Discovering 3 Hidden Stock Gems With Strong Potential

In the current global market landscape, U.S. stocks have faced volatility due to AI competition fears and mixed corporate earnings, while European markets have been buoyed by strong earnings and an interest rate cut from the ECB. Amid these fluctuations, identifying promising small-cap stocks can be particularly rewarding as they often offer unique opportunities for growth that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yashima Denki | 2.71% | -1.00% | 18.12% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Kuo Yang Construction | 83.40% | -32.54% | -39.68% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Arriyadh Development (SASE:4150)

Simply Wall St Value Rating: ★★★★★★

Overview: Arriyadh Development Co. is involved in the purchase and sale of lands and real estate in Saudi Arabia, with a market capitalization of SAR6.42 billion.

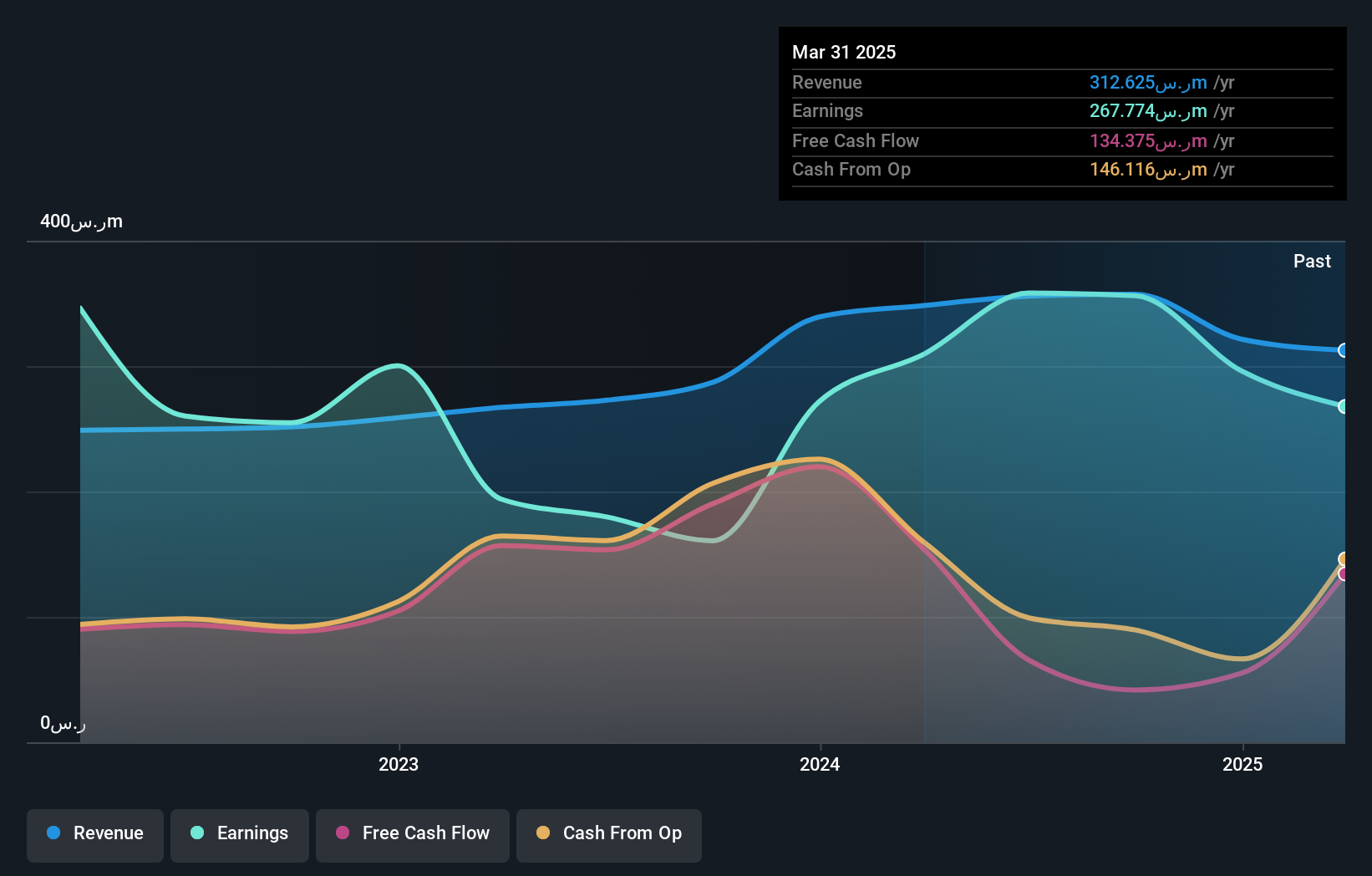

Operations: Arriyadh Development generates revenue primarily from its Trade Center Sector and Utility Sector Hydration, with contributions of SAR165.51 million and SAR150.54 million, respectively.

Arriyadh Development, a notable player in the real estate sector, has shown impressive earnings growth of 121.6% over the past year, outpacing the industry's 15% increase. This growth is supported by its debt-free status for five years and a favorable price-to-earnings ratio of 17.9x compared to the South African market's 24.2x. The company boasts high-quality non-cash earnings and positive free cash flow, indicating robust financial health. With revenue projected to grow at 21.75% annually, Arriyadh Development stands as an intriguing prospect for those exploring under-the-radar investment opportunities in real estate markets.

- Navigate through the intricacies of Arriyadh Development with our comprehensive health report here.

Gain insights into Arriyadh Development's past trends and performance with our Past report.

APT Electronics (SEHK:2551)

Simply Wall St Value Rating: ★★★★★★

Overview: APT Electronics Co., Ltd. is a company that specializes in providing intelligent vision products and system solutions, with a market capitalization of approximately HK$1.99 billion.

