Here's Why It's Unlikely That Dadi International Group Limited's (HKG:8130) CEO Will See A Pay Rise This Year

Key Insights

- Dadi International Group's Annual General Meeting to take place on 27th of September

- Total pay for CEO Darren Wu includes HK$1.97m salary

- The total compensation is 32% higher than the average for the industry

- Dadi International Group's three-year loss to shareholders was 74% while its EPS was down 11% over the past three years

Dadi International Group Limited (HKG:8130) has not performed well recently and CEO Darren Wu will probably need to up their game. At the upcoming AGM on 27th of September, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for Dadi International Group

Comparing Dadi International Group Limited's CEO Compensation With The Industry

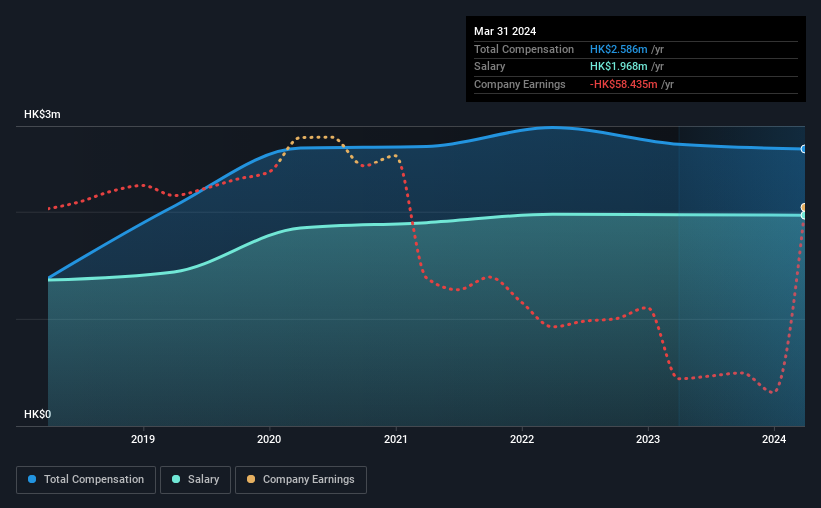

According to our data, Dadi International Group Limited has a market capitalization of HK$36m, and paid its CEO total annual compensation worth HK$2.6m over the year to March 2024. That is, the compensation was roughly the same as last year. We note that the salary portion, which stands at HK$1.97m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Hong Kong Media industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.0m. This suggests that Darren Wu is paid more than the median for the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$2.0m | HK$2.0m | 76% |

| Other | HK$618k | HK$657k | 24% |

| Total Compensation | HK$2.6m | HK$2.6m | 100% |

Talking in terms of the industry, salary represented approximately 83% of total compensation out of all the companies we analyzed, while other remuneration made up 17% of the pie. There isn't a significant difference between Dadi International Group and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Dadi International Group Limited's Growth Numbers

Dadi International Group Limited has reduced its earnings per share by 11% a year over the last three years. It saw its revenue drop 46% over the last year.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Dadi International Group Limited Been A Good Investment?

The return of -74% over three years would not have pleased Dadi International Group Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 4 warning signs for Dadi International Group (of which 3 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English