A Look At Grab Holdings (GRAB) Valuation After Conflicting Analyst Calls On Margins And Growth Potential

Recent analyst moves around Grab Holdings (GRAB), including a price target cut with earnings estimate trims at Bernstein and an upgrade at BofA Securities, have put the stock under closer investor scrutiny.

See our latest analysis for Grab Holdings.

At a share price of US$4.41, Grab’s recent 30 day share price return of a 13.19% decline and 90 day share price return of a 23.77% decline suggest momentum has been fading. However, the 3 year total shareholder return of 27.46% still contrasts with the 69.77% total shareholder return decline over five years as investors reassess growth prospects and risk after mixed analyst updates.

If Grab’s recent swings have you thinking about where else growth and sentiment might line up, this could be a useful moment to scan high growth tech and AI stocks for other tech enabled platforms catching attention.

So with Grab trading at US$4.41, mixed analyst calls, earnings estimate tweaks and valuation flags like a PEG of 0.84 in the background, is the market offering you a mispriced growth story, or already baking future gains into the stock?

Most Popular Narrative: 46.2% Undervalued

BlackGoat’s narrative pegs Grab Holdings’ fair value at $8.20, compared with the last close at $4.41. This sets up a very different picture from recent price action.

Advertising is still in its infancy. Grab runs at a $240M annualised Ad revenue pace today, with just 191K active advertisers; barely ~3% penetration of its 6M merchants. The ad take rate is 1.7%, rising as more merchants adopt self-serve ads (+31% YoY). Like Amazon a decade ago, ads are a hidden profit lever that could quietly transform Grab’s margin structure without raising take rates in mobility or deliveries.

Curious how a still-early ads business and a scaling fintech arm support that higher fair value? The full narrative spells out the growth, margins, and profit multiple assumptions driving BlackGoat’s $8.20 view.

Result: Fair Value of $8.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside view still runs into real pressure points, including thin GAAP margins and any Grab or GoTo deal setbacks that could challenge the long term growth story.

Find out about the key risks to this Grab Holdings narrative.

Another Angle on Valuation

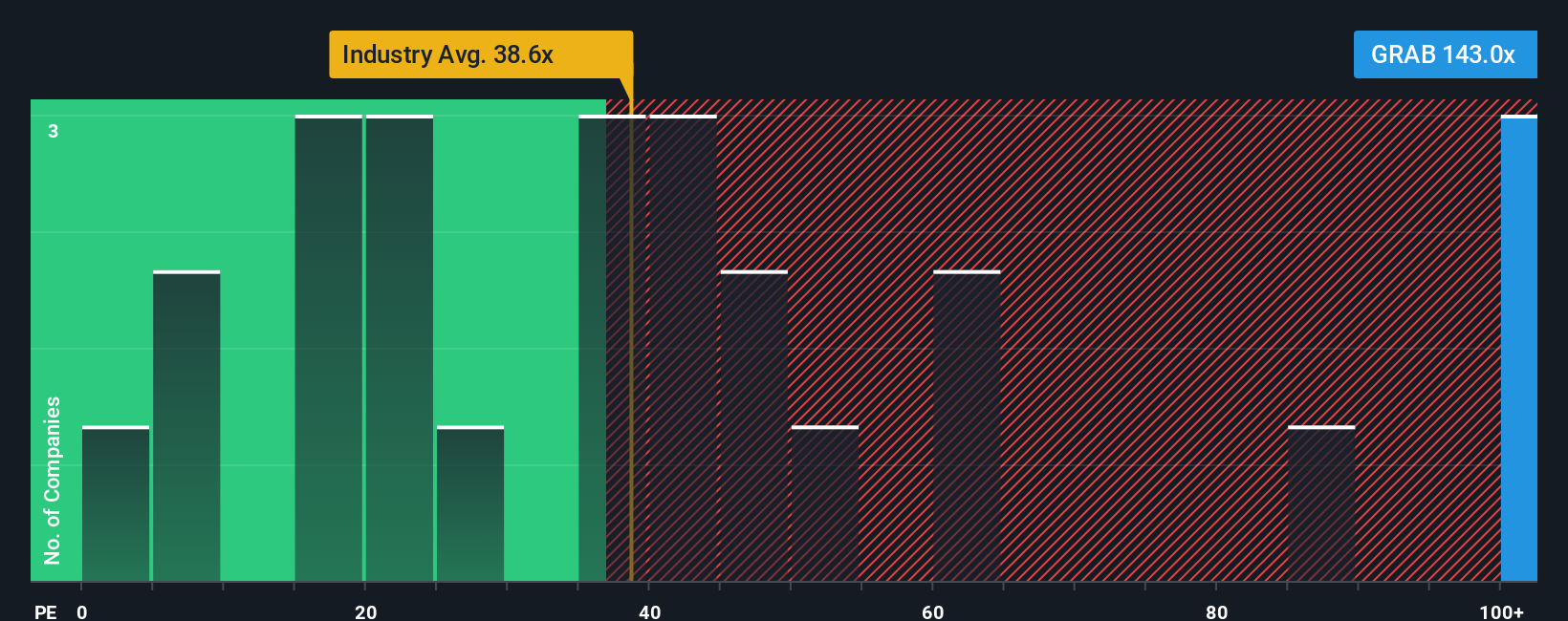

BlackGoat’s $8.20 fair value leans on growth, margins, and multiples, but our fair ratio view using the P/E ratio points in a different direction. At 147.7x P/E versus a fair ratio of 29.7x and an industry average of 34.3x, the gap signals valuation risk rather than a clear bargain. How much weight do you put on that premium when expectations are already this high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grab Holdings Narrative

If you look at the numbers and reach a different conclusion, or prefer to do your own homework, you can pull together a custom view in a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Grab Holdings.

Looking for more investment ideas?

If Grab has you thinking more broadly about where to put your next dollar, do not stop here. Widen your lens and see what else stands out.

- Spot potential bargains by scanning these 876 undervalued stocks based on cash flows that currently trade at prices some investors may view as below what their cash flows suggest.

- Ride new technology themes by checking out these 24 AI penny stocks that are tied to artificial intelligence trends across different parts of the market.

- Lean into income focused ideas by reviewing these 13 dividend stocks with yields > 3% that may appeal if regular cash returns are high on your priority list.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English