Despite recent sales, BrainAurora Medical Technology Limited (HKG:6681) insiders own 43% shares but recent downturn may have set them back

Key Insights

- BrainAurora Medical Technology's significant insider ownership suggests inherent interests in company's expansion

- A total of 5 investors have a majority stake in the company with 54% ownership

- Recent sales by insiders

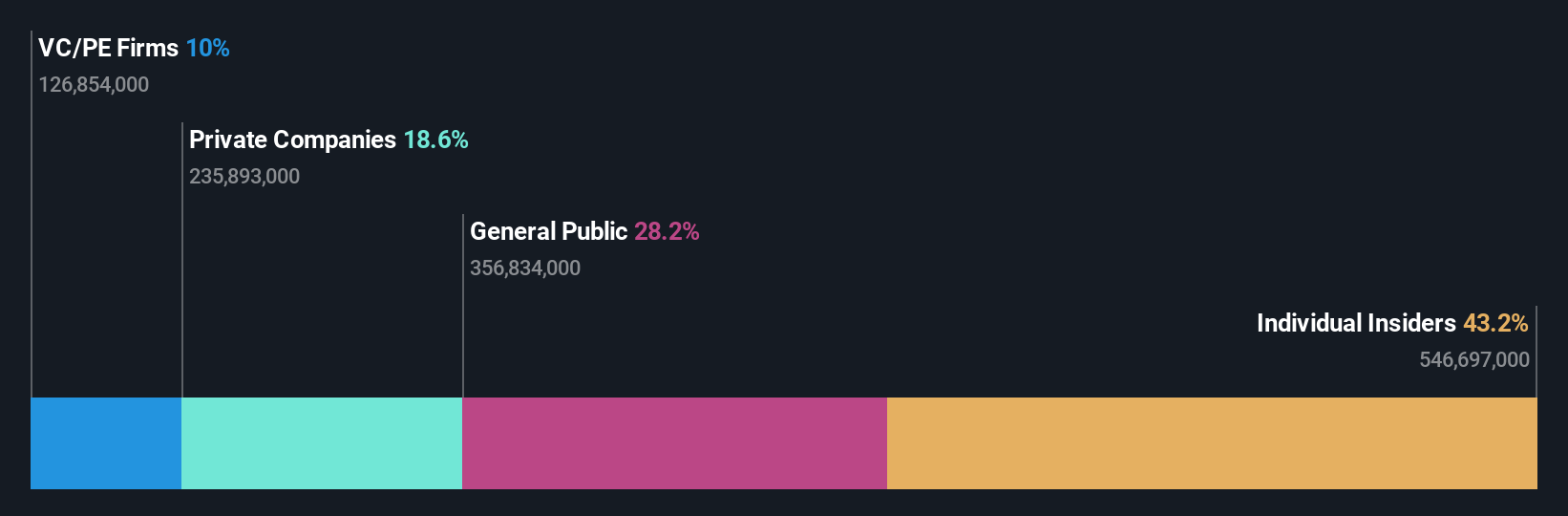

If you want to know who really controls BrainAurora Medical Technology Limited (HKG:6681), then you'll have to look at the makeup of its share registry. With 43% stake, individual insiders possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

Even though insiders have sold shares recently, the group owns the most numbers of shares in the company. As a result, they were also the group to endure the biggest losses as the stock fell by 23%.

In the chart below, we zoom in on the different ownership groups of BrainAurora Medical Technology.

See our latest analysis for BrainAurora Medical Technology

What Does The Lack Of Institutional Ownership Tell Us About BrainAurora Medical Technology?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of BrainAurora Medical Technology, for yourself, below.

Hedge funds don't have many shares in BrainAurora Medical Technology. Our data suggests that Zheng Tan, who is also the company's Top Key Executive, holds the most number of shares at 17%. When an insider holds a sizeable amount of a company's stock, investors consider it as a positive sign because it suggests that insiders are willing to have their wealth tied up in the future of the company. With 11% and 10% of the shares outstanding respectively, Xiaoyi Wang and Northern Light Venture Capital are the second and third largest shareholders.

On looking further, we found that 54% of the shares are owned by the top 5 shareholders. In other words, these shareholders have a meaningful say in the decisions of the company.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There is a little analyst coverage of the stock, but not much. So there is room for it to gain more coverage.

Insider Ownership Of BrainAurora Medical Technology

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders maintain a significant holding in BrainAurora Medical Technology Limited. It has a market capitalization of just HK$5.4b, and insiders have HK$2.3b worth of shares in their own names. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

With a 28% ownership, the general public, mostly comprising of individual investors, have some degree of sway over BrainAurora Medical Technology. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Equity Ownership

Private equity firms hold a 10% stake in BrainAurora Medical Technology. This suggests they can be influential in key policy decisions. Some might like this, because private equity are sometimes activists who hold management accountable. But other times, private equity is selling out, having taking the company public.

Private Company Ownership

Our data indicates that Private Companies hold 19%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand BrainAurora Medical Technology better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for BrainAurora Medical Technology you should know about.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English