Undiscovered Gems In Hong Kong To Watch This September 2024

As global markets navigate a period of economic adjustments, the Hong Kong market has shown resilience, with the Hang Seng Index experiencing moderate fluctuations amid broader market sentiment. This September 2024, investors are particularly focused on small-cap companies that demonstrate strong fundamentals and potential for growth despite prevailing economic uncertainties. In this context, identifying stocks with robust financial health and innovative business models can be crucial for uncovering hidden opportunities in the Hong Kong market.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| HBM Holdings | 52.89% | 66.59% | 31.70% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

IVD Medical Holding (SEHK:1931)

Simply Wall St Value Rating: ★★★★★☆

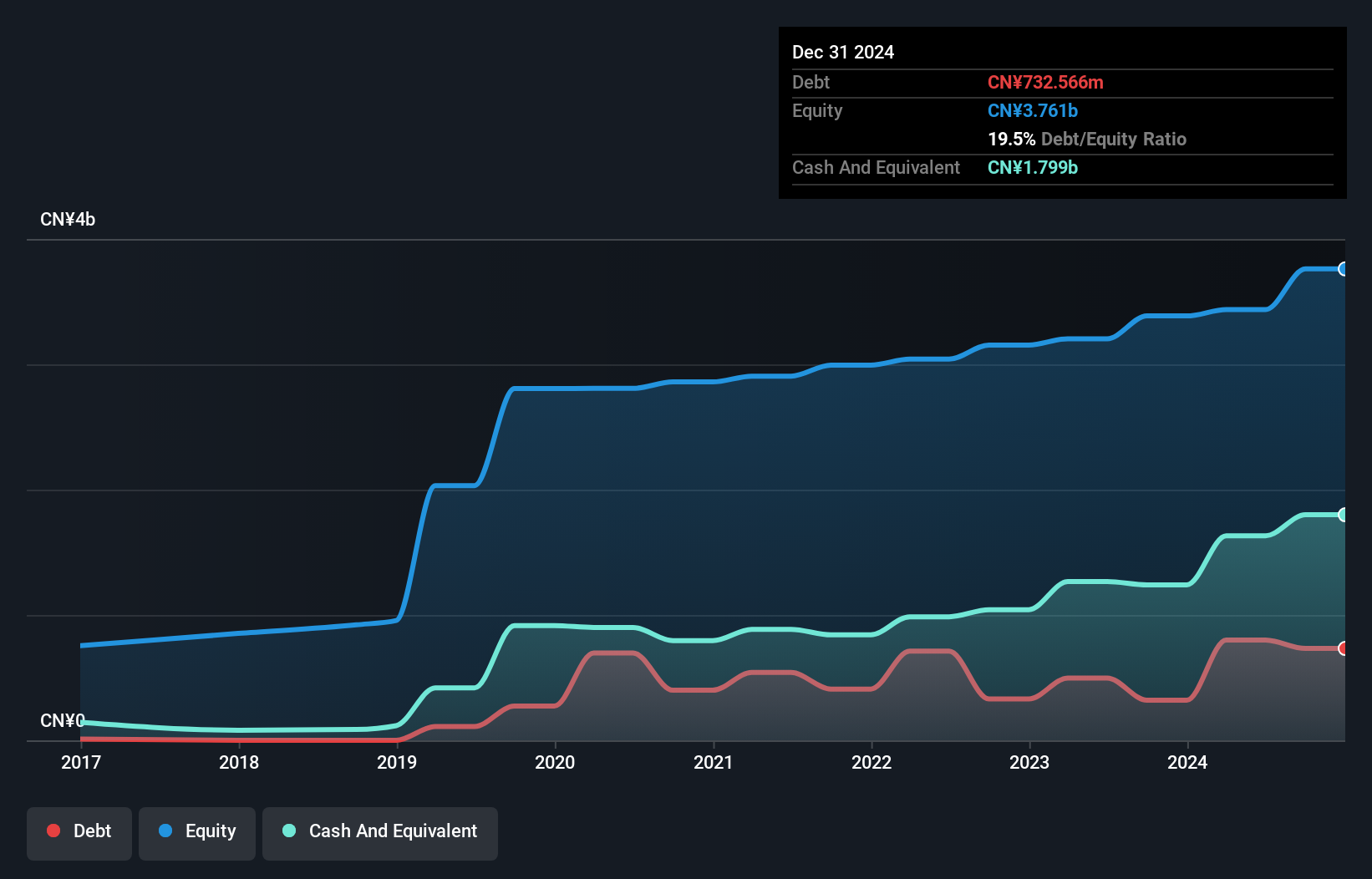

Overview: IVD Medical Holding Limited is an investment holding company that distributes in vitro diagnostic (IVD) products in Mainland China and internationally, with a market cap of approximately HK$2.81 billion.

Operations: The company generates revenue primarily from its Distribution Business (CN¥2.86 billion) and After-sales services (CN¥196.47 million), with a minor contribution from Self-Branded Products Business (CN¥9.05 million).

