Exploring Three Undiscovered Gems In Hong Kong With Strong Potential

As global markets continue to show resilience, with the Hang Seng Index in Hong Kong rising by 1.99% despite weaker-than-expected economic activity in China, investors are increasingly looking towards small-cap stocks for untapped potential. In this dynamic environment, identifying promising stocks often involves finding companies that demonstrate strong fundamentals and growth potential amidst broader market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| China Leon Inspection Holding | 17.06% | 24.06% | 27.08% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Time Interconnect Technology Limited, an investment holding company with a market cap of HK$7.10 billion, manufactures and sells cable assembly and networking cable products in China, the United States, the Netherlands, Singapore, the United Kingdom, Hong Kong, Mexico, and internationally.

Operations: Time Interconnect Technology Limited generates revenue primarily from three segments: Server (HK$2.98 billion), Digital Cable (HK$1.18 billion), and Cable Assembly (HK$2.31 billion).

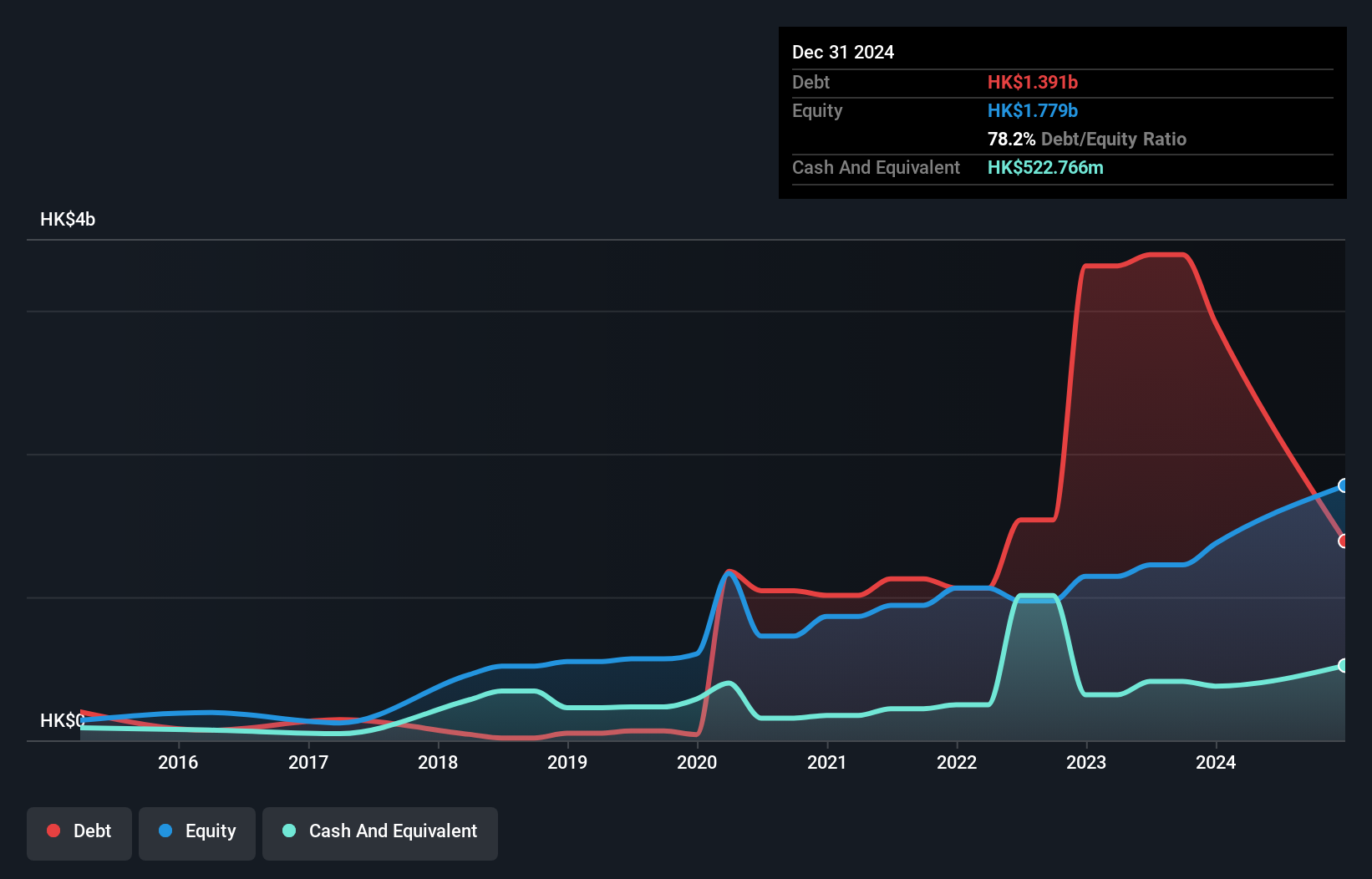

Time Interconnect Technology's earnings surged 93.1% last year, outpacing the Electrical industry’s 11%. The company’s net debt to equity ratio stands at a high 184.9%, but interest payments are well covered by EBIT at nine times coverage. Recent guidance indicates a potential net profit increase of 30-40% for the six months ending June 2024, driven by higher revenue from medical equipment and data center cable assembly sectors. Additionally, a final dividend of HK$0.007 per share was approved in May 2024.

- Click here to discover the nuances of Time Interconnect Technology with our detailed analytical health report.

Understand Time Interconnect Technology's track record by examining our Past report.

Scholar Education Group (SEHK:1769)

Simply Wall St Value Rating: ★★★★★★

Overview: Scholar Education Group, an investment holding company with a market cap of HK$3.26 billion, provides K-12 after-school education services in the People’s Republic of China.

Operations: Scholar Education Group generates revenue primarily from its K-12 after-school education services in China. The company's net profit margin has shown notable trends over recent financial periods.

