A Look At Avnet (AVT) Valuation After Strong Earnings And Upbeat Growth Guidance

Avnet (AVT) shares have been in focus after a strong quarterly earnings report that paired broad-based sales growth with improved operational efficiency, tighter inventory management, and margin expansion, along with upbeat guidance for the next quarter.

See our latest analysis for Avnet.

That earnings beat and upbeat guidance have arrived alongside a sharp shift in sentiment, with a 7 day share price return of 22.74% and a 30 day share price return of 26.45% at US$62.39. The 1 year total shareholder return of 24.10% and 5 year total shareholder return of 87.72% suggest momentum has been building over time.

If this kind of earnings driven move has your attention, it could be a good moment to see what else is setting up in tech through high growth tech and AI stocks.

With Avnet now trading above the average analyst price target and with fresh earnings and guidance in hand, the key question is whether the recent surge has gone too far or if the market is only beginning to incorporate potential future growth into the share price.

Most Popular Narrative: 17.7% Overvalued

Avnet's most followed narrative sets a fair value of $53.00, which sits below the last close at $62.39, and frames the recent rally as ahead of that estimate.

With improving book-to-bill ratios, a stabilizing inventory environment, and a strong commitment to operational efficiency (cost control and optimized capital allocation), Avnet is set to translate industry tailwinds into higher earnings and cash flow, supporting future shareholder returns through buybacks/dividends and potential multiple expansion.

Want to see what kind of revenue reset, margin rebuild, and earnings power this narrative is baking in by 2028? The full storyline breaks those assumptions into a detailed earnings path, a tighter share count, and a future P/E that looks very different from where the stock trades today.

Result: Fair Value of $53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative depends on higher margin regions stabilising and inventory staying under control, so prolonged EMEA weakness or fresh inventory issues could quickly change the story.

Find out about the key risks to this Avnet narrative.

Another Angle On Valuation

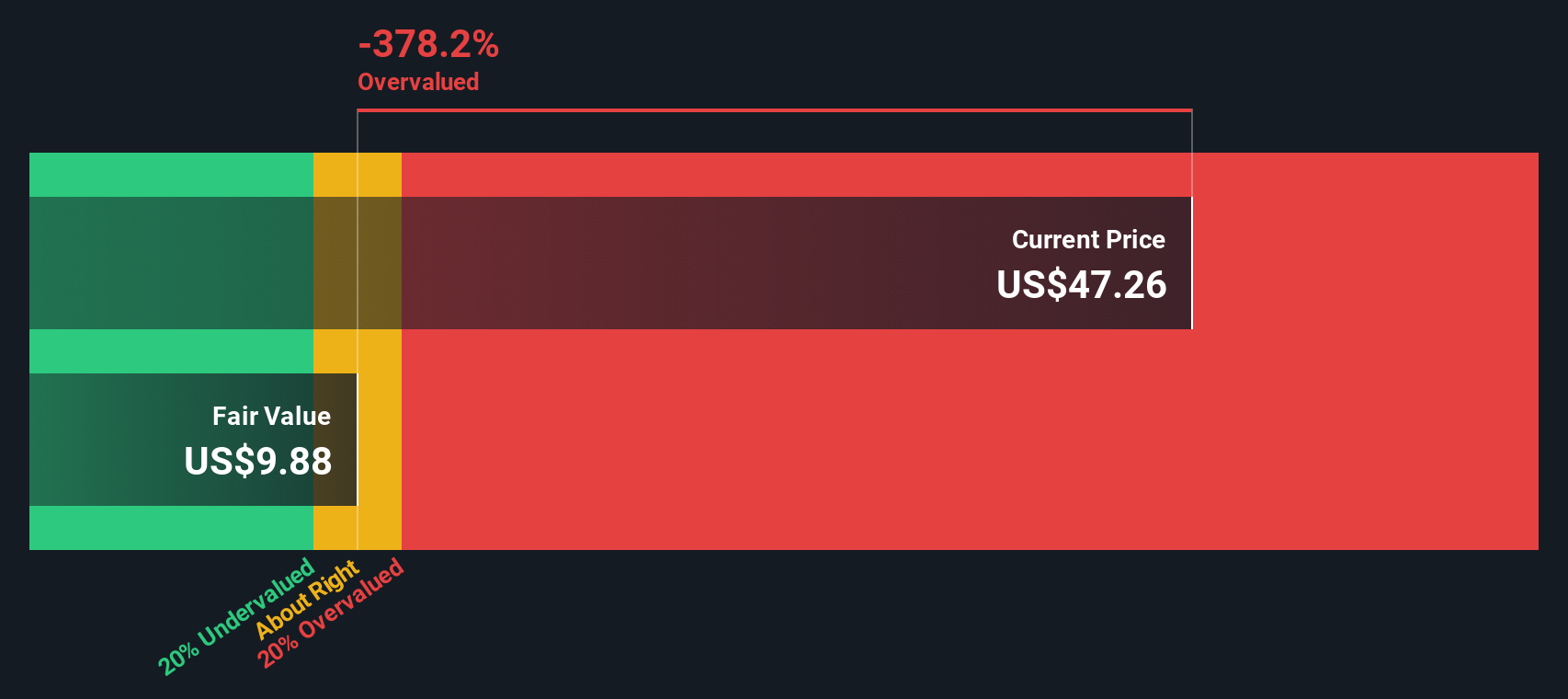

Our SWS DCF model presents a very different view compared with the US$53 fair value narrative. With Avnet trading at US$62.39 and our cash flow estimate at just US$0.53 per share, the model suggests that the shares may be significantly overvalued. It leads to a straightforward question: are you more comfortable relying on earnings power or cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Avnet Narrative

If you see the numbers differently or prefer to build your own view from scratch, you can piece together a custom Avnet storyline in minutes by starting with Do it your way.

A great starting point for your Avnet research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Avnet has sharpened your appetite for new ideas, do not stop here. The Simply Wall St screener is built to help you find your next move.

- Spot potential bargains early by checking out these 875 undervalued stocks based on cash flows that may not yet be fully appreciated by the wider market.

- Ride powerful tech themes by scanning these 24 AI penny stocks that are tied to artificial intelligence trends across different industries.

- Tap into income-focused ideas with these 12 dividend stocks with yields > 3% that could complement growth names in a balanced portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English