YesAsia Holdings And 2 Other Undiscovered Gems with Promising Potential

Global markets have recently experienced mixed performance, with the S&P 500 Index wrapping up a strong year despite some year-end volatility and economic indicators like the Chicago PMI revealing ongoing challenges in manufacturing. In this environment, investors often seek out smaller companies that may be overlooked but possess promising fundamentals and growth potential; this article highlights three such undiscovered gems, including YesAsia Holdings.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

YesAsia Holdings (SEHK:2209)

Simply Wall St Value Rating: ★★★★★★

Overview: YesAsia Holdings Limited is an investment holding company involved in the procurement, sale, and trading of Asian fashion and lifestyle, beauty, cosmetics, accessories, and entertainment products with a market cap of HK$2.11 billion.

Operations: The primary revenue streams for YesAsia Holdings come from its Fashion & Lifestyle and Beauty Products segment, generating HK$270.65 million, and its Entertainment Products segment, contributing HK$2.56 million.

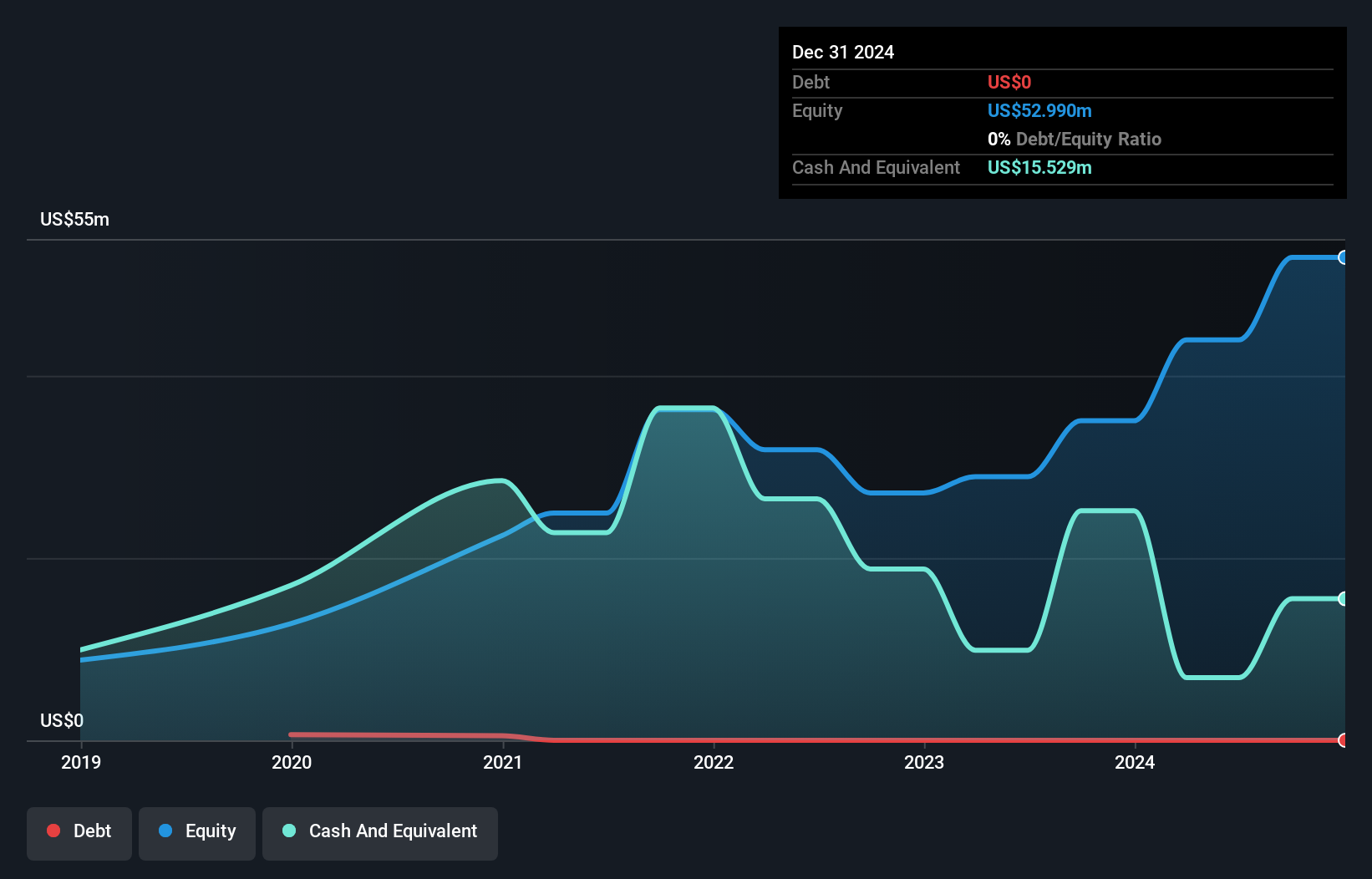

YesAsia Holdings, a relatively small player in the market, has recently turned profitable, marking a significant shift from five years ago when it had a debt-to-equity ratio of 2.9%. The company is now debt-free and boasts high-quality earnings characterized by substantial non-cash components. Despite its profitability, YesAsia's share price has been highly volatile over the past three months. Cash flow dynamics reveal that while levered free cash flow was negative at US$11.16 million as of June 2023, it improved to US$1.08 million by January 2025. Earnings are projected to grow annually at nearly 49%, suggesting potential for robust future performance amidst industry challenges.

- Click here to discover the nuances of YesAsia Holdings with our detailed analytical health report.

Review our historical performance report to gain insights into YesAsia Holdings''s past performance.

Shengtak New Material (SZSE:300881)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shengtak New Material Co., Ltd focuses on the R&D, production, and sale of seamless steel pipes for industrial energy equipment in China with a market cap of CN¥3.35 billion.

Operations: Shengtak New Material generates revenue primarily from the sale of seamless steel pipes, with financial performance influenced by production costs and market demand. The company's net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and cost management strategies.

