Top Penny Stocks To Watch In November 2024

Global markets have experienced significant shifts, with U.S. stocks rallying to record highs following a Republican "red sweep" in the recent elections, sparking hopes for growth and tax reforms. Amid these changes, investors are increasingly seeking opportunities in smaller or newer companies often referred to as penny stocks—a term that may sound outdated but remains relevant today. These stocks can offer growth potential at lower price points, especially when they possess strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR351.85M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR136.84M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$552.27M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.29B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$144.95M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.04 | THB1.67B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6075 | A$72.68M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.63 | £190.08M | ★★★★★★ |

Click here to see the full list of 5,755 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Brii Biosciences (SEHK:2137)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brii Biosciences Limited focuses on developing therapies for infectious and central nervous system diseases in China and the United States, with a market cap of approximately HK$789.65 million.

Operations: The company's revenue is derived entirely from its biotechnology segment, amounting to CN¥38.38 million.

Market Cap: HK$789.65M

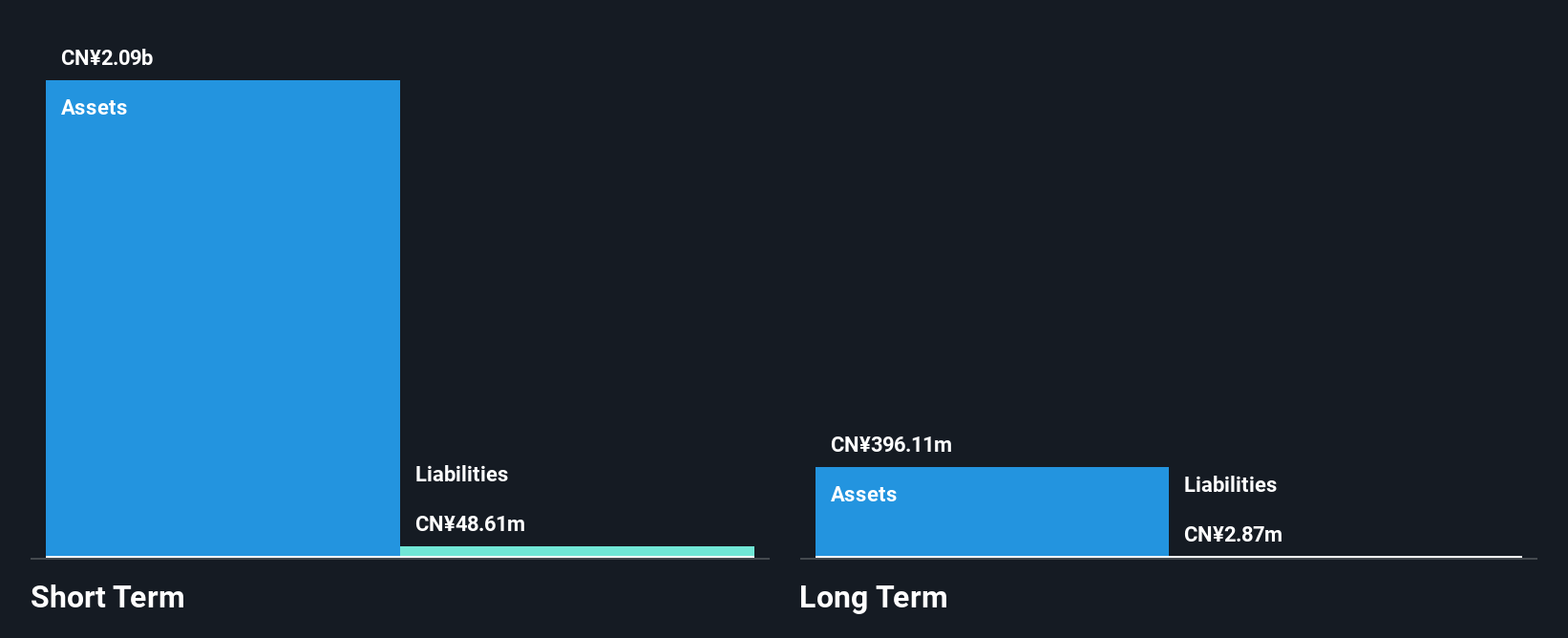

Brii Biosciences, with a market cap of approximately HK$789.65 million, operates in the biotech sector focusing on infectious and central nervous system diseases. The company is pre-revenue, generating CN¥38.38 million entirely from its biotechnology segment. Despite being unprofitable, Brii has reduced losses by 41.3% annually over the past five years and maintains a sufficient cash runway for more than three years without debt concerns. Recent events include its exclusion from the S&P Global BMI Index and reporting increased net losses for H1 2024 compared to last year, highlighting ongoing financial challenges amidst strategic developments in its pipeline.

- Take a closer look at Brii Biosciences' potential here in our financial health report.

- Examine Brii Biosciences' earnings growth report to understand how analysts expect it to perform.

China Health Group (SEHK:673)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Health Group Limited, with a market cap of HK$344.15 million, operates as an investment holding company focused on the distribution and services of medical equipment and consumables in the People's Republic of China.

Operations: The company's revenue is primarily generated from its Distribution and Service in Medical Equipment and Consumables segment, accounting for HK$45.85 million, followed by the Hospital Operation and Management Service segment at HK$14.08 million.

Market Cap: HK$344.15M

China Health Group Limited, with a market cap of HK$344.15 million, focuses on medical equipment distribution and services in China. The company reported revenues of HK$45.85 million from this segment and HK$14.08 million from hospital operations. Despite these revenue streams, it remains unprofitable with a negative return on equity of -71.12%. Shareholders experienced dilution over the past year as shares outstanding increased by 4.2%. The company's cash position exceeds its debt, providing some financial stability despite high volatility and an unstable share price recently impacted by auditor changes and board restructuring events.

