It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Jilin Province Huinan Changlong Bio-pharmacy (HKG:8049). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Jilin Province Huinan Changlong Bio-pharmacy

How Fast Is Jilin Province Huinan Changlong Bio-pharmacy Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. We can see that in the last three years Jilin Province Huinan Changlong Bio-pharmacy grew its EPS by 17% per year. That growth rate is fairly good, assuming the company can keep it up.

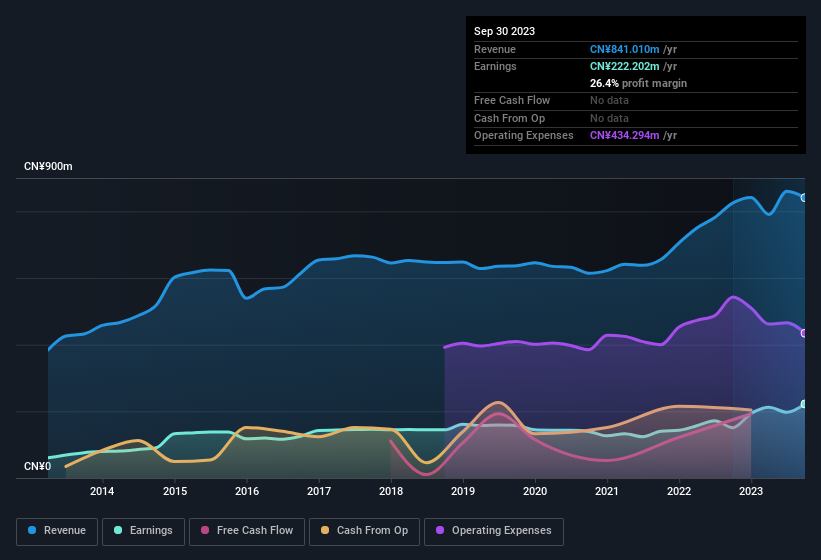

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Despite the relatively flat revenue figures, shareholders will be pleased to see EBIT margins have grown from 18% to 24% in the last 12 months. That's something to smile about.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Jilin Province Huinan Changlong Bio-pharmacy is no giant, with a market capitalisation of HK$980m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Jilin Province Huinan Changlong Bio-pharmacy Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Jilin Province Huinan Changlong Bio-pharmacy followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Indeed, they hold CN¥339m worth of its stock. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 35% of the shares on issue for the business, an appreciable amount considering the market cap.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to Jilin Province Huinan Changlong Bio-pharmacy, with market caps under CN¥1.4b is around CN¥1.7m.

The CEO of Jilin Province Huinan Changlong Bio-pharmacy only received CN¥539k in total compensation for the year ending December 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Jilin Province Huinan Changlong Bio-pharmacy To Your Watchlist?

One positive for Jilin Province Huinan Changlong Bio-pharmacy is that it is growing EPS. That's nice to see. The fact that EPS is growing is a genuine positive for Jilin Province Huinan Changlong Bio-pharmacy, but the pleasant picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. You still need to take note of risks, for example - Jilin Province Huinan Changlong Bio-pharmacy has 1 warning sign we think you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Hong Kong companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

③ Pre-market (4:00 AM - 9:30 AM ET) , after-hours (4:00 PM - 8:00 PM ET) .

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English