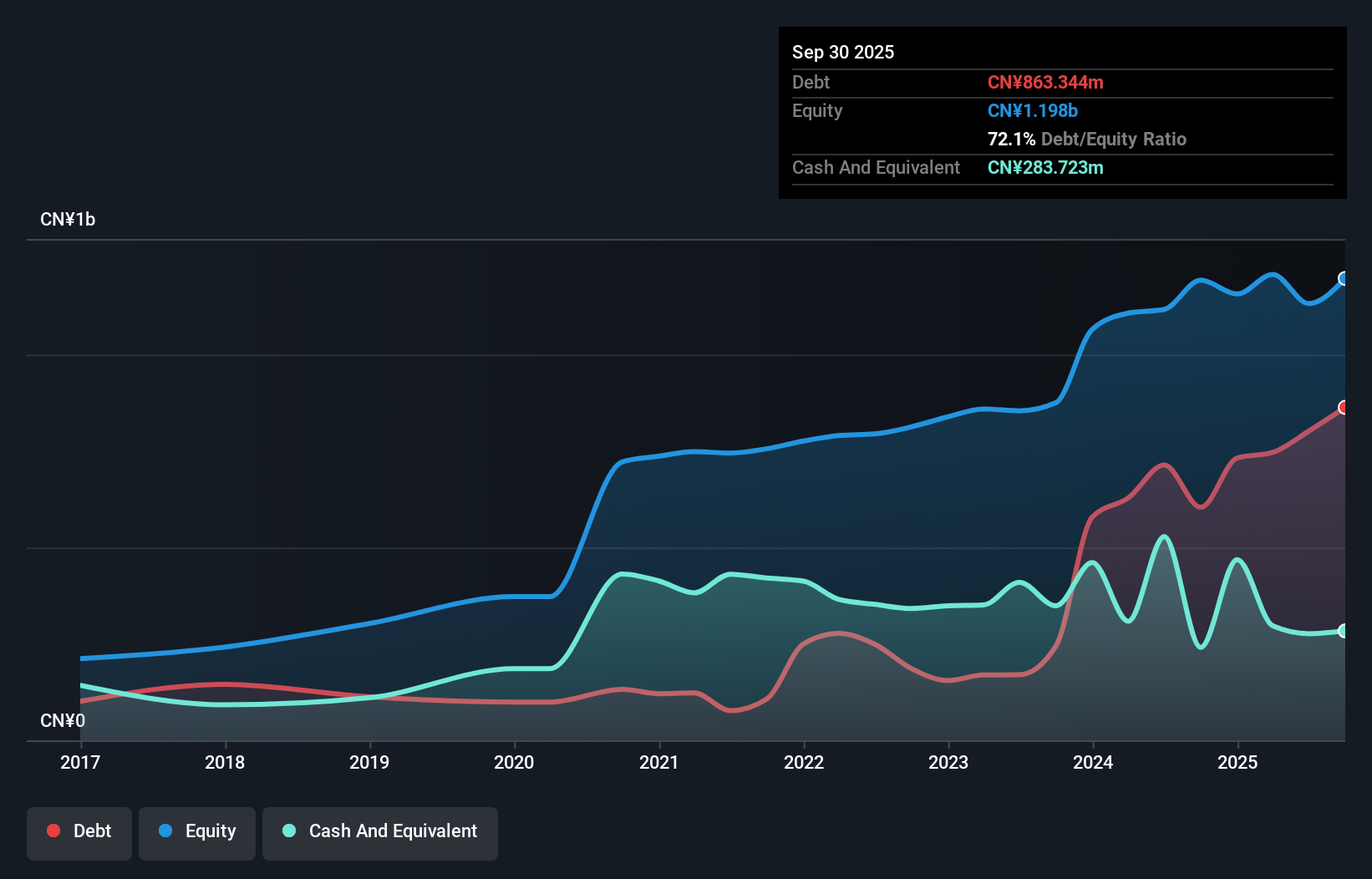

Shengtak New Material, a dynamic player in the materials sector, has shown impressive earnings growth of 144% over the past year, significantly outpacing the broader Metals and Mining industry. Its net income for the first nine months of 2024 reached CNY 192.89 million, up from CNY 72.43 million a year prior. The company's price-to-earnings ratio stands at an attractive 13.9x compared to the broader Chinese market's average of 33.2x, suggesting potential undervaluation. With interest payments well covered by EBIT at a ratio of 21.3x and satisfactory net debt to equity ratio at 30.4%, Shengtak appears financially robust despite its increased debt over five years from 28.9% to 50.6%.

- Take a closer look at Shengtak New Material's potential here in our health report.

Evaluate Shengtak New Material's historical performance by accessing our past performance report.

ZERO (TSE:9028)

Simply Wall St Value Rating: ★★★★★☆

Overview: ZERO Co., Ltd. and its subsidiaries offer vehicle transportation and maintenance services in Japan, with a market capitalization of approximately ¥45.19 billion.

Operations: ZERO Co., Ltd. generates revenue primarily from its Domestic Car Related Business, contributing ¥66.47 billion, followed by the Overseas Related Business at ¥48.69 billion. The Human Resource Business and General Cargo Transportation segments contribute ¥23.92 billion and ¥6.46 billion, respectively.

