned at approximately 13.10% of its 52-week range, much closer to its annual low than its high.

The stock's decline and weak positioning suggest that any signs of recovery would need clear confirmation before investors consider making significant moves.

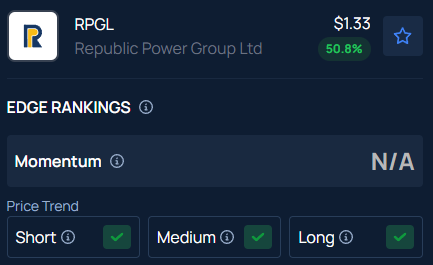

Benzinga’s Edge Stock Rankings indicate that RPGL has a positive price trend across all time frames.

Photo courtesy: Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English