Biosino Bio-Technology and Science Incorporation (HKG:8247) Held Back By Insufficient Growth Even After Shares Climb 56%

Biosino Bio-Technology and Science Incorporation (HKG:8247) shares have continued their recent momentum with a 56% gain in the last month alone. The last 30 days were the cherry on top of the stock's 803% gain in the last year, which is nothing short of spectacular.

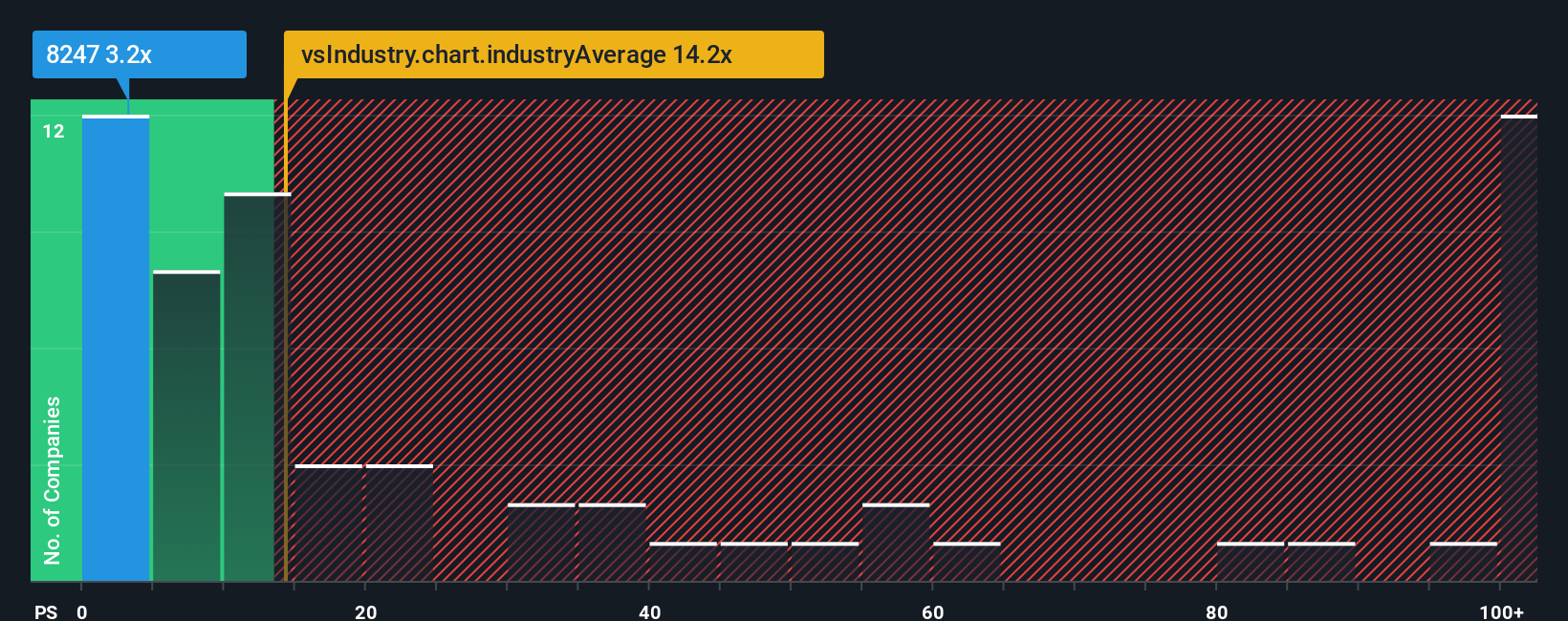

Even after such a large jump in price, Biosino Bio-Technology and Science Incorporation may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.2x, considering almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios greater than 14.2x and even P/S higher than 71x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Biosino Bio-Technology and Science Incorporation

What Does Biosino Bio-Technology and Science Incorporation's Recent Performance Look Like?

For instance, Biosino Bio-Technology and Science Incorporation's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Biosino Bio-Technology and Science Incorporation will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Biosino Bio-Technology and Science Incorporation would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. This means it has also seen a slide in revenue over the longer-term as revenue is down 35% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 650% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Biosino Bio-Technology and Science Incorporation is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Shares in Biosino Bio-Technology and Science Incorporation have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Biosino Bio-Technology and Science Incorporation revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about this 1 warning sign we've spotted with Biosino Bio-Technology and Science Incorporation.

If these risks are making you reconsider your opinion on Biosino Bio-Technology and Science Incorporation, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English