IVD Medical Holding has demonstrated solid financial performance, with net income rising to CNY 125.29 million for the first half of 2024, up from CNY 103.01 million a year ago. Earnings per share improved to CNY 0.0927 from CNY 0.0762 in the same period last year. Despite a slight dip in sales to CNY 1,353.47 million from CNY 1,377.31 million, the company remains profitable and free cash flow positive at HK$344.90 million as of September 2023.

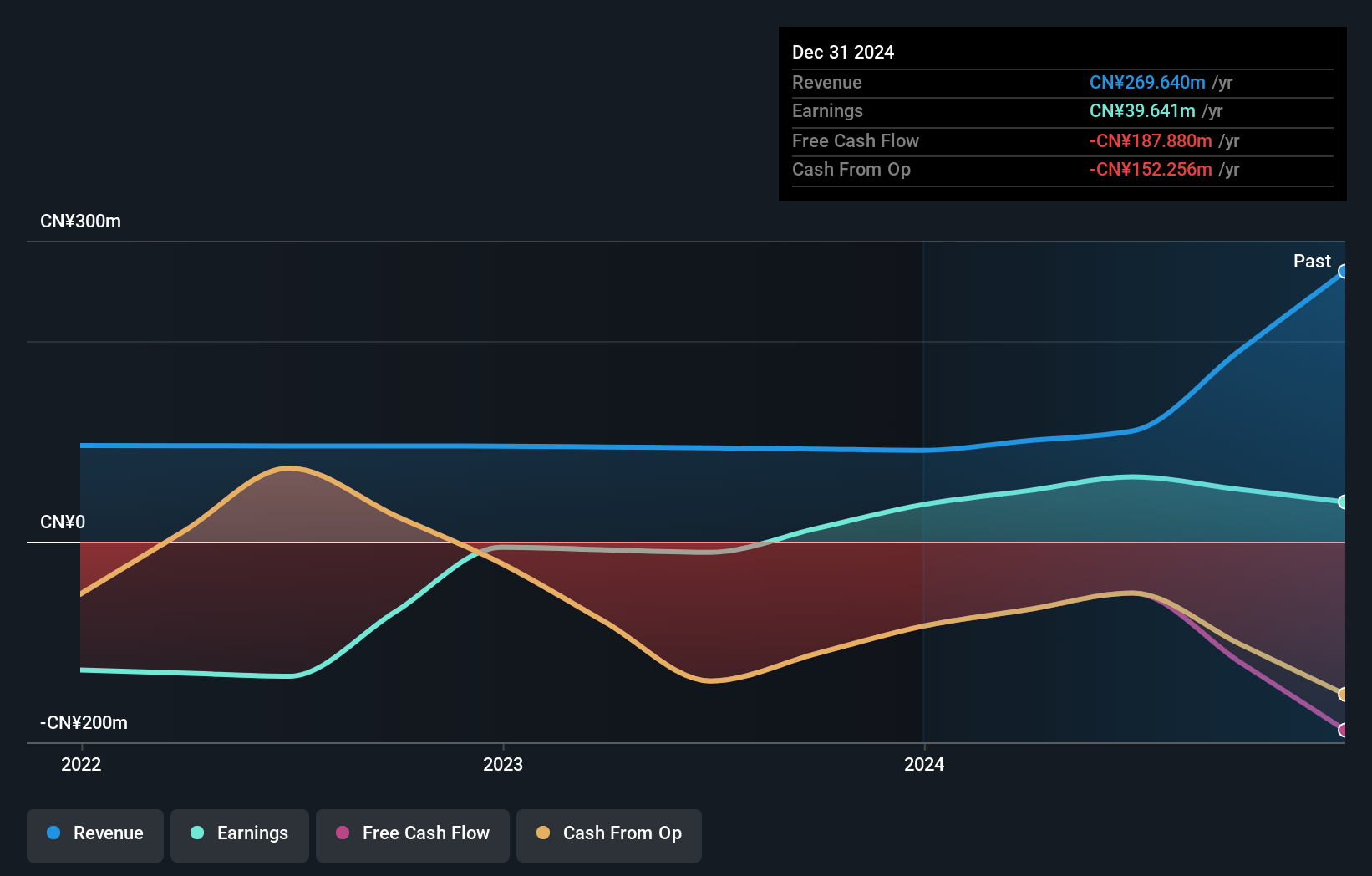

Gome Finance Technology (SEHK:628)

Simply Wall St Value Rating: ★★★★★★

Overview: Gome Finance Technology Co., Ltd., an investment holding company with a market cap of HK$2.24 billion, provides various financial services in the People's Republic of China.

Operations: Gome Finance Technology generates revenue primarily from its commercial factoring business (CN¥81.20 million) and other financing services (CN¥19.16 million).

Gome Finance Technology has turned profitable this year, reporting a net income of CNY 25.28 million for the first half of 2024, compared to a loss of CNY 2.23 million last year. The company’s earnings per share rose to CNY 0.0089 from a loss per share of CNY 0.0008 previously. Notably, Gome is debt-free and has reduced its debt significantly over the past five years from a debt-to-equity ratio of 46%.

