3 SEHK Stocks Including Ocumension Therapeutics Estimated To Be Trading Below Intrinsic Value

The Hong Kong market has recently experienced mixed performance, with the Hang Seng Index declining by 0.45% amid weak manufacturing data and concerns over domestic demand. This presents a potential opportunity for discerning investors to identify undervalued stocks that may be trading below their intrinsic value. In light of current market conditions, focusing on stocks with strong fundamentals and growth potential can be particularly advantageous. Here are three SEHK stocks, including Ocumension Therapeutics, estimated to be trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Best Pacific International Holdings (SEHK:2111) | HK$2.20 | HK$4.33 | 49.2% |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$6.79 | 42.6% |

| BYD Electronic (International) (SEHK:285) | HK$29.30 | HK$53.40 | 45.1% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$3.05 | HK$5.70 | 46.5% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$28.25 | HK$56.41 | 49.9% |

| Pacific Textiles Holdings (SEHK:1382) | HK$1.69 | HK$2.99 | 43.5% |

| iDreamSky Technology Holdings (SEHK:1119) | HK$2.20 | HK$4.20 | 47.7% |

| Weimob (SEHK:2013) | HK$1.19 | HK$2.19 | 45.6% |

| Innovent Biologics (SEHK:1801) | HK$39.25 | HK$73.73 | 46.8% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.75 | HK$1.39 | 45.9% |

Here we highlight a subset of our preferred stocks from the screener.

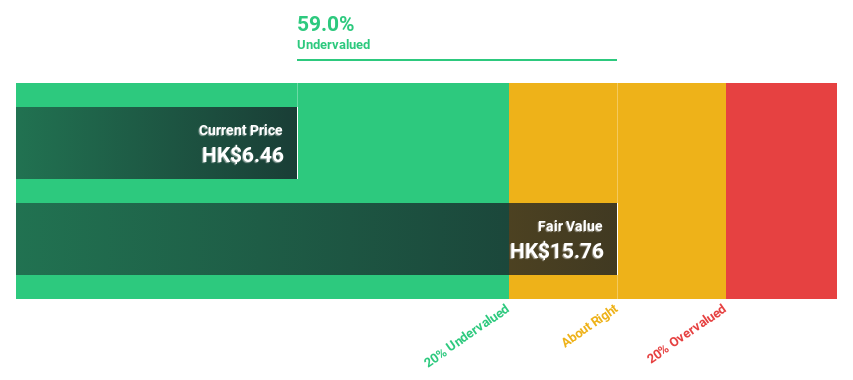

Ocumension Therapeutics (SEHK:1477)

Overview: Ocumension Therapeutics, with a market cap of HK$4.84 billion, operates as an ophthalmic pharmaceutical platform company in the People's Republic of China through its subsidiaries.

Operations: The company's revenue segment includes discovering, developing, and commercializing ophthalmic therapies, generating CN¥246.37 million.

Estimated Discount To Fair Value: 11.4%

Ocumension Therapeutics, trading at HK$6.98, is considered undervalued with a fair value estimate of HK$7.88. The company’s revenue is forecast to grow 35.2% annually, significantly outpacing the Hong Kong market's 7.4%. Earnings are projected to increase by 93.7% per year and the firm is expected to become profitable within three years. Recent acceptance of their BLA for OT-702 by China’s CDE boosts future cash flow prospects through commercialization rights in China.

- Our growth report here indicates Ocumension Therapeutics may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Ocumension Therapeutics' balance sheet health report.

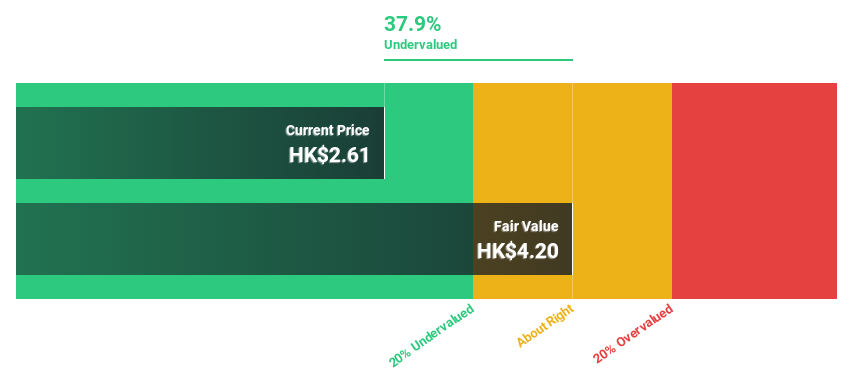

Shanghai Conant Optical (SEHK:2276)

Overview: Shanghai Conant Optical Co., Ltd. manufactures and sells resin spectacle lenses across Mainland China, the Americas, Asia, Europe, Oceania, and Africa with a market cap of HK$4.90 billion.

Operations: The company's revenue primarily comes from the manufacturing and sales of resin spectacle lenses, totaling CN¥1.76 billion.

