Exploring Time Interconnect Technology And 2 Promising Small Caps In Hong Kong

As global markets show signs of recovery, the Hong Kong market has also experienced positive momentum, with the Hang Seng Index up nearly 2% recently. Against this backdrop, small-cap stocks are garnering attention for their potential to outperform in a stabilizing economic environment. In this article, we explore three promising small-cap stocks in Hong Kong, starting with Time Interconnect Technology. A good stock often combines strong fundamentals with growth potential—qualities that these companies exhibit amid improving market sentiment and economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| China Leon Inspection Holding | 17.06% | 24.06% | 27.08% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

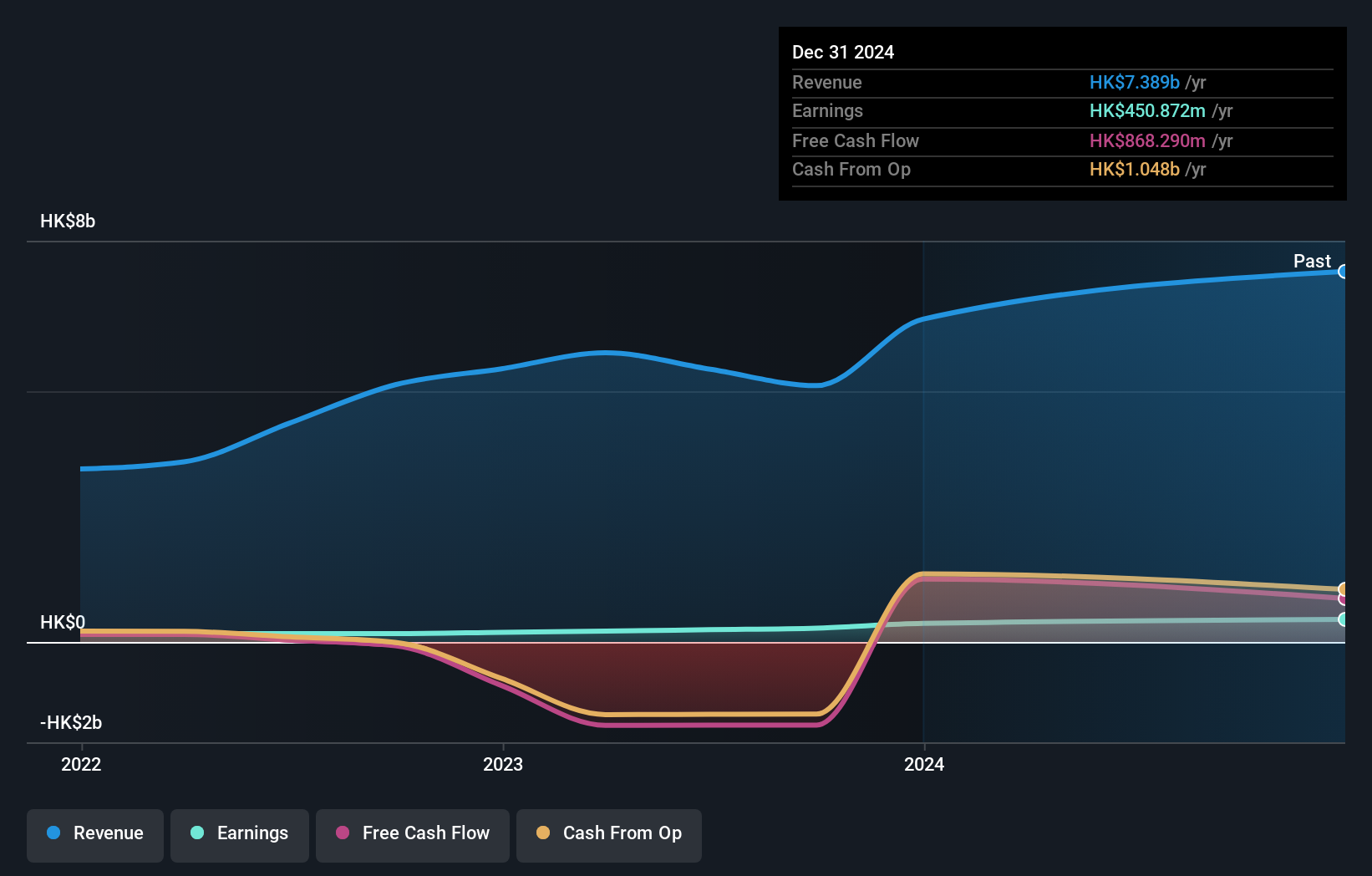

Overview: Time Interconnect Technology Limited, an investment holding company with a market cap of HK$7.10 billion, manufactures and sells cable assembly and networking cable products in various international markets including the People's Republic of China, the United States, and the Netherlands.

