Min Fu International Holding Limited (HKG:8511) Shares Slammed 32% But Getting In Cheap Might Be Difficult Regardless

Min Fu International Holding Limited (HKG:8511) shares have retraced a considerable 32% in the last month, reversing a fair amount of their solid recent performance. The last month has meant the stock is now only up 7.5% during the last year.

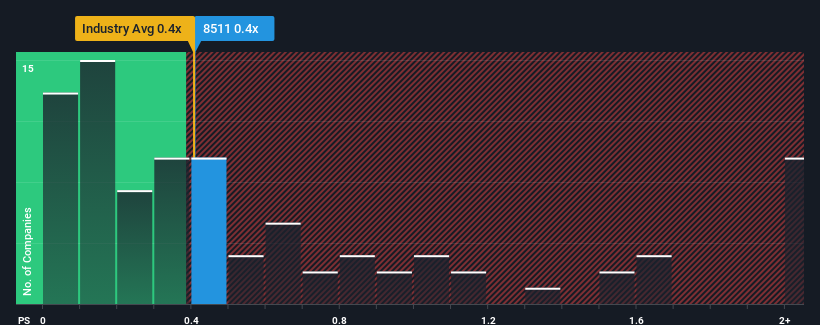

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Min Fu International Holding's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in Hong Kong is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Min Fu International Holding

What Does Min Fu International Holding's Recent Performance Look Like?

Min Fu International Holding certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on Min Fu International Holding will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Min Fu International Holding's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Min Fu International Holding?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Min Fu International Holding's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 153% last year. The strong recent performance means it was also able to grow revenue by 87% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 24% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we can see why Min Fu International Holding is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

What We Can Learn From Min Fu International Holding's P/S?

With its share price dropping off a cliff, the P/S for Min Fu International Holding looks to be in line with the rest of the Electronic industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears to us that Min Fu International Holding maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

It is also worth noting that we have found 4 warning signs for Min Fu International Holding that you need to take into consideration.

If these risks are making you reconsider your opinion on Min Fu International Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English