Investors Still Waiting For A Pull Back In Ocumension Therapeutics (HKG:1477)

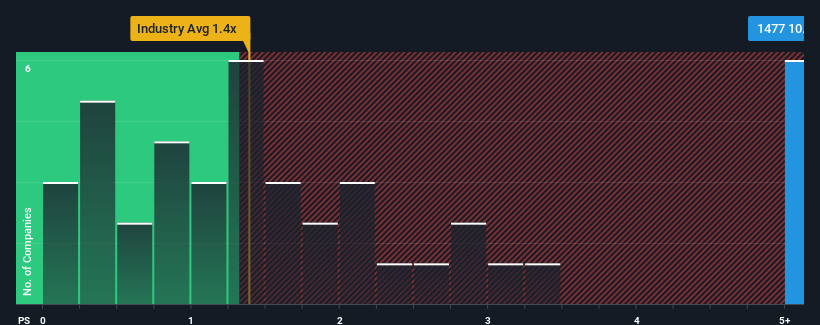

When close to half the companies in the Pharmaceuticals industry in Hong Kong have price-to-sales ratios (or "P/S") below 1.4x, you may consider Ocumension Therapeutics (HKG:1477) as a stock to avoid entirely with its 10.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Ocumension Therapeutics

What Does Ocumension Therapeutics' Recent Performance Look Like?

Recent times have been advantageous for Ocumension Therapeutics as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Ocumension Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Ocumension Therapeutics' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 49% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 79% per annum over the next three years. With the industry only predicted to deliver 9.6% each year, the company is positioned for a stronger revenue result.

With this information, we can see why Ocumension Therapeutics is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Ocumension Therapeutics' P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Ocumension Therapeutics maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Pharmaceuticals industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Ocumension Therapeutics that we have uncovered.

If these risks are making you reconsider your opinion on Ocumension Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English