Wai Chun Bio-Technology Limited's (HKG:660) Share Price Boosted 37% But Its Business Prospects Need A Lift Too

The Wai Chun Bio-Technology Limited (HKG:660) share price has done very well over the last month, posting an excellent gain of 37%. The last month tops off a massive increase of 206% in the last year.

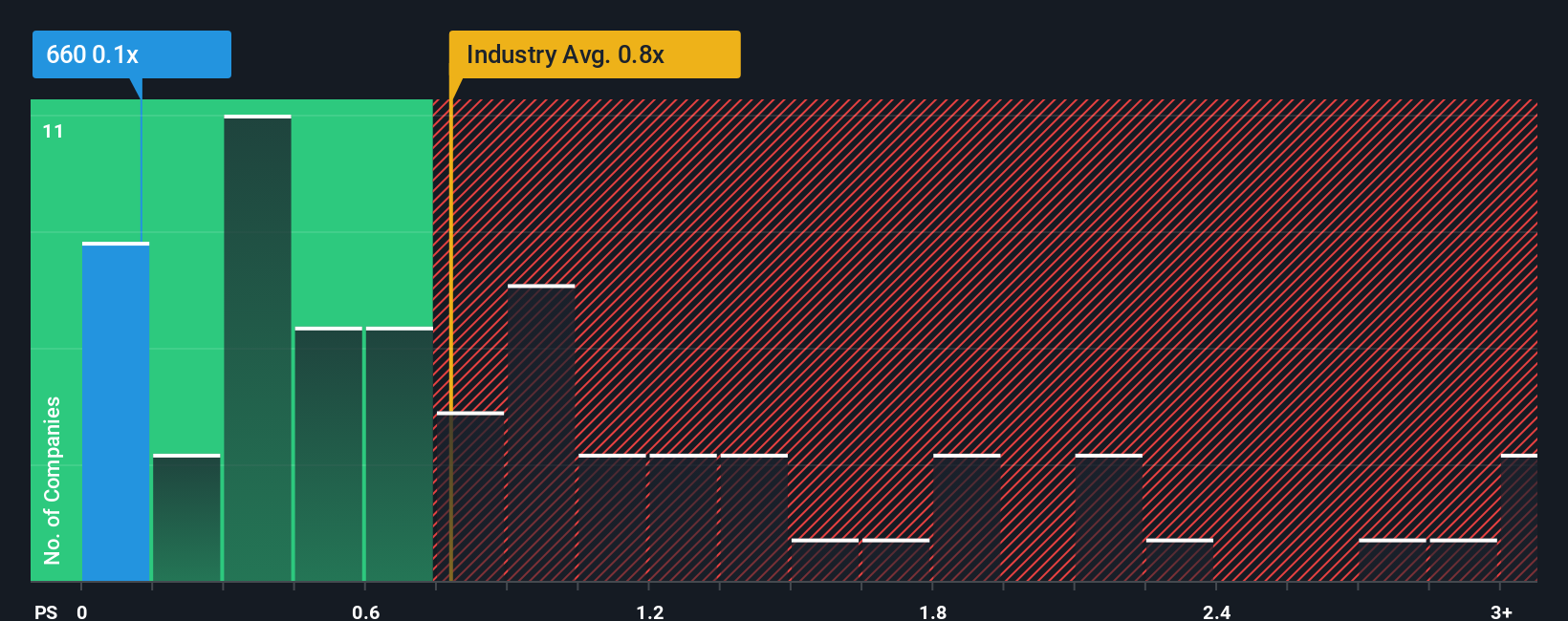

Although its price has surged higher, considering around half the companies operating in Hong Kong's Food industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Wai Chun Bio-Technology as an solid investment opportunity with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Wai Chun Bio-Technology

How Has Wai Chun Bio-Technology Performed Recently?

We'd have to say that with no tangible growth over the last year, Wai Chun Bio-Technology's revenue has been unimpressive. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Wai Chun Bio-Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Wai Chun Bio-Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Wai Chun Bio-Technology would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 44% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 4.5% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why Wai Chun Bio-Technology's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Wai Chun Bio-Technology's P/S

The latest share price surge wasn't enough to lift Wai Chun Bio-Technology's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Wai Chun Bio-Technology maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Wai Chun Bio-Technology (4 are a bit unpleasant!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Wai Chun Bio-Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English