Operations: Time Interconnect Technology generates revenue primarily from its Server segment (HK$2.98 billion), Digital Cable segment (HK$1.18 billion), and Cable Assembly segment (HK$2.31 billion).

Time Interconnect Technology's earnings growth of 93.1% over the past year outpaced the Electrical industry’s 11%. Despite a highly volatile share price in the last three months, its interest payments are well covered by EBIT at 9x. The company has high-quality earnings and is free cash flow positive. However, it carries a significant net debt to equity ratio of 184.9%, which has surged from 9% over five years. Recent guidance indicates a potential net profit increase of up to 40%, driven by revenue boosts in medical equipment and data center cable assemblies.

Scholar Education Group (SEHK:1769)

Simply Wall St Value Rating: ★★★★★★

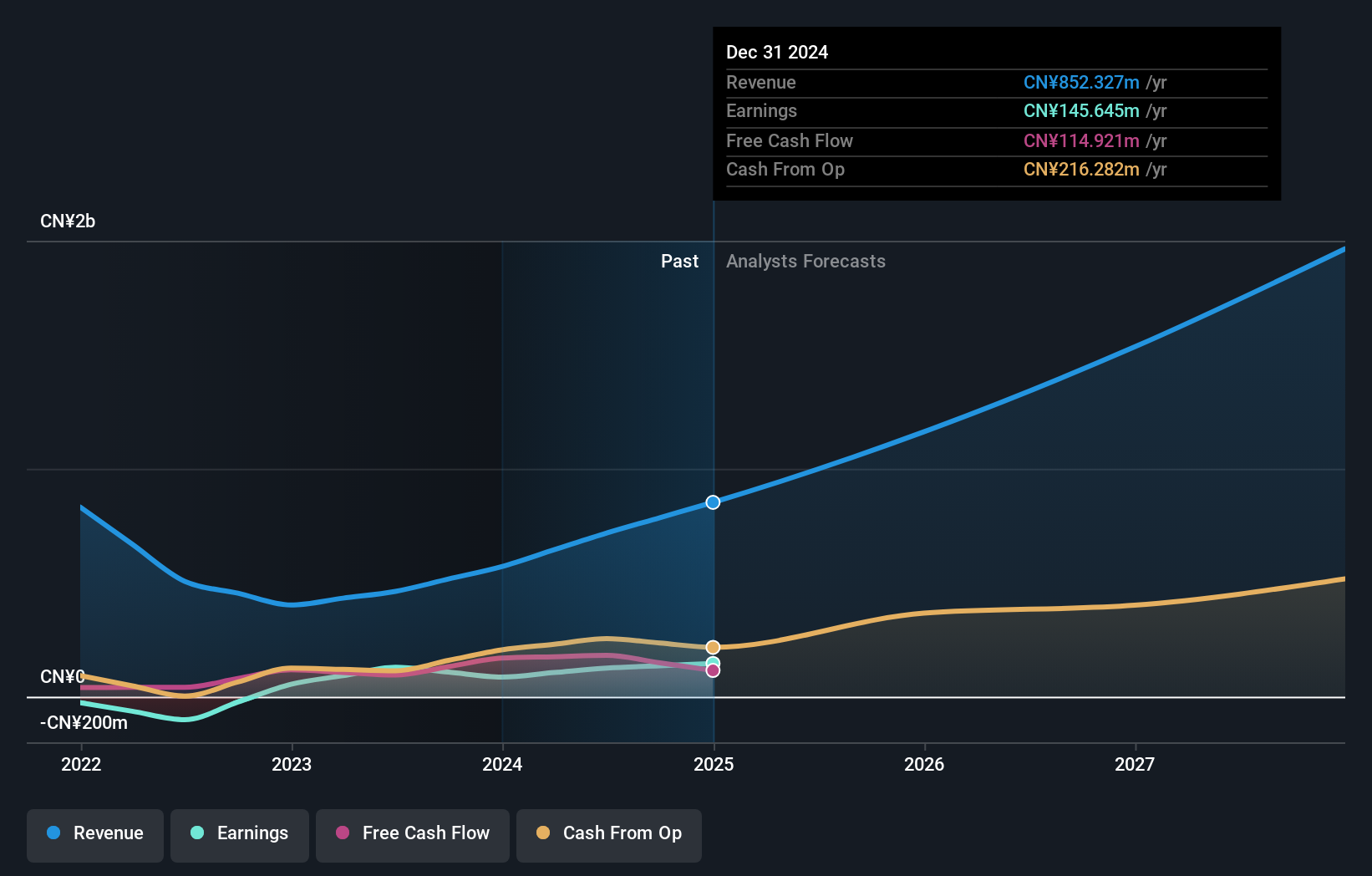

Overview: Scholar Education Group, an investment holding company with a market cap of HK$3.26 billion, provides K-12 after-school education services in the People’s Republic of China.

Operations: Scholar Education Group generates revenue primarily from providing K-12 after-school education services in the People’s Republic of China. The company's cost structure includes expenses related to educational materials, staff salaries, and facility maintenance.

Scholar Education Group, a small cap player in the education sector, reported earnings for the half year ended June 30, 2024. Sales reached CNY 399.11 million from CNY 251.32 million last year, while net income rose to CNY 82.65 million from CNY 42.94 million previously. Basic earnings per share increased to CNY 0.1521 from CNY 0.0773 a year ago, reflecting improved profitability despite lower profit margins of 17.5% compared to last year's 28%.