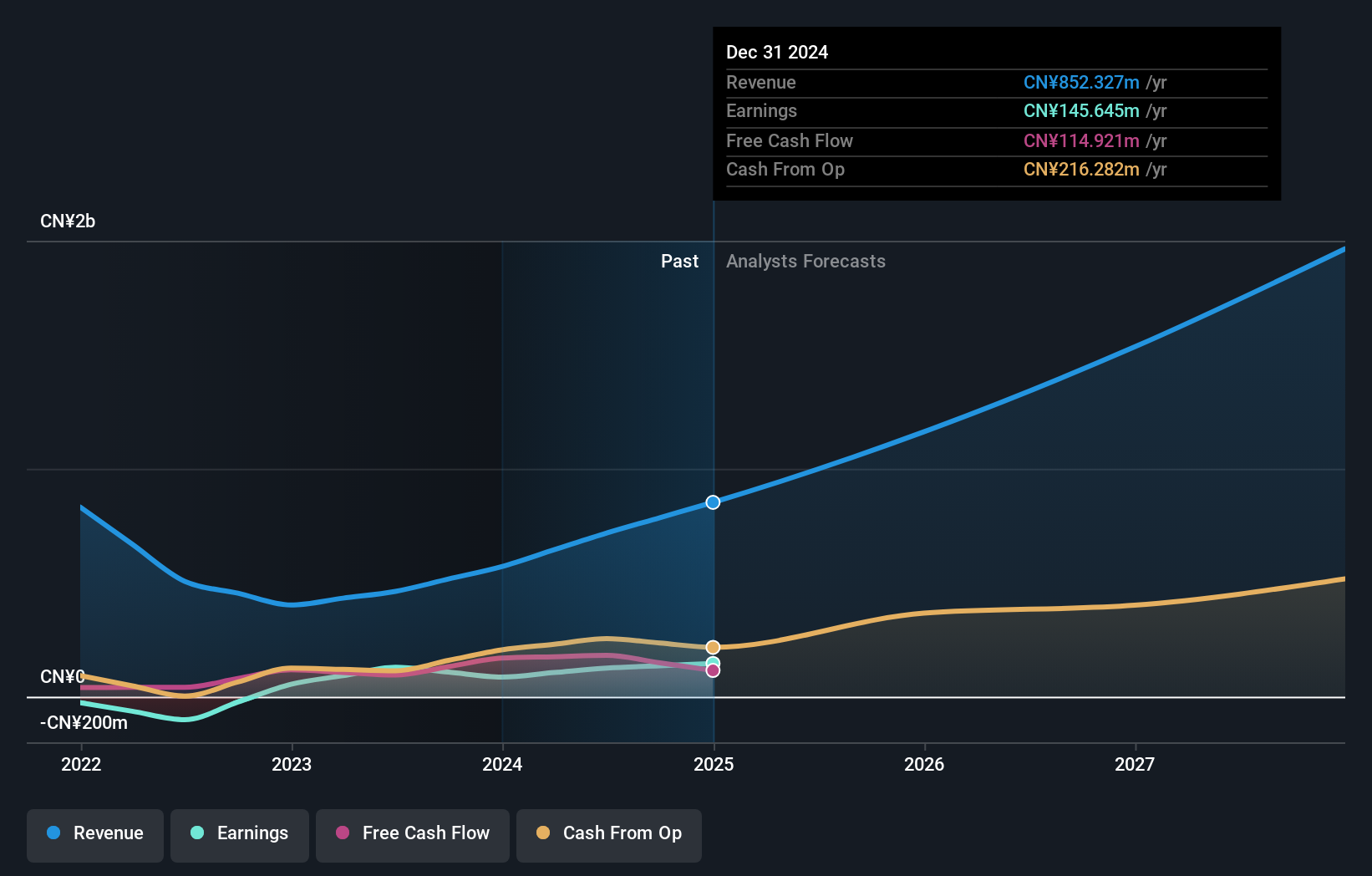

Scholar Education Group, a promising player in Hong Kong's education sector, reported CNY 399.11 million in sales for the first half of 2024, up from CNY 251.32 million last year. Net income reached CNY 82.65 million compared to CNY 42.94 million previously, with basic earnings per share at CNY 0.1521 versus CNY 0.0773 a year ago. The company trades at a substantial discount to its estimated fair value and has reduced its debt-to-equity ratio from 9% to 5.6% over five years.

- Dive into the specifics of Scholar Education Group here with our thorough health report.

Learn about Scholar Education Group's historical performance.

Launch Tech (SEHK:2488)

Simply Wall St Value Rating: ★★★★★☆

Overview: Launch Tech Company Limited, along with its subsidiaries, offers products and services to the automotive aftermarket and automobile industry both in China and globally, with a market cap of HK$2.24 billion.

