A Look At PPG Industries (PPG) Valuation After Earnings Beat And 2026 Growth Guidance

PPG Industries (PPG) has drawn fresh investor attention after reporting detailed 2025 results, issuing 2026 earnings guidance, and securing new business wins that support its coatings focused business model and capital return plans.

See our latest analysis for PPG Industries.

The latest news on Q4 2025 results, 2026 earnings guidance and new coatings and refinish contracts comes against a backdrop of firm momentum, with a 30 day share price return of 17.78% and a 90 day share price return of 29.27%. At the same time, the 1 year total shareholder return of 10.19% and 5 year total shareholder return of 0.56% suggest a more measured long term profile.

If this earnings and product update has you looking beyond a single stock, it could be a good moment to widen your search through our screener of 22 power grid technology and infrastructure stocks.

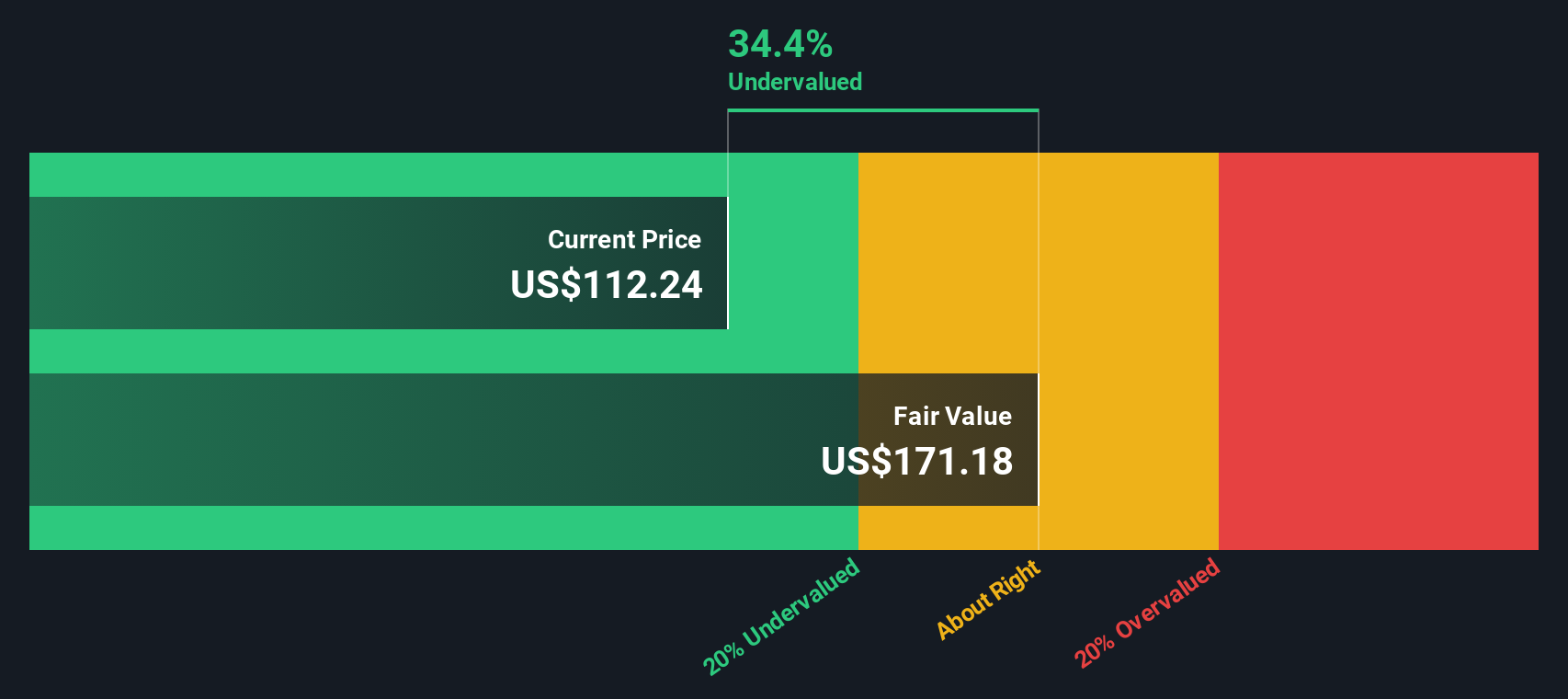

With PPG shares up almost 30% over 90 days and trading slightly above the average analyst target, yet carrying a 22% intrinsic discount estimate, you have to ask: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 4.4% Overvalued

The most followed narrative puts PPG Industries' fair value at $119.15, a touch below the last close at $124.42, which frames a slightly stretched setup for anyone watching the recent share price run.

The analysts have a consensus price target of $127.35 for PPG Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $112.0.

Curious what justifies that fair value gap? The narrative leans on measured revenue progress, firmer margins, and a future earnings multiple that is not especially aggressive. Result: Fair Value of $119.15 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this thesis still faces pressure from weaker automotive production and currency headwinds, either of which could undermine the earnings and margin assumptions behind that fair value.

Find out about the key risks to this PPG Industries narrative.

Another Take: Market Price Versus Cash Flow Value

The 4.4% overvaluation figure appears at odds with our DCF model, which indicates a future cash flow value of $159.61 per share compared with the current $124.42. On this view, PPG appears materially undervalued. Which perspective do you think better reflects its cash generation potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PPG Industries Narrative

If you are not fully on board with these views or simply prefer to test the assumptions yourself, you can build your own thesis in just a few minutes and see how it stacks up against the market, Do it your way.

A great starting point for your PPG Industries research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready to widen your opportunity set?

If PPG has sharpened your interest in fresh ideas, do not stop here. The right shortlist could make a real difference to your long term returns.

- Target quality at a discount by scanning our list of 55 high quality undervalued stocks that pair fundamentals with appealing valuations.

- Prioritise resilience by reviewing 81 resilient stocks with low risk scores that score well on our risk checks and may offer a smoother ride.

- Get ahead of the crowd by uncovering our screener containing 25 high quality undiscovered gems that the market may not be focusing on yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English