- Click to explore a detailed breakdown of our findings in China Health Group's financial health report.

- Understand China Health Group's track record by examining our performance history report.

Food Empire Holdings (SGX:F03)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Food Empire Holdings Limited is an investment holding company that manufactures and distributes food and beverages in markets such as Russia, Ukraine, Kazakhstan, CIS countries, South-East Asia, South Asia and internationally with a market cap of SGD541.80 million.

Operations: The company's revenue is primarily derived from South-East Asia ($267.25 million), Russia ($144.22 million), Ukraine, Kazakhstan and CIS countries ($118.53 million), and South Asia ($79.02 million).

Market Cap: SGD541.8M

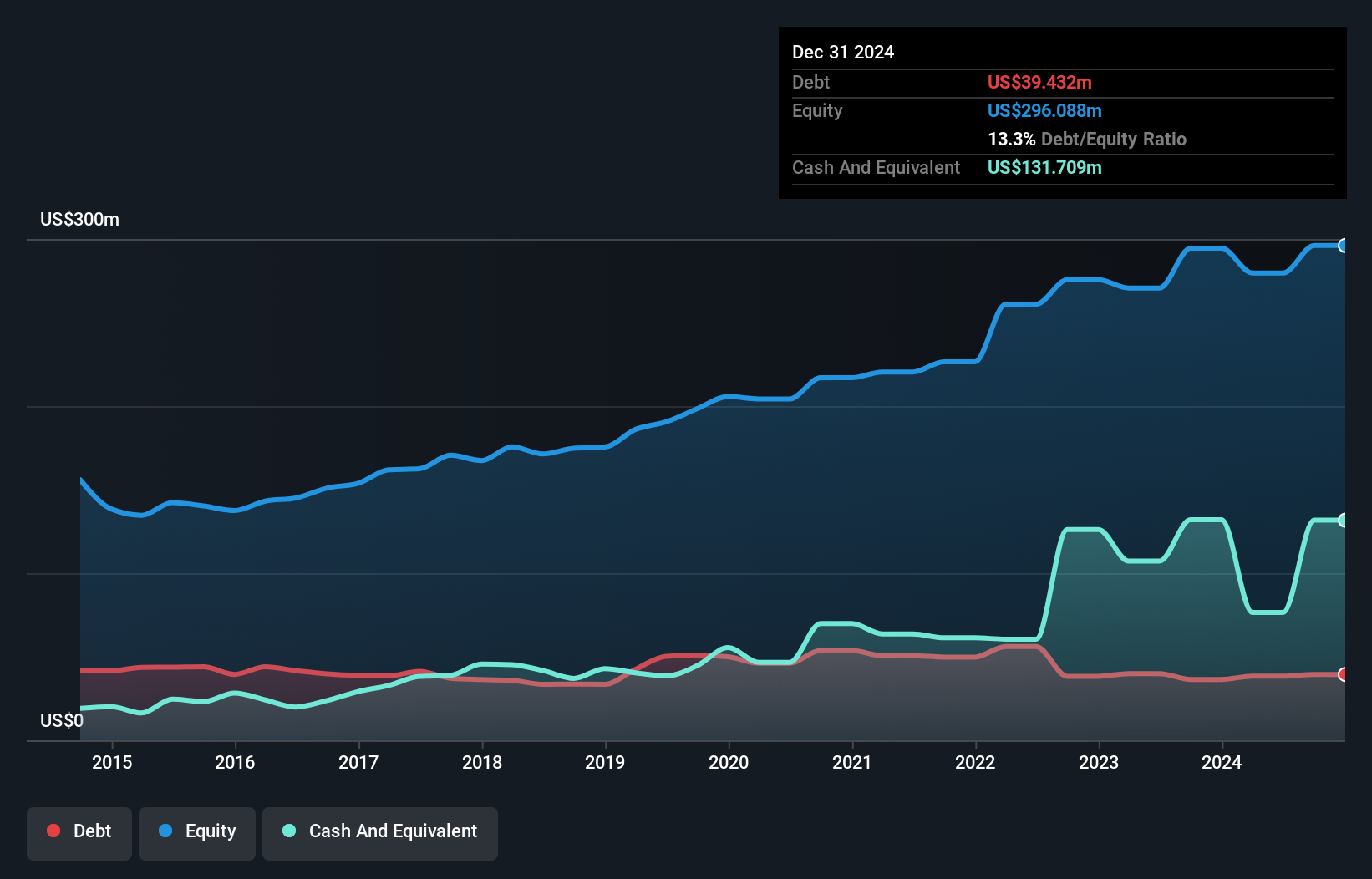

Food Empire Holdings, with a market cap of SGD541.80 million, is strategically expanding its manufacturing capabilities in Asia, investing USD 80 million in a new Vietnamese coffee facility to capitalize on the robust Robusta supply. This move aligns with its diversification strategy and complements existing operations in India and Malaysia. Despite negative earnings growth over the past year, Food Empire's financial health remains strong; short-term assets cover liabilities, debt levels are manageable with cash exceeding total debt, and interest payments are well-covered by profits. However, the dividend coverage is weak due to insufficient free cash flows.

- Click here and access our complete financial health analysis report to understand the dynamics of Food Empire Holdings.

- Evaluate Food Empire Holdings' prospects by accessing our earnings growth report.

Next Steps

- Embark on your investment journey to our 5,755 Penny Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English