Health Check: How Prudently Does China Demeter Financial Investments (HKG:8120) Use Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, China Demeter Financial Investments Limited (HKG:8120) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for China Demeter Financial Investments

What Is China Demeter Financial Investments's Debt?

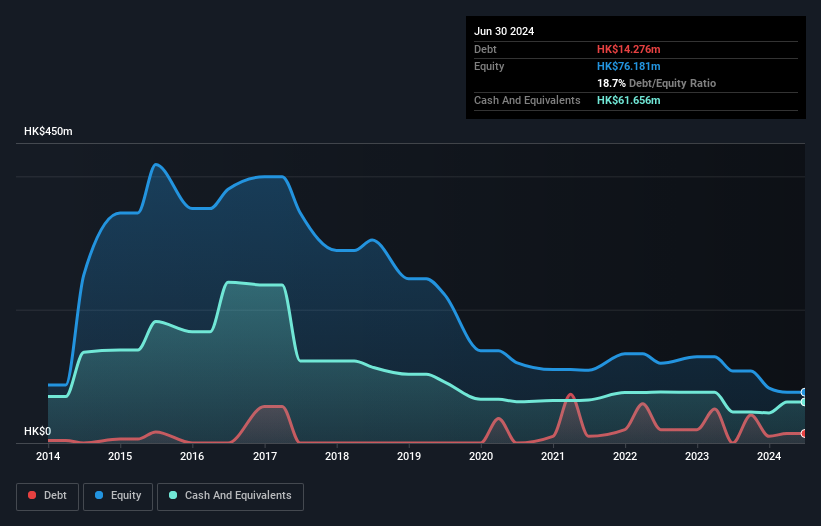

The image below, which you can click on for greater detail, shows that at June 2024 China Demeter Financial Investments had debt of HK$14.3m, up from none in one year. However, it does have HK$61.7m in cash offsetting this, leading to net cash of HK$47.4m.

How Healthy Is China Demeter Financial Investments' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that China Demeter Financial Investments had liabilities of HK$95.3m due within 12 months and liabilities of HK$32.0m due beyond that. Offsetting this, it had HK$61.7m in cash and HK$7.08m in receivables that were due within 12 months. So it has liabilities totalling HK$58.5m more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of HK$44.3m, we think shareholders really should watch China Demeter Financial Investments's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. China Demeter Financial Investments boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total. There's no doubt that we learn most about debt from the balance sheet. But it is China Demeter Financial Investments's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, China Demeter Financial Investments made a loss at the EBIT level, and saw its revenue drop to HK$146m, which is a fall of 9.4%. We would much prefer see growth.

So How Risky Is China Demeter Financial Investments?

While China Demeter Financial Investments lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow HK$18m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. We're not impressed by its revenue growth, so until we see some positive sustainable EBIT, we consider the stock to be high risk. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with China Demeter Financial Investments (including 1 which is a bit unpleasant) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English