Intel (NasdaqGS:INTC) Valuation Check As Apple And Nvidia Weigh U.S. Foundry Partnerships

Intel (INTC) is back in focus after reports that Apple and Nvidia are actively exploring using Intel’s U.S. foundry capacity for future chip production, along with progress in its next generation manufacturing technologies.

See our latest analysis for Intel.

The share price has moved sharply in recent months, with a 1-day share price return of 4.99%, 7-day return of 14.83% and 90-day return of 31.76%. The 1-year total shareholder return of about 1.5x highlights how sentiment around Intel’s foundry progress and recent Apple and Nvidia headlines has shifted from caution to renewed interest.

If the Intel news has you looking more broadly at chipmakers tied to AI, it could be a good moment to check out high growth tech and AI stocks as well.

After a 1-year total return of about 1.5x and shares now around US$48.79, has Intel already reflected its foundry buzz and Apple or Nvidia headlines in the price, or is the market still underestimating its potential?

Most Popular Narrative: 31.6% Undervalued

According to one widely followed valuation, Intel's fair value of $71.33 sits well above the recent $48.79 close. This puts a spotlight on what assumptions are driving that gap.

Intel está profundamente infravalorada porque el mercado sigue mirando su pasado y no su futuro. Durante casi una década fue vista como el gigante que se durmió: perdió el liderazgo en la carrera de los semiconductores, se retrasó en los nodos de fabricación y cedió cuota frente a AMD, Apple y TSMC. Sin embargo, esa narrativa ya no refleja la realidad actual. Bajo el liderazgo de Pat Gelsinger, la compañía ha ejecutado un plan agresivo de recuperación tecnológica, los “5 nodos en 4 años”, que culmina en 2025 con el proceso Intel 18A, validado por el propio gobierno de EE.UU. y por clientes como Amazon, Qualcomm y Microsoft. Esto marca el regreso de Intel al grupo de punta en la fabricación avanzada, una posición que el mercado todavía no ha reconocido en su valoración.

It is worth examining what earnings profile sits behind that valuation gap. The narrative leans on expectations of higher growth, healthier margins and a future earnings multiple more typical of premium chip names. Investors may want to understand which specific assumptions are most influential in that $71.33 fair value estimate.

Result: Fair Value of $71.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on Intel turning its foundry plan into sustained profits. Any delay in major customer commitments or manufacturing execution could quickly weaken that optimism.

Find out about the key risks to this Intel narrative.

Another View: DCF Flags Overvaluation Risk

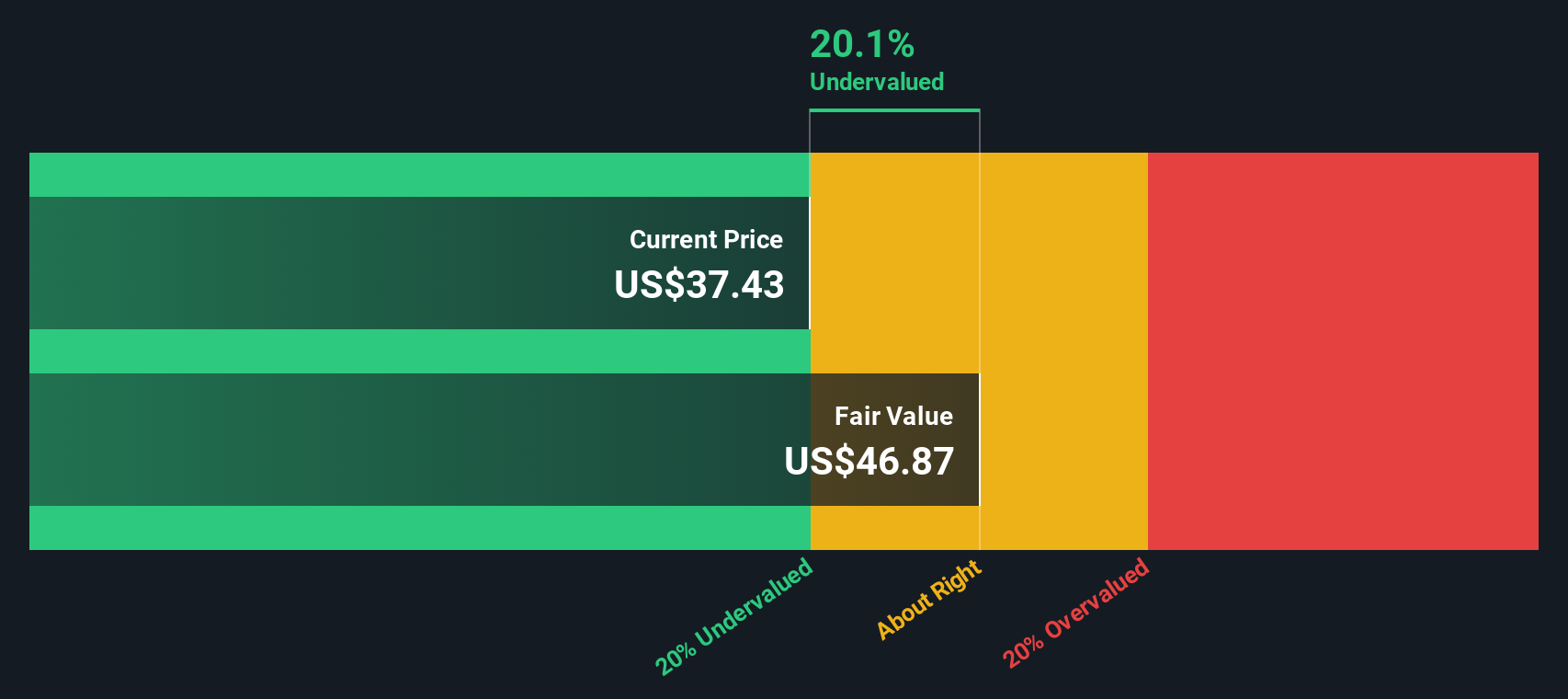

While the user narrative points to a fair value of $71.33 and a 31.6% discount, our DCF model lands in a very different place. On this view, Intel at $48.79 sits above an estimated future cash flow value of $28.50, which points to potential overvaluation instead of a bargain.

This raises a simple but important question for you: which story do you think better reflects Intel's actual cash generation over time, the growth heavy narrative or the more conservative DCF view?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Intel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Intel Narrative

If you are not on board with either valuation, or simply prefer to test the numbers yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Intel research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Intel has you thinking more broadly about where to put fresh capital to work, do not stop here, you could miss some compelling opportunities on the screener.

- Hunt for potential mispricing with these 876 undervalued stocks based on cash flows to screen for companies where cash flow assumptions and current prices look out of sync.

- Target growth themes by scanning these 24 AI penny stocks to focus on businesses tied directly to AI demand and related chip and software trends.

- Add income angles to your watchlist using these 13 dividend stocks with yields > 3% to filter for companies offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English