- Get an in-depth perspective on Scholar Education Group's performance by reading our health report here.

Understand Scholar Education Group's track record by examining our Past report.

Launch Tech (SEHK:2488)

Simply Wall St Value Rating: ★★★★★☆

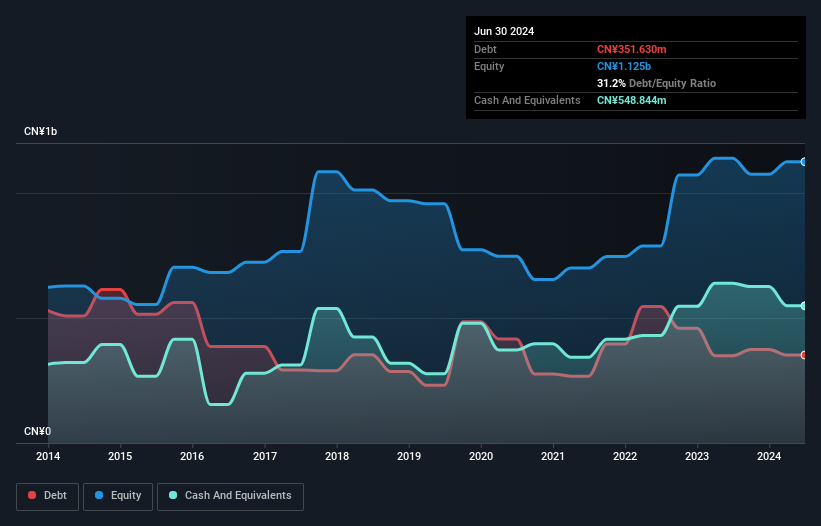

Overview: Launch Tech Company Limited, along with its subsidiaries, offers products and services to the automotive aftermarket and automobile industry both in China and internationally, with a market cap of HK$2.24 billion.

Operations: Launch Tech generates revenue from its products and services in the automotive aftermarket and automobile industry. The company has a market cap of HK$2.24 billion.

Launch Tech, a small cap in Hong Kong's auto components sector, has shown mixed performance recently. Sales for the first half of 2024 reached CNY 999.05 million, up from CNY 721.15 million last year, while net income rose to CNY 152.45 million from CNY 65.04 million. Despite this growth, profit margins dropped to 13.7% from last year's 26.1%. The company’s debt-to-equity ratio increased over five years from 24.1% to 31.2%.

- Click here to discover the nuances of Launch Tech with our detailed analytical health report.

Gain insights into Launch Tech's past trends and performance with our Past report.

Next Steps

- Gain an insight into the universe of 175 SEHK Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English