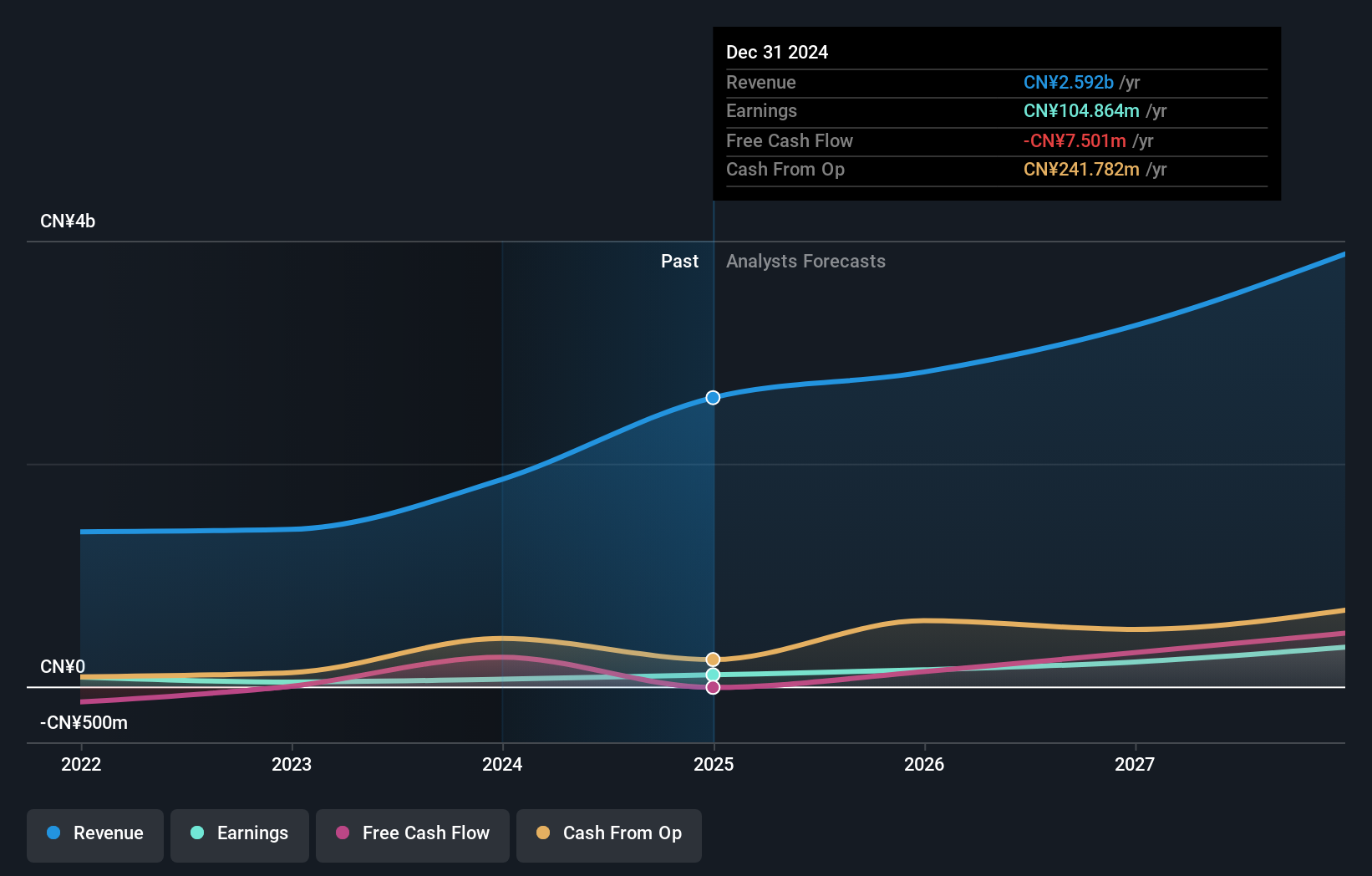

Operations: APT Electronics generates revenue primarily from its Electric Lighting & Other Fixtures segment, amounting to CN¥1.86 billion.

Earnings for APT Electronics have surged by 62.7% over the past year, outpacing the Electrical industry’s modest 7.7%. This growth is complemented by a favorable debt-to-equity ratio, which has improved from 12.3% to 7.8% in five years, indicating effective debt management. The company recently raised HKD 139 million through an IPO at HKD 3.61 per share, underscoring market confidence despite its volatile stock price in recent months. Trading significantly below estimated fair value suggests potential for future appreciation if current trends persist and volatility stabilizes.

- Get an in-depth perspective on APT Electronics' performance by reading our health report here.

Assess APT Electronics' past performance with our detailed historical performance reports.

Chongyi Zhangyuan Tungsten (SZSE:002378)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Chongyi Zhangyuan Tungsten Co., Ltd. is involved in the mining of tungsten and other metal mineral products both in China and internationally, with a market capitalization of CN¥8.15 billion.

