PennyMac Financial Services (PFSI) Net Margin Expansion Reinforces Bullish Profitability Narratives

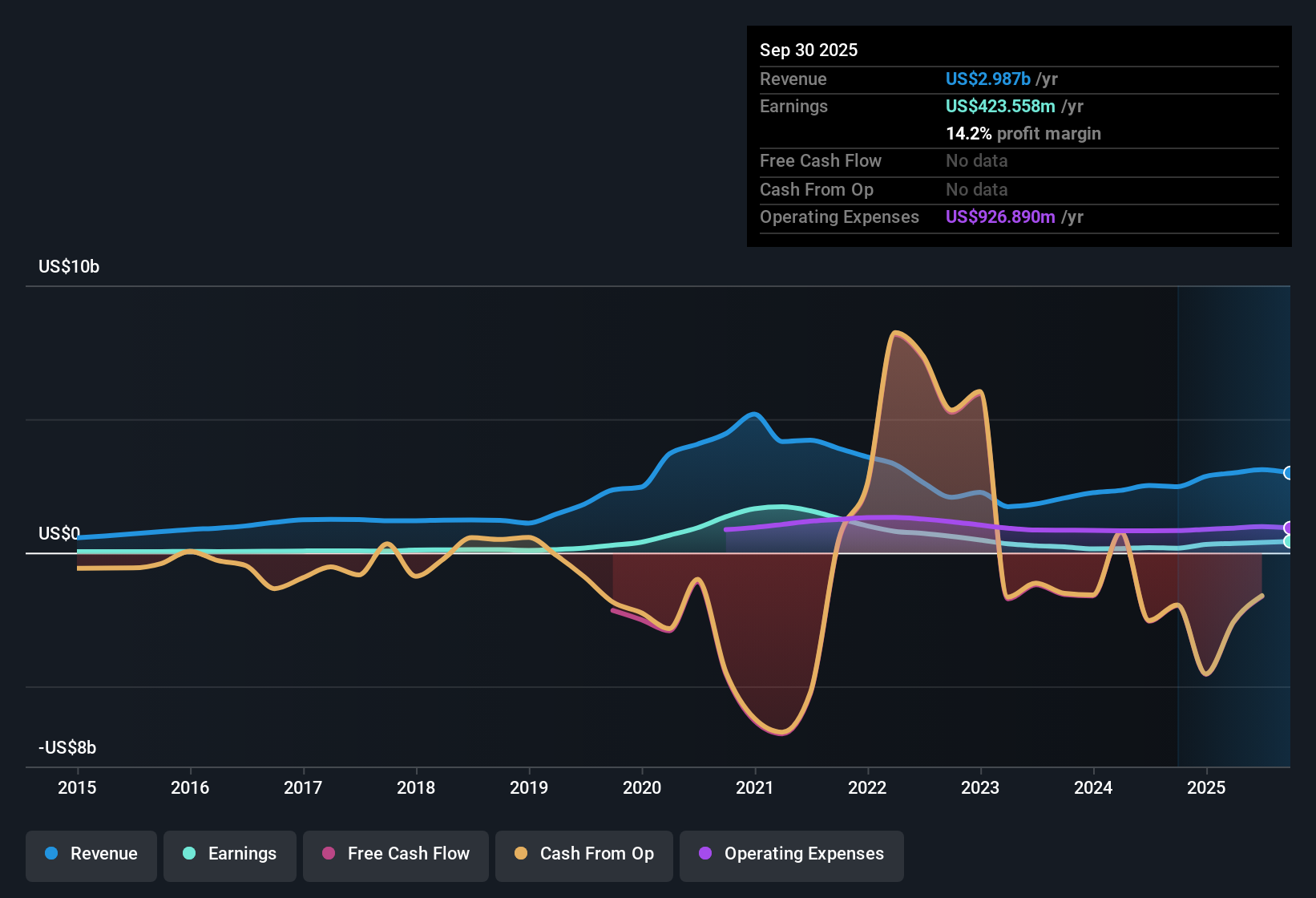

PennyMac Financial Services (PFSI) has wrapped up FY 2025 with fourth quarter revenue of US$538.0 million, basic EPS of US$2.05 and net income of US$106.8 million, while the trailing twelve months show total revenue of US$2.0 billion, basic EPS of US$9.69 and net income of US$501.1 million against last year’s net margin of 15.4% and earnings growth of 60.9%. Over the past few quarters, revenue has ranged from US$690.8 million to US$1.0 billion with quarterly basic EPS between US$1.48 and US$3.51, setting the backdrop for analyst expectations of 16.7% annual revenue growth and 24.7% annual EPS growth. Taken together, the latest print points to a period where profitability and margins are central to how investors read the story.

See our full analysis for PennyMac Financial Services.With the numbers on the table, the next step is to see how this earnings profile lines up against the widely followed narratives around PennyMac’s growth, risks and long term positioning.

Curious how numbers become stories that shape markets? Explore Community Narratives

24.5% net margin reshapes the story

- PennyMac’s trailing net profit margin sits at 24.5% versus 15.4% last year, alongside trailing twelve month net income of US$501.1 million on US$2.0b of revenue.

- What really backs a more bullish view on profitability is that earnings grew 60.9% over the past year while the margin lifted to 24.5%, which

- gives bulls hard numbers to point to when they argue that recent EPS of US$9.69 on a trailing basis is being supported by stronger profitability, not just one off items

- means critics need to factor in both higher margins and higher earnings when they question how sustainable the current earnings run rate is.

P/E of 10.4x versus higher peers

- The shares trade on a trailing P/E of 10.4x, compared with 15.4x for the US Diversified Financial industry and 25.8x for the peer group. The stock price of US$99.92 sits below both the analyst target of US$140.75 and the DCF fair value of US$132.86.

- Supporters of the more bullish narrative often point to this valuation gap by arguing the current P/E and price leave room for upside if recent earnings power holds. Yet

- the roughly 24.8% gap to the stated fair value estimate and the implied upside to US$140.75 are being weighed against the fact that the company’s debt is not well covered by operating cash flow

- so anyone leaning bullish needs to be comfortable that a 24.5% net margin and 60.9% earnings growth can offset that balance sheet risk over time.

Debt coverage stands out as the key risk

- While the trailing twelve month profile shows US$501.1 million of net income and US$9.69 of basic EPS, the analysis flags that debt is not well covered by operating cash flow.

- Bears focus heavily on this debt coverage issue, arguing that even with 60.9% earnings growth and a 24.5% net margin, the capital structure adds meaningful risk, which

- leads them to question whether a P/E discount to peers truly compensates for weaker cash flow coverage of obligations

- and prompts some investors to watch for any shift in earnings quality or cash generation that could change how comfortable they feel with that leverage profile.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on PennyMac Financial Services's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

PennyMac’s earnings and margins look strong, but the flagged issue of debt not being well covered by operating cash flow keeps the risk profile elevated.

If that kind of balance sheet pressure makes you cautious, you may want to consider companies that pair earnings power with healthier cushioning by checking out CTA_SCREENER_SOLID_BALANCE_SHEET for ideas that prioritize stronger financial footing and fewer funding constraints.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English