Investors Don't See Light At End Of C&D Newin Paper & Pulp Corporation Limited's (HKG:731) Tunnel And Push Stock Down 37%

C&D Newin Paper & Pulp Corporation Limited (HKG:731) shareholders that were waiting for something to happen have been dealt a blow with a 37% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

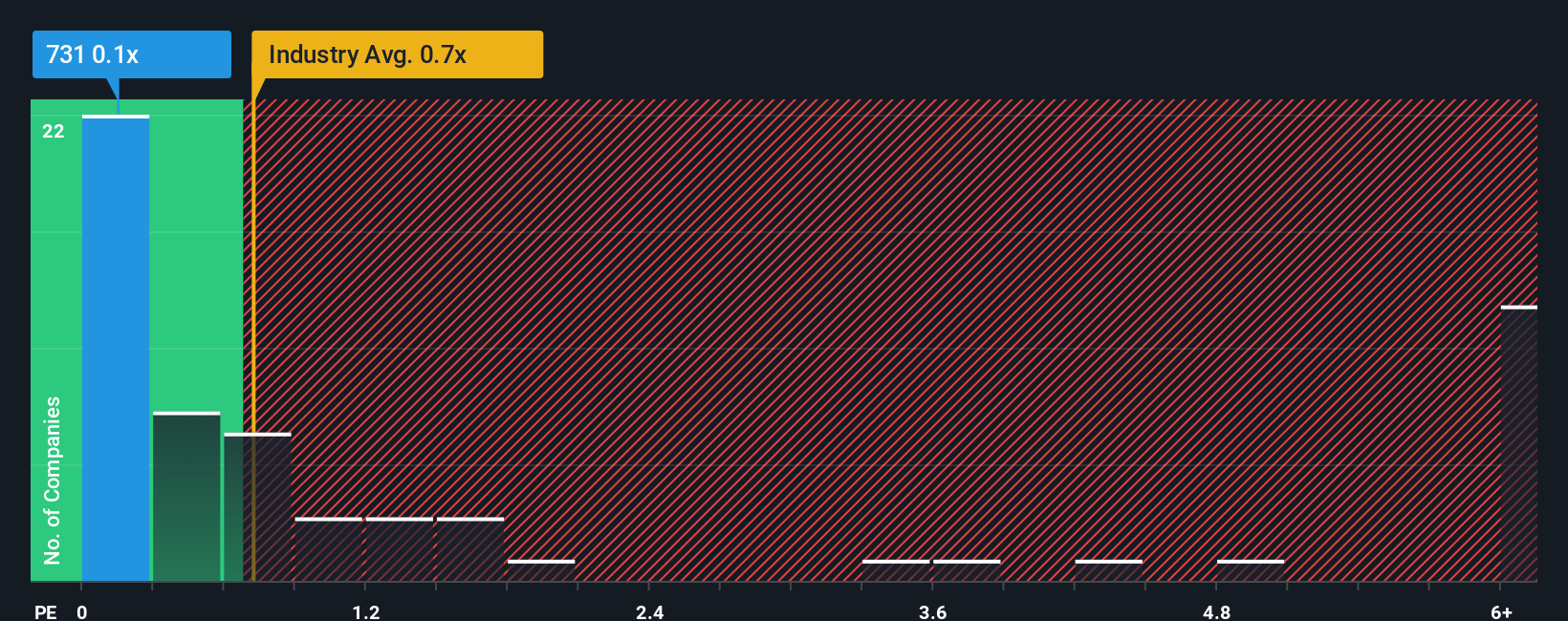

In spite of the heavy fall in price, given about half the companies operating in Hong Kong's Trade Distributors industry have price-to-sales ratios (or "P/S") above 0.7x, you may still consider C&D Newin Paper & Pulp as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for C&D Newin Paper & Pulp

What Does C&D Newin Paper & Pulp's P/S Mean For Shareholders?

For example, consider that C&D Newin Paper & Pulp's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on C&D Newin Paper & Pulp will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on C&D Newin Paper & Pulp's earnings, revenue and cash flow.How Is C&D Newin Paper & Pulp's Revenue Growth Trending?

In order to justify its P/S ratio, C&D Newin Paper & Pulp would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.4%. As a result, revenue from three years ago have also fallen 10% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 24% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why C&D Newin Paper & Pulp's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From C&D Newin Paper & Pulp's P/S?

The southerly movements of C&D Newin Paper & Pulp's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that C&D Newin Paper & Pulp maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 2 warning signs for C&D Newin Paper & Pulp (1 is a bit concerning!) that you should be aware of before investing here.

If you're unsure about the strength of C&D Newin Paper & Pulp's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English