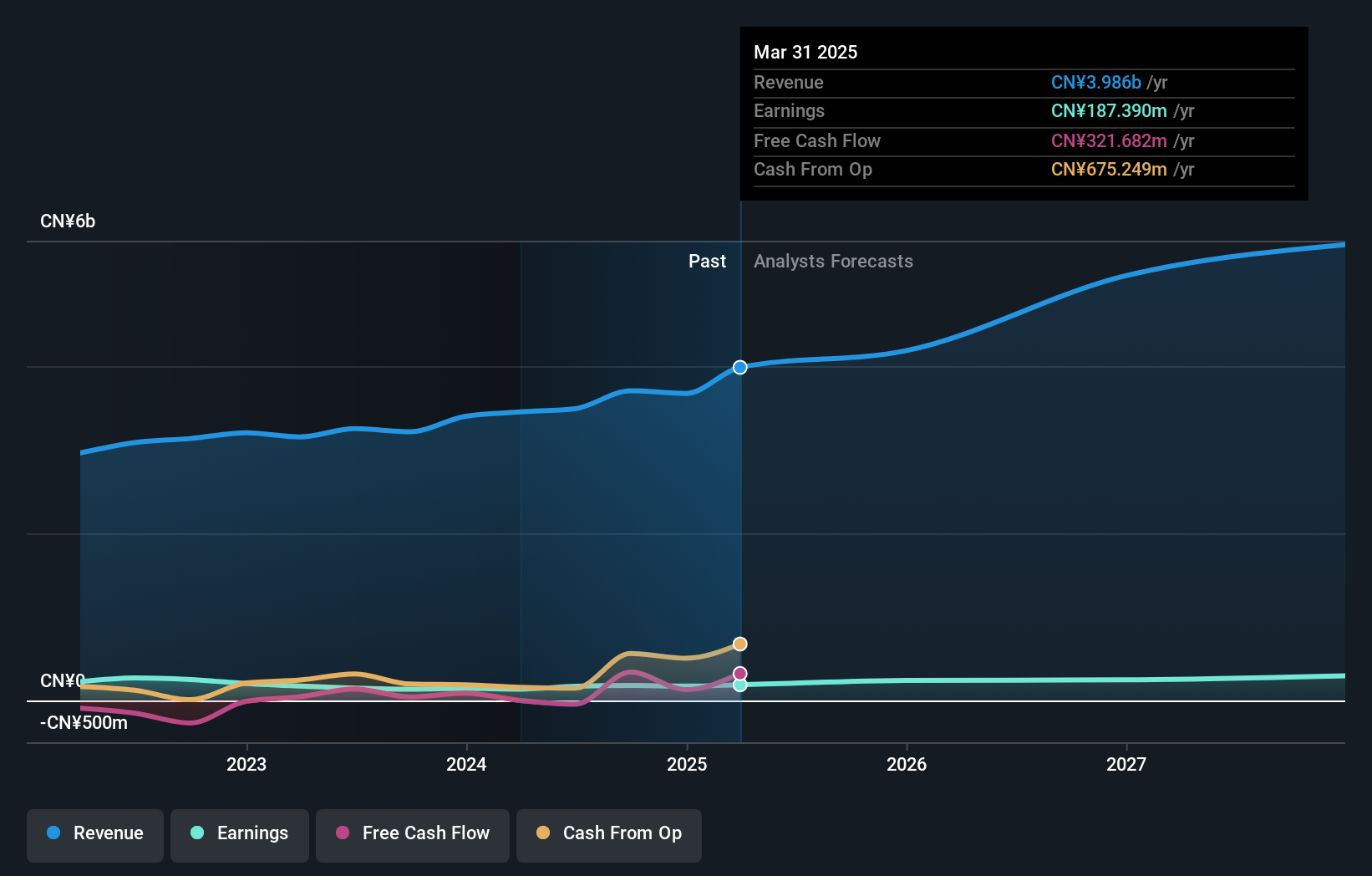

Operations: Chongyi Zhangyuan Tungsten generates revenue primarily from the mining and sale of tungsten and other metal mineral products. The company has a market capitalization of CN¥8.15 billion.

Chongyi Zhangyuan Tungsten, a smaller player in the metals and mining sector, has shown impressive earnings growth of 32.9% over the past year, outpacing its industry peers who saw a -2.3% change. Despite this strong performance, the company carries a high net debt to equity ratio of 64.2%, which could be concerning for potential investors. A one-off gain of CN¥41M significantly impacted recent financial results, highlighting some volatility in earnings quality. Trading at 85.5% below its estimated fair value suggests it might offer good value for those willing to navigate these financial complexities.

Summing It All Up

- Click this link to deep-dive into the 4717 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English