Corning Meta Deal Highlights AI Data Center Growth And Execution Questions

- Corning (NYSE:GLW) has signed a multi year agreement with Meta Platforms to supply advanced optical fiber and connectivity products for AI data centers.

- The deal includes a manufacturing expansion in North Carolina that is expected to create new jobs and increase US production capacity.

- Corning has updated its long term sales growth targets through 2028 in connection with this agreement.

For investors watching NYSE:GLW, this Meta agreement provides additional detail on Corning's role in AI infrastructure build outs. The stock last closed at $103.25, with returns of 10.7% over the past week, 17.9% over the past month, and 13.9% year to date. The 1 year and 3 year returns are described as very large, based on the referenced data.

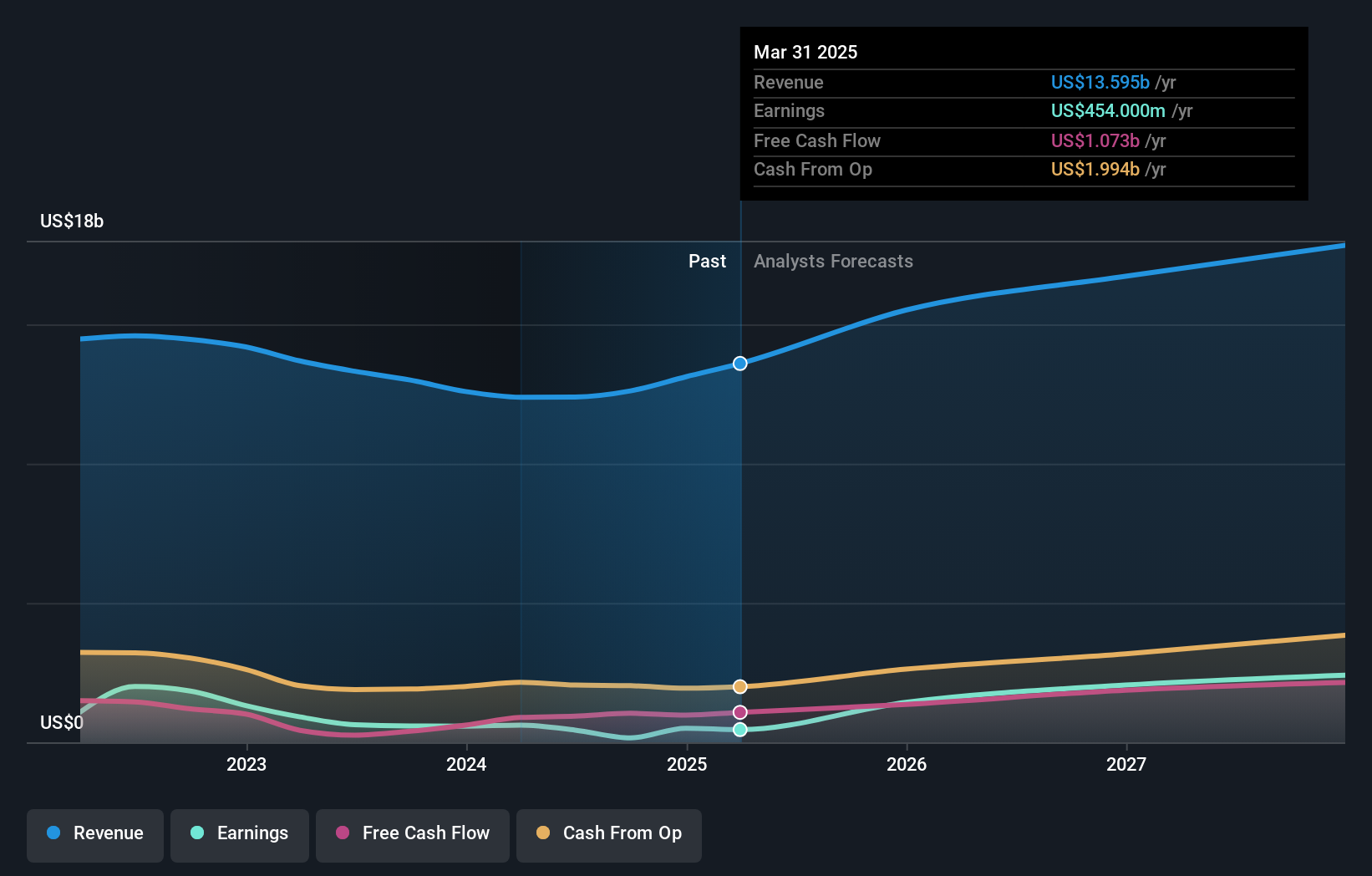

The new deal indicates that Corning is tying more of its business to AI data center demand, which can offer clearer visibility on future orders and revenue streams. The updated sales growth objectives through 2028 present this as a long running opportunity. Investors may now track how these commitments relate to capacity expansion, job additions in North Carolina, and reported segment trends over the coming years.

Stay updated on the most important news stories for Corning by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Corning.

How Corning stacks up against its biggest competitors

The Meta agreement gives Corning a clearer line of sight on optical communications demand, tying a multiyear, up to US$6b order book directly to AI data center buildouts. For you as a shareholder, that links recent earnings strength in optical products to a specific hyperscale client and helps explain why management felt comfortable upgrading its Springboard growth plan and supporting a sizable North Carolina capacity expansion, even as peers like Cisco and Ciena are also competing for AI data center spend.

How This Fits Into The Corning Narrative

This deal plugs directly into both the more cautious and more optimistic narratives around Corning, because it shows AI and data center themes moving from story to signed contracts. Bulls who focus on long term optical and solar demand get another proof point that large customers are willing to sign multiyear agreements, while the more cautious view around execution and capital payback will likely focus on whether this US$6b commitment and higher growth targets can be delivered without stretching the balance sheet or overbuilding capacity.

Key Risks And Rewards To Keep In Mind

- Contract size up to US$6b increases revenue visibility for Corning's optical communications business and supports its higher incremental sales targets through 2028.

- North Carolina manufacturing expansion and Meta as an anchor customer may help Corning strengthen its position as a core supplier to large AI data centers, alongside competitors such as Cisco, Ciena and Broadcom.

- Management has highlighted a wide set of macro, trade, supply chain and execution risks around large manufacturing investments, so delays or weaker than expected orders could weigh on returns from the expanded facilities.

- Analysts have flagged that expectations for AI driven optical growth are already reflected in the share price to some extent, which can limit upside if contract economics or margins in optical communications fall short of current hopes.

What To Watch Next

From here, it makes sense to watch how quickly new capacity in North Carolina ramps, how much of the Springboard sales uplift is credited to Meta and other hyperscalers, and whether margins in the optical communications segment move in line with recent company guidance. If you want to see how different investors are connecting this Meta contract to longer term growth and valuation debates, take a few minutes to check community narratives on Corning's dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English