Assessing American Airlines Group (AAL) Valuation After Earnings Miss And Weather And Shutdown Disruptions

American Airlines Group (AAL) is back in focus after fourth quarter 2025 earnings and revenue came in below analyst expectations, with government shutdown effects and Winter Storm Fern weighing directly on recent profitability.

See our latest analysis for American Airlines Group.

The recent earnings miss and revenue headwinds linked to the government shutdown and Winter Storm Fern have been matched by weaker trading in the stock, with a 7 day share price return of a 10.05% decline and a 1 year total shareholder return of a 20.06% decline. This points to fading momentum even as management reiterates longer term plans for capacity growth, premium product expansion and debt reduction.

If this kind of volatility has you looking across the sector, it could be a good time to scan other aerospace and defense stocks that might better fit your risk and return preferences.

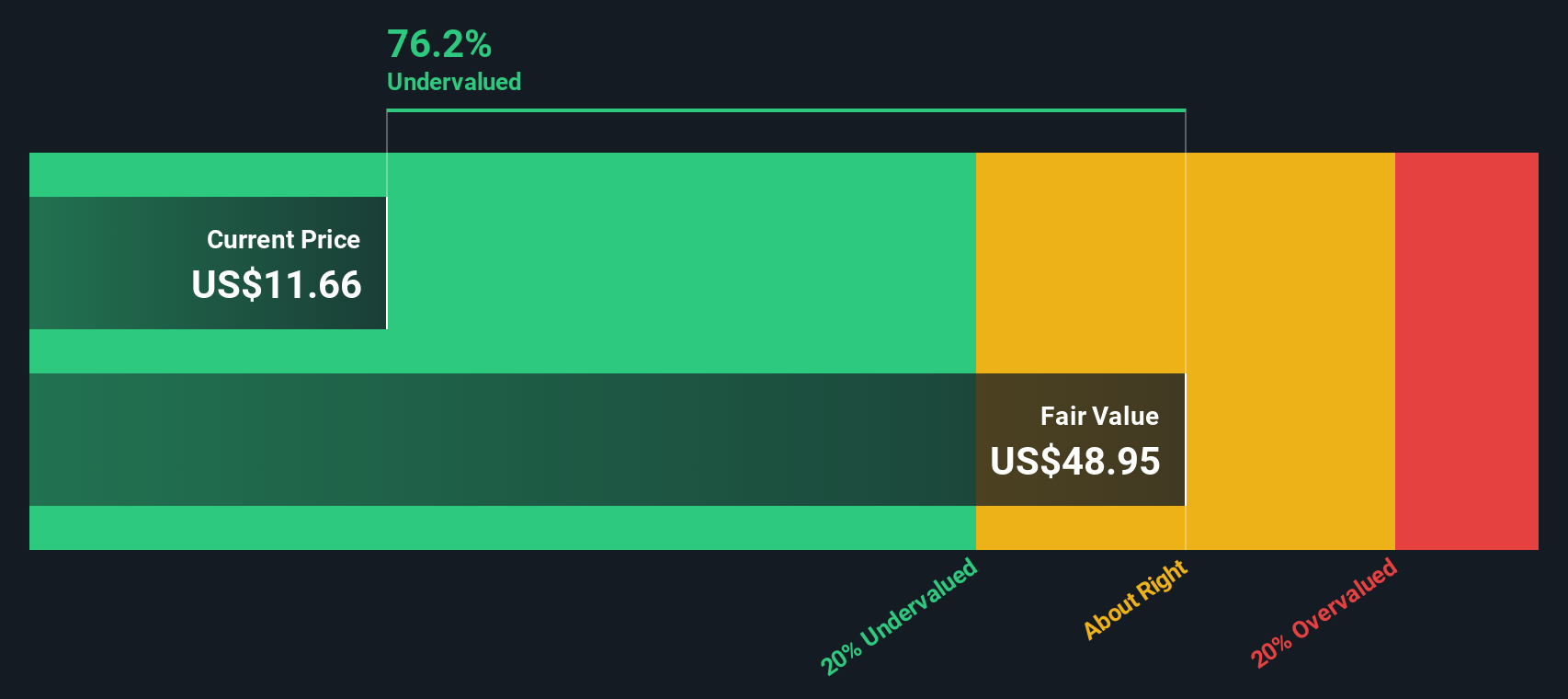

With AAL trading well below its 1 year high, sitting on an intrinsic discount of about 70% and a roughly 31% gap to the current analyst price target, you have to ask: is this a reset buying opportunity, or is the market already pricing in all the future growth?

Most Popular Narrative: 27.3% Overvalued

According to the most followed narrative, American Airlines Group's fair value of $10.61 sits well below the last close of $13.51. This puts a clear spotlight on the assumptions behind that gap.

There is a single reason why American is the least attractive of US legacy carriers (in terms of investing, anyway): its balance sheet. If most airlines and certainly those in the US are loaded up to the hilt with debt, American goes so far as to boast negative equity, any startup would go belly up with a balance sheet such as this one.

If you want to see what kind of growth path and profit margins have to line up to reach that $10.61 fair value, even with negative equity and premium expansion plans in the mix, and how a richer profit multiple is justified based on those inputs, according to PittTheYounger, you will need to read the full narrative.

Result: Fair Value of $10.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy debt and negative equity still leave American highly exposed if travel demand softens again or if refinancing costs move against the company.

Find out about the key risks to this American Airlines Group narrative.

Another View: Cash Flows Paint A Different Picture

While the popular narrative sees American Airlines Group as 27.3% overvalued at $13.51 versus a $10.61 fair value, our DCF model points in the opposite direction. On that approach, the shares trade at a steep discount to an estimated future cash flow value of $45.67. This raises a different question entirely: is sentiment too focused on the balance sheet and not enough on cash generation potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Airlines Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 866 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Airlines Group Narrative

If you do not see the story the same way, or prefer to test the inputs yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at one airline. Use the screener to surface ideas that match your own game plan.

- Spot early movers by scanning these 3524 penny stocks with strong financials that combine smaller market size with financial profiles that may differ from common expectations.

- Explore technology-related opportunities by reviewing these 24 AI penny stocks that connect artificial intelligence with specific business models and measurable fundamentals.

- Look for potential price gaps by filtering for these 866 undervalued stocks based on cash flows that compare current market prices with underlying cash flow estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English