The Sunny Side Up Culture Holdings Limited (HKG:8082) share price has done very well over the last month, posting an excellent gain of 37%. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

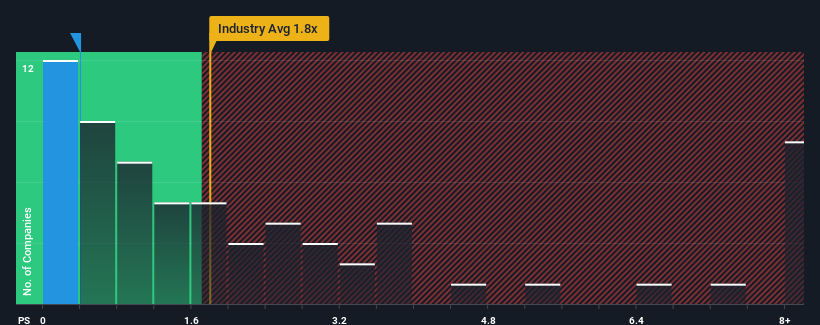

Even after such a large jump in price, Sunny Side Up Culture Holdings may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Entertainment industry in Hong Kong have P/S ratios greater than 1.8x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Sunny Side Up Culture Holdings

What Does Sunny Side Up Culture Holdings' Recent Performance Look Like?

Recent times have been quite advantageous for Sunny Side Up Culture Holdings as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Sunny Side Up Culture Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Sunny Side Up Culture Holdings' to be considered reasonable.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Pleasingly, revenue has also lifted 295% in aggregate from three years ago, thanks to the last 12 months of explosive growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 45% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Sunny Side Up Culture Holdings is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Sunny Side Up Culture Holdings' stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Sunny Side Up Culture Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Sunny Side Up Culture Holdings (of which 1 is potentially serious!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English