Estimated Discount To Fair Value: 17.4%

Shanghai Conant Optical, trading at HK$11.48, is undervalued with a fair value estimate of HK$13.9. Earnings are forecast to grow 16.1% annually, outpacing the Hong Kong market's 11.3%. Despite revenue growth being slower than 20%, it's still expected to exceed the market average at 11.8% per year. Recent approval of a final dividend payment further solidifies its financial stability and shareholder returns, making it an attractive option based on cash flows.

- Upon reviewing our latest growth report, Shanghai Conant Optical's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Shanghai Conant Optical stock in this financial health report.

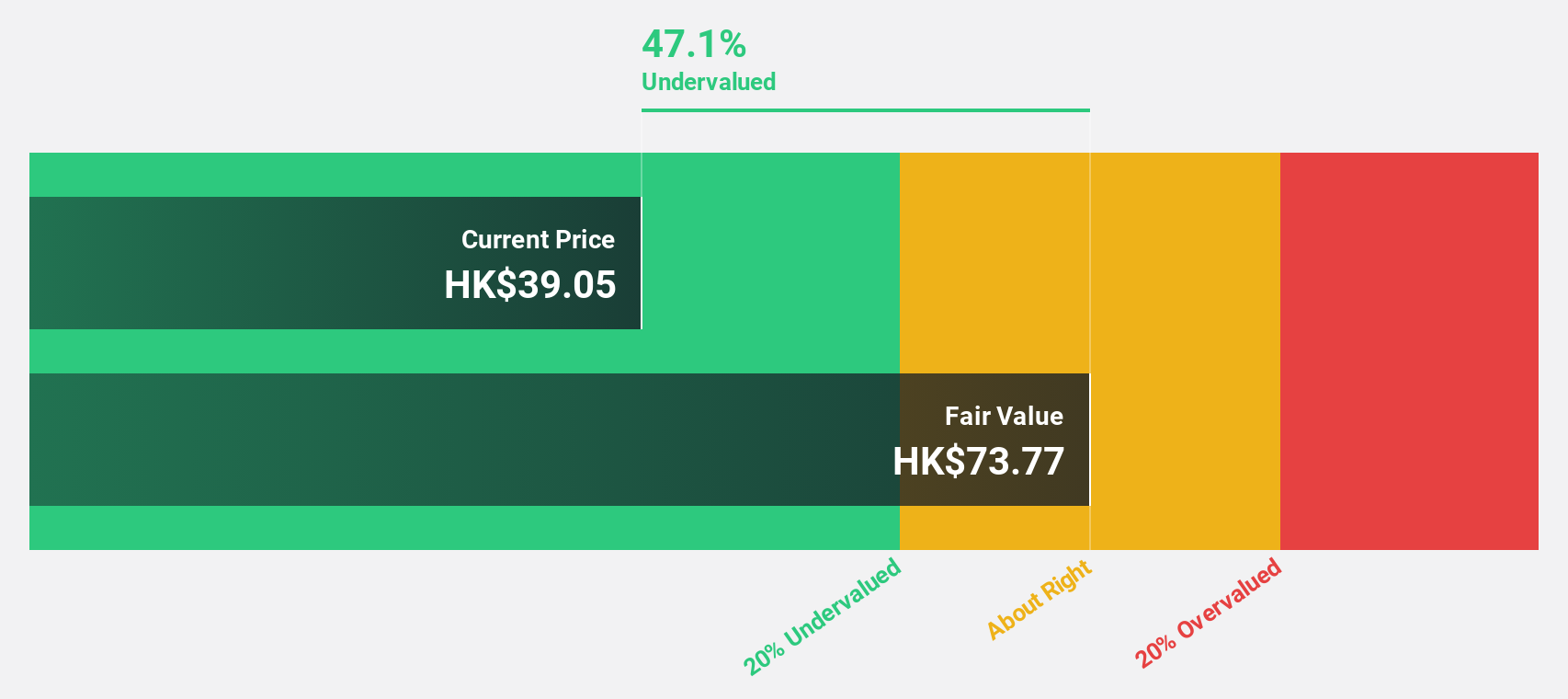

IGG (SEHK:799)

Overview: IGG Inc, an investment holding company with a market cap of HK$3.08 billion, develops and operates mobile and online games across Asia, North America, Europe, and internationally.

Operations: Revenue from the development and operation of online games amounts to HK$5.27 billion.

Estimated Discount To Fair Value: 35.8%

IGG, currently priced at HK$2.72, is trading significantly below its fair value estimate of HK$4.24. The company recently became profitable and is forecast to achieve high earnings growth of 51.17% annually over the next three years, outpacing the Hong Kong market's 11.3%. Despite slower revenue growth projections (4.2% per year), analysts agree on a potential stock price increase by 55.1%. Recent governance changes include new amendments to the articles of association and appointing Ms. Feng Li as an independent non-executive Director.

- Our expertly prepared growth report on IGG implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on IGG's balance sheet by reading our health report here.

Seize The Opportunity

- Embark on your investment journey to our 31 Undervalued SEHK Stocks Based On Cash Flows selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English