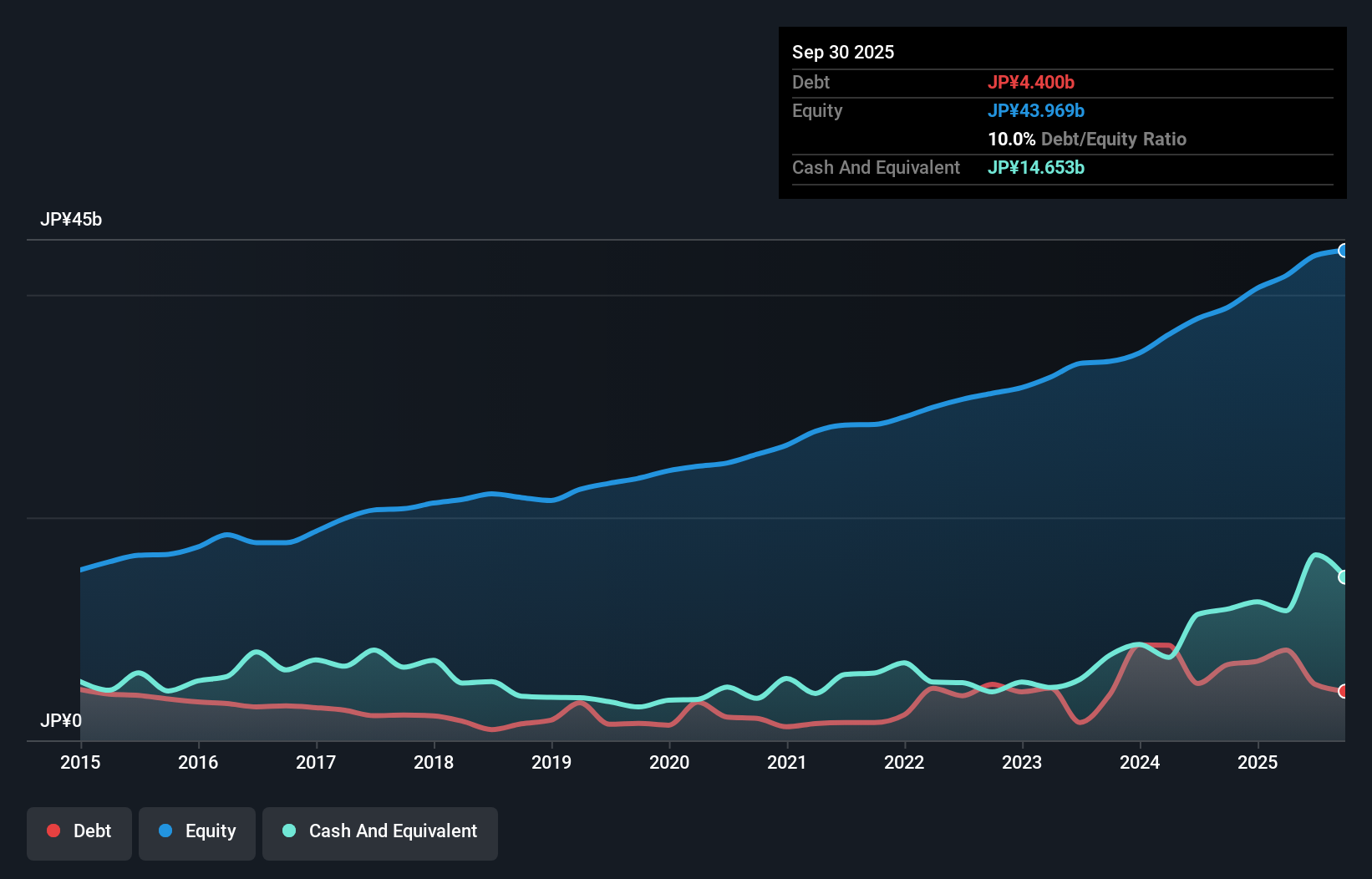

ZERO, a dynamic player in its sector, has shown impressive earnings growth of 59.7% over the past year, outpacing the Transportation industry's 25.1%. Despite a volatile share price recently, it trades at 67.5% below its estimated fair value, suggesting potential undervaluation. The company's financial health appears robust with interest payments well covered by EBIT at an impressive 833 times coverage and free cash flow remaining positive. However, its debt-to-equity ratio has risen from 6.5% to 17.5% over five years, which may warrant attention for future leverage management strategies within this promising yet challenging market environment.

- Delve into the full analysis health report here for a deeper understanding of ZERO.

Gain insights into ZERO's historical performance by reviewing our past performance report.

Summing It All Up

- Get an in-depth perspective on all 4650 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English