Operations: Launch Tech generates revenue primarily from its products and services in the automotive aftermarket and automobile industry. The company has a market cap of HK$2.24 billion.

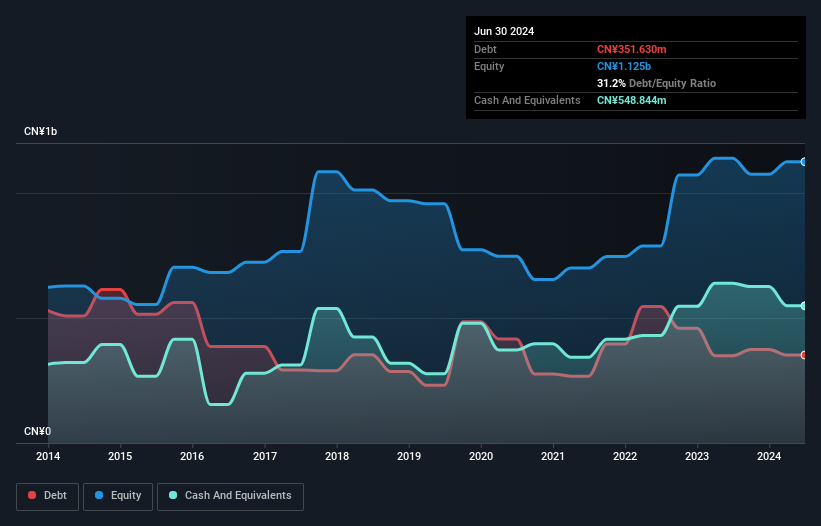

Launch Tech's recent earnings report shows impressive growth, with sales reaching CNY 999.05 million for the half-year ended June 30, 2024, up from CNY 721.15 million a year ago. Net income also surged to CNY 152.45 million compared to last year's CNY 65.04 million, reflecting strong operational performance despite lower profit margins (13.7% vs. last year's 26.1%). The company declared an interim dividend of RMB 0.20 per share against RMB 0.34 in the previous year, indicating cautious optimism moving forward.

- Unlock comprehensive insights into our analysis of Launch Tech stock in this health report.

Examine Launch Tech's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Discover the full array of 175 SEHK Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English