Assessing JetBlue Airways (JBLU) Valuation After Wider Quarterly Loss And Cautious 2026 Outlook

JetBlue Airways (JBLU) stock is in focus after the airline reported a wider fourth quarter loss and issued cautious 2026 guidance, highlighting ongoing cost pressures along with progress in its JetForward operational improvement program.

See our latest analysis for JetBlue Airways.

At a share price of US$5.05, JetBlue has seen a 20.24% 3 month share price return and a 10.02% year to date share price return. However, the 1 year total shareholder return of 20.09% loss points to momentum rebuilding only recently as investors weigh the latest loss, JetForward progress and cautious 2026 guidance.

If this kind of reset in expectations has your attention, it can be a moment to scan other airline and defense names using aerospace and defense stocks.

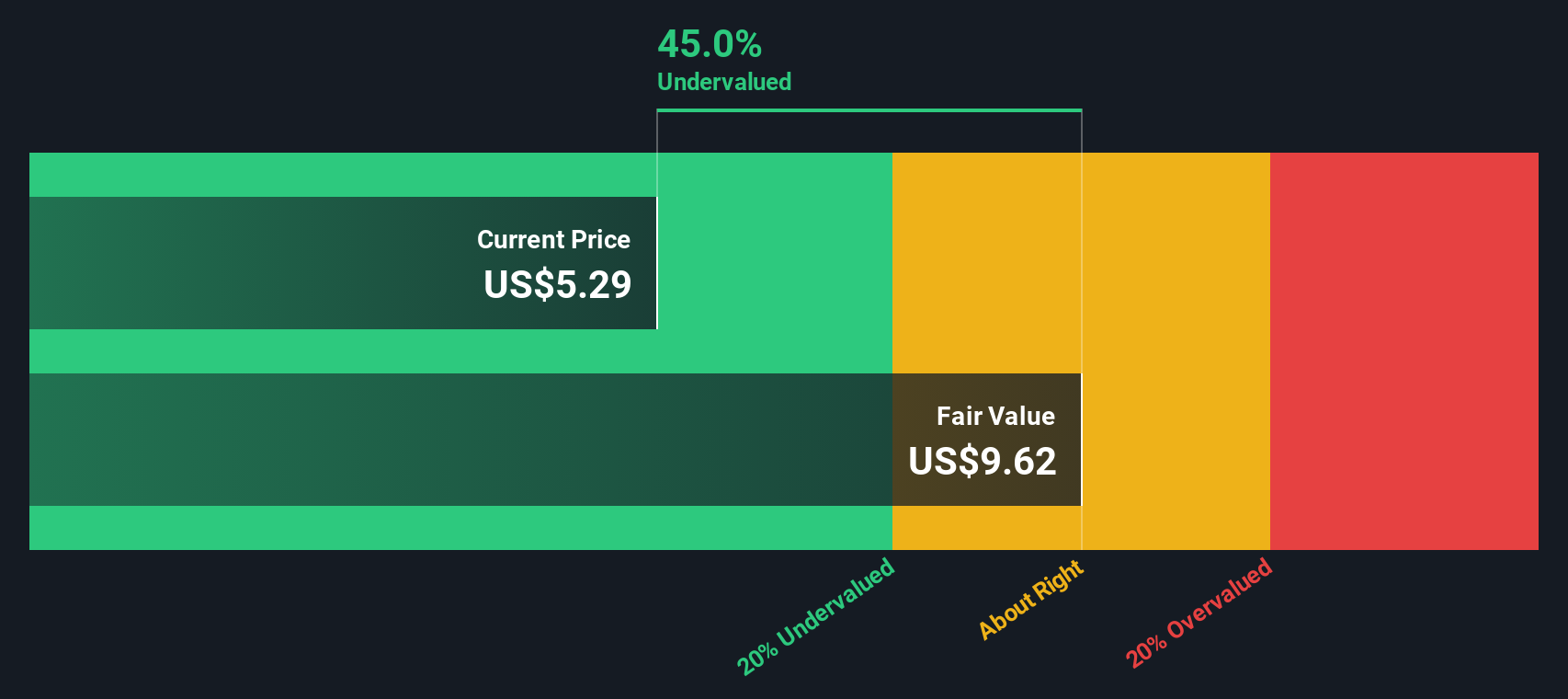

With JetBlue still loss making but trading at what looks like a steep intrinsic discount and mixed analyst targets around the current price, you have to ask: is this a reset entry point, or is the market already pricing in the JetForward goals?

Most Popular Narrative: 8.5% Overvalued

Compared with JetBlue Airways' last close at $5.05, the most followed narrative fair value of $4.65 suggests the shares are pricing in a premium today.

The rebound in leisure travel and resilient demand, especially among Millennials and Gen Z prioritizing experiences, continues to drive close-in bookings and support premium cabin and loyalty revenue growth, which is likely to result in higher ticket revenues and topline expansion.

Major operational improvements, including leading on-time performance, network optimization (redeploying over 20% of network to core customers), and elevated customer satisfaction, are expected to support better load factors and boost both revenue and net earnings through increased preference for JetBlue.

Want to see what kind of long term revenue growth, margin lift, and future earnings power this story is built on? The core assumptions might surprise you.

Result: Fair Value of $4.65 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are clear pressure points too, including rising labor costs and exposure to fuel price swings, which could quickly squeeze margins and test this upbeat narrative.

Find out about the key risks to this JetBlue Airways narrative.

Another View: Cash Flows Tell a Different Story

While the most followed narrative and analyst targets cluster around fair values between $4.23 and $4.65, our DCF model points to a very different picture, with JetBlue trading about 43.7% below its estimated future cash flow value of $8.97. Is sentiment leaning too hard on recent losses and caution, or are the cash flow assumptions too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own JetBlue Airways Narrative

If this perspective does not quite match how you see JetBlue, you can review the same data, form your own three-minute view, and Do it your way.

A great starting point for your JetBlue Airways research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If JetBlue has you thinking differently about risk and reward, do not stop here. The next opportunity you care about could already be sitting in another corner of the market.

- Spot early movers by checking out these 3526 penny stocks with strong financials that pair lower share prices with fundamentals you can actually assess.

- Consider the AI theme in a more targeted way with these 24 AI penny stocks that focus on companies linked to real products, customers, and cash flow.

- Explore potential mispricings by scanning these 869 undervalued stocks based on cash flows that screen for stocks trading below estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English