Hatcher Group Limited (HKG:8365) shares have had a horrible month, losing 37% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 95% loss during that time.

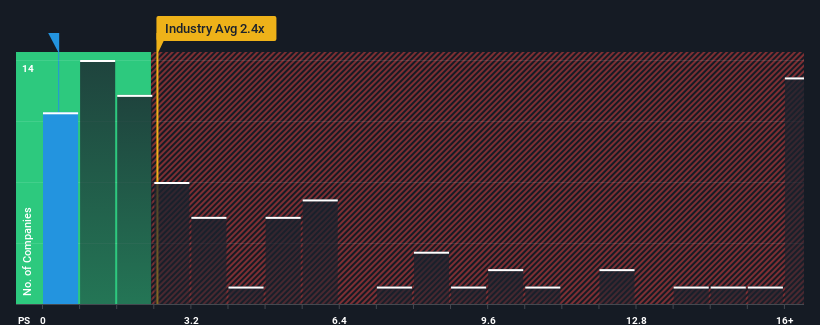

Since its price has dipped substantially, Hatcher Group may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Capital Markets industry in Hong Kong have P/S ratios greater than 2.4x and even P/S higher than 10x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Hatcher Group

How Has Hatcher Group Performed Recently?

With revenue growth that's exceedingly strong of late, Hatcher Group has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. Those who are bullish on Hatcher Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Hatcher Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Hatcher Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Hatcher Group's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 56% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 143% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 38% shows it's about the same on an annualised basis.

In light of this, it's peculiar that Hatcher Group's P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What Does Hatcher Group's P/S Mean For Investors?

Shares in Hatcher Group have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Hatcher Group currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. While recent

It is also worth noting that we have found 4 warning signs for Hatcher Group (3 shouldn't be ignored!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English