Coherent’s Bondable Diamond Launch Meets High Expectations And Rich Valuation

- Coherent (NYSE:COHR) introduced a bondable diamond thermal management solution for semiconductors and opto electronics.

- The product is designed to bond directly to various semiconductor materials and reduce thermal interface resistance.

- The launch targets high performance electronic and opto electronic devices that face demanding heat dissipation requirements.

- The offering includes vertically integrated production and options for customized solutions for customers.

Coherent, listed on the NYSE under ticker COHR, operates across lasers, optics, and materials that support semiconductor and opto electronic applications. Thermal management has become a key focus area as devices push higher power densities and tighter form factors, which can stress traditional cooling approaches. In this context, a bondable diamond material is relevant for customers looking to manage heat in compact, high performance designs.

For investors, the new product highlights how Coherent is focusing on materials technology that could appeal to chipmakers and system integrators working on power electronics, data center hardware, and advanced sensing. The emphasis on vertical integration and customization may influence how the company positions itself within supply chains where reliability, performance, and long term supply relationships matter.

Stay updated on the most important news stories for Coherent by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Coherent.

How Coherent stacks up against its biggest competitors

Quick Assessment

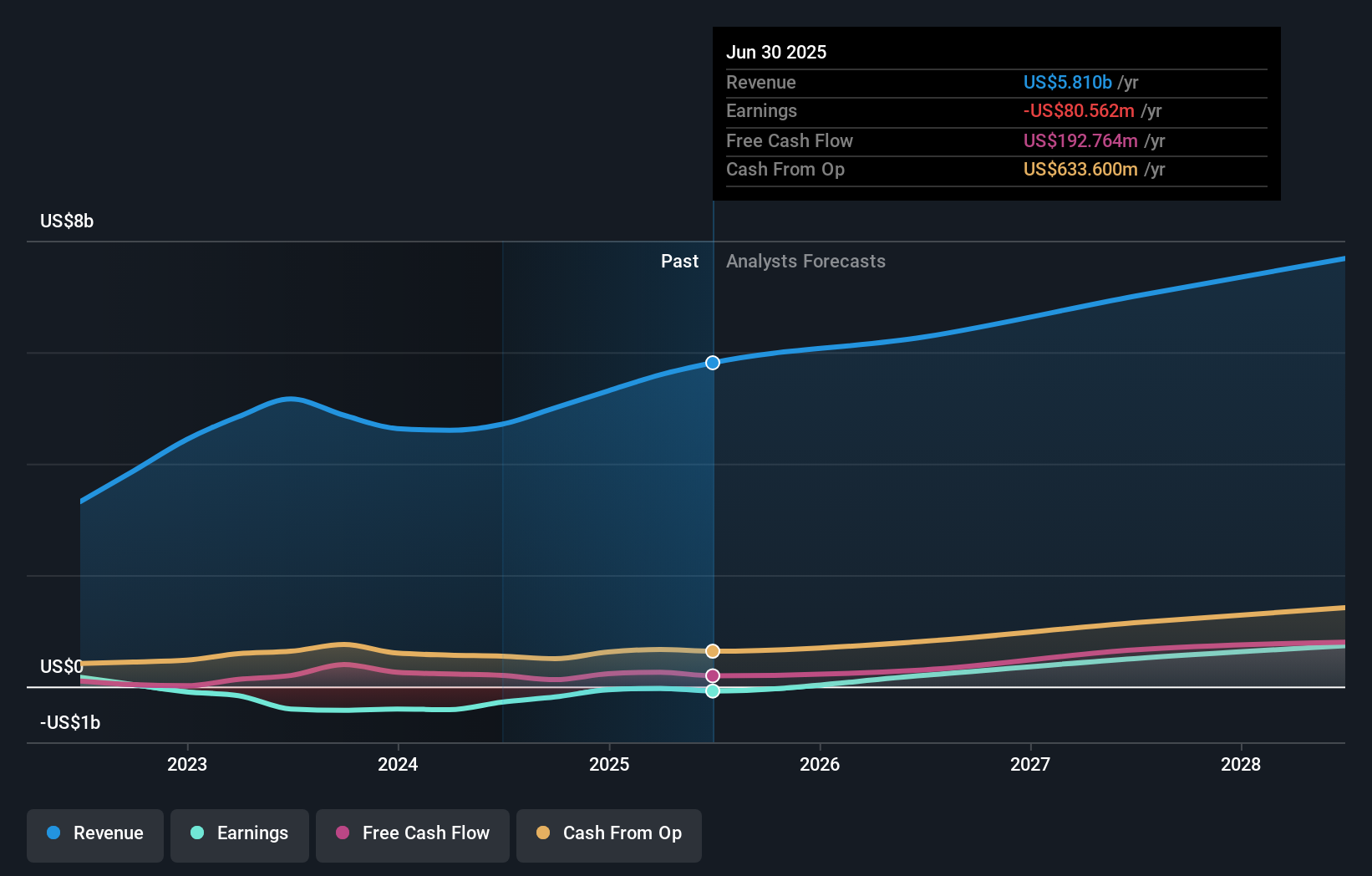

- ❌ Price vs Analyst Target: At US$212.18, the share price is about 8.3% above the US$195.84 analyst target midpoint and near the upper half of the target range.

- ❌ Simply Wall St Valuation: Shares are described as trading 42.6% above estimated fair value, which indicates a rich valuation.

- ✅ Recent Momentum: The 30 day return of about 15.0% points to strong short term momentum ahead of and around this product launch.

Check out Simply Wall St's in depth valuation analysis for Coherent.

Key Considerations

- 📊 The bondable diamond solution supports Coherent's role in high performance semiconductors and opto electronics, which could be relevant for power dense applications.

- 📊 It may be useful to watch how customers in areas like power electronics and data center hardware respond, and whether this is reflected in revenue and margin trends over coming reporting periods.

- ⚠️ With a P/E of about 306.3 against an industry average of 26.6 and a 42.6% premium to estimated fair value, expectations around this type of product launch appear demanding.

Dig Deeper

For a fuller view of the company, including more information on risks and potential rewards, you can review the complete Coherent analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English