Investing in FIT Hon Teng (HKG:6088) a year ago would have delivered you a 208% gain

When you buy shares in a company, there is always a risk that the price drops to zero. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the FIT Hon Teng Limited (HKG:6088) share price had more than doubled in just one year - up 208%. On top of that, the share price is up 82% in about a quarter. It is also impressive that the stock is up 123% over three years, adding to the sense that it is a real winner.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for FIT Hon Teng

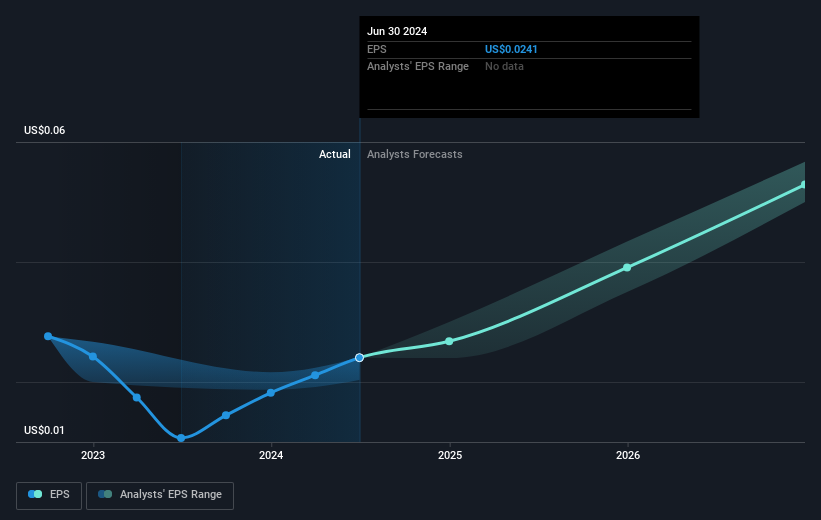

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

FIT Hon Teng was able to grow EPS by 125% in the last twelve months. This EPS growth is significantly lower than the 208% increase in the share price. So it's fair to assume the market has a higher opinion of the business than it a year ago.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that FIT Hon Teng has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at FIT Hon Teng's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that FIT Hon Teng has rewarded shareholders with a total shareholder return of 208% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 5% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand FIT Hon Teng better, we need to consider many other factors. Even so, be aware that FIT Hon Teng is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English