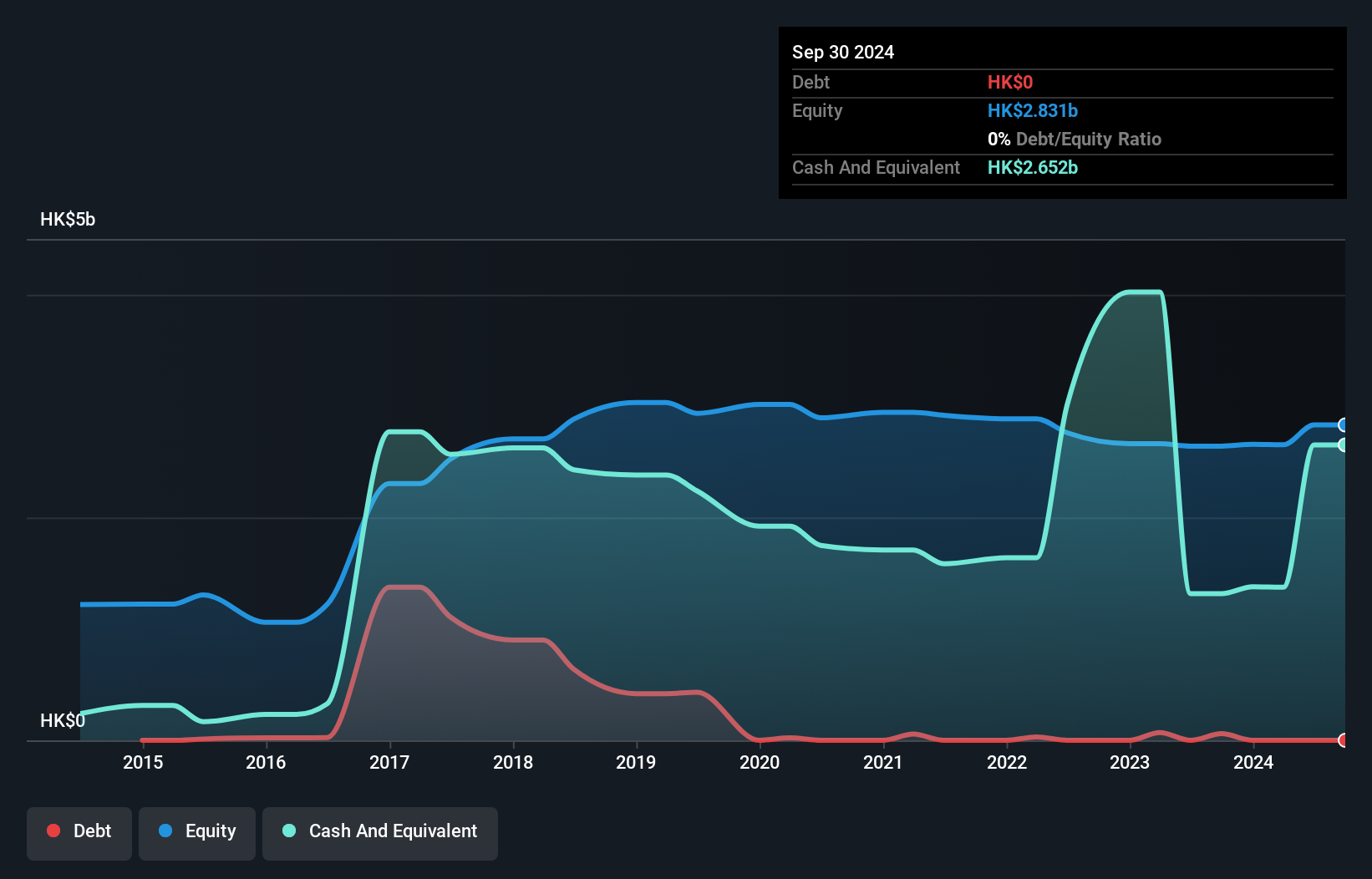

AGTech Holdings (SEHK:8279)

Simply Wall St Value Rating: ★★★★★★

Overview: AGTech Holdings Limited operates as an integrated technology and services company in the People’s Republic of China and Macau with a market cap of HK$2.50 billion.

Operations: AGTech Holdings Limited generates revenue primarily from its Lottery Operation (HK$248.76 million) and Electronic Payment and Related Services (HK$364.50 million).

AGTech Holdings has recently turned profitable, reporting net income of HK$31.86 million for the fifteen months ending March 2024. The company’s basic earnings per share from continuing operations stood at HK$0.00279, with diluted earnings per share slightly lower at HK$0.00278. Notably, AGTech has no debt compared to five years ago when its debt-to-equity ratio was 13.8%. Recent board changes include Mr. Zou Liang retiring as a non-executive director to focus on other business commitments.

- Dive into the specifics of AGTech Holdings here with our thorough health report.

Assess AGTech Holdings' past performance with our detailed historical performance reports.

Where To Now?

- Click here to access our complete index of 172 SEHK Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English