IonQ’s Vertical Quantum Stack Reshapes Growth Prospects And Investor Tradeoffs

- IonQ has moved to become a fully vertically integrated quantum computing company through recent acquisitions.

- The company has completed its purchase of Skyloom Global and plans to acquire SkyWater Technology.

- These deals add in house chip manufacturing and secure quantum networking capabilities to IonQ's platform.

IonQ, listed as NYSE:IONQ, now combines quantum hardware, chip production, and networking under one roof, aiming to create a tightly controlled technology stack. The shares most recently closed at $38.56, with a 3 year return that is very large and a 5 year return of 227.3%. Over the past year the stock return is 7.0% lower, while the past month and past week show returns of 17.6% and 11.1% lower, respectively.

For investors, these moves matter because IonQ is building an in house ecosystem that can appeal to government and enterprise users that prioritize security, supply chain control, and long term access to specialized hardware. The combination of chip manufacturing and secure quantum networking could influence how partners, regulators, and large customers view the company compared with other quantum computing players.

Stay updated on the most important news stories for IonQ by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on IonQ.

How IonQ stacks up against its biggest competitors

Quick Assessment

- ✅ Price vs Analyst Target: At US$38.56 versus an analyst target of about US$74.89, the share price sits roughly 49% below consensus.

- ⚖️ Simply Wall St Valuation: Simply Wall St's DCF view is currently unknown, so treat the stock as valuation opaque for now.

- ❌ Recent Momentum: The 30 day return of about 17.6% decline signals weak short term momentum.

Check out Simply Wall St's in depth valuation analysis for IonQ.

Key Considerations

- 📊 Vertical integration across quantum hardware, chips, and networking could make IonQ more attractive to customers that care about security and supply chain control.

- 📊 With a P/E of 9.32, loss making, and an industry average profit margin of 12.35%, keep an eye on how acquisitions affect future profitability and dilution.

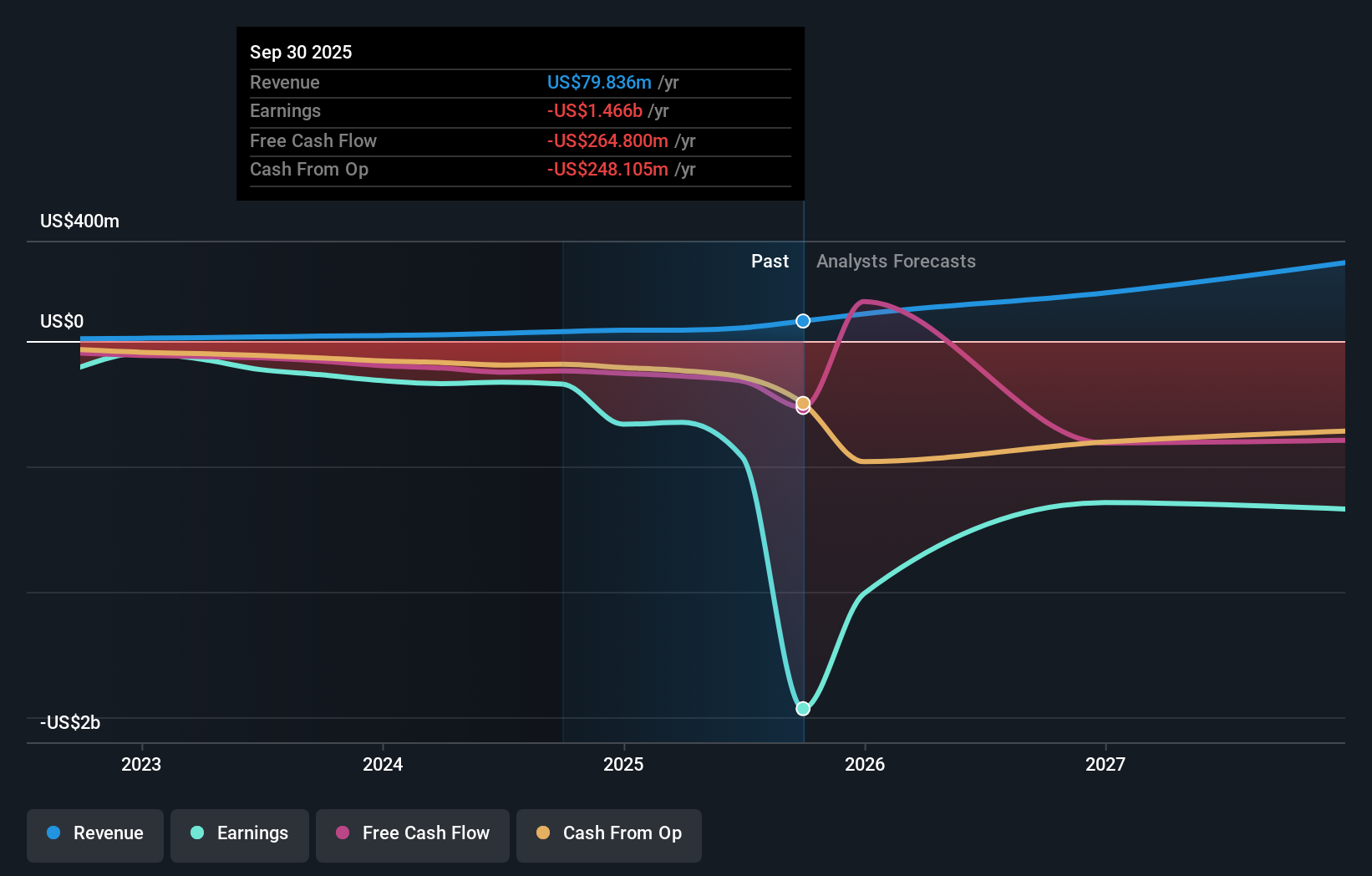

- ⚠️ The company reported a net loss of US$1,466.04m and shareholders have been substantially diluted over the past year, which raises funding and execution risk around these deals.

Dig Deeper

For the full picture including more risks and rewards, check out the complete IonQ analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English