Undiscovered Gems in Asia for March 2025

As global markets navigate a complex landscape of policy risks and economic uncertainties, the Asian market presents unique opportunities amid these challenges. In this environment, identifying promising small-cap stocks requires a keen eye for companies that demonstrate resilience and potential for growth despite broader market pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Gem-Year IndustrialLtd | 1.70% | -3.85% | -33.56% | ★★★★★★ |

| Guangdong Lingxiao Pump IndustryLtd | NA | 2.07% | 6.46% | ★★★★★★ |

| Sonix TechnologyLtd | NA | -10.07% | -16.54% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Advanced International Multitech | 36.42% | 6.79% | 4.08% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Xiaocaiyuan International Holding (SEHK:999)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xiaocaiyuan International Holding Ltd. is an investment holding company that operates in the restaurant industry within the People’s Republic of China, with a market capitalization of approximately HK$12.57 billion.

Operations: Xiaocaiyuan derives its revenue primarily from restaurant operations, contributing CN¥3.05 billion, and the delivery business, which adds CN¥1.49 billion to its revenue streams.

Xiaocaiyuan International Holding, a relatively small player in its sector, recently completed an IPO raising HKD 860.04 million, offering shares at HKD 8.5 each with a slight discount. The company is trading at 61% below its estimated fair value and boasts high-quality earnings. In the past year, Xiaocaiyuan's earnings surged by 124%, significantly outpacing the Hospitality industry's growth of 28.3%. Additionally, their interest payments are well covered by EBIT at a ratio of 31.3x, suggesting robust financial health despite limited data on debt reduction over time.

Jiangsu Changyou Environmental Protection Technology (SZSE:301557)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Changyou Environmental Protection Technology Co., Ltd. specializes in environmental protection technology and solutions, with a market cap of CN¥3.99 billion.

Operations: Jiangsu Changyou Environmental Protection Technology generates revenue primarily through its environmental protection technology and solutions. The company's market cap stands at CN¥3.99 billion.

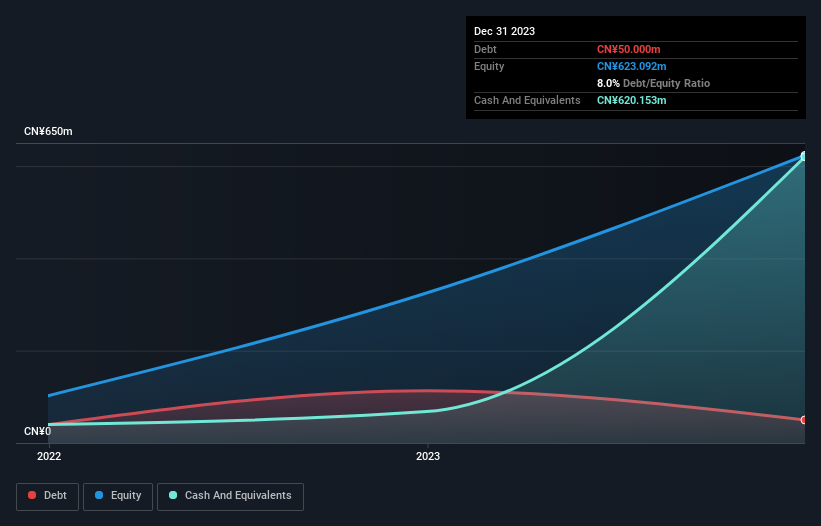

Jiangsu Changyou Environmental Protection Technology, a small player in the market, has shown impressive growth with earnings rising by 27.4% over the past year, outpacing its industry peers. The company's debt to equity ratio improved significantly from 98.1% to 35.3% over five years, indicating better financial health. Its recent IPO raised CNY 319.99 million at CNY 28.88 per share and saw it added to major indices like the Shenzhen Stock Exchange Composite Index, reflecting increased investor interest. With net income climbing from CNY 82.6 million to CNY 105.23 million last year, it seems poised for potential growth in its sector.

Max (TSE:6454)

Simply Wall St Value Rating: ★★★★★★

Overview: Max Co., Ltd. manufactures and sells industrial and office equipment both in Japan and internationally, with a market cap of approximately ¥202.17 billion.

Operations: Max generates revenue primarily from industrial equipment and office equipment, contributing ¥65.29 billion and ¥21.73 billion respectively, with a smaller segment in home care & rehabilitation equipment at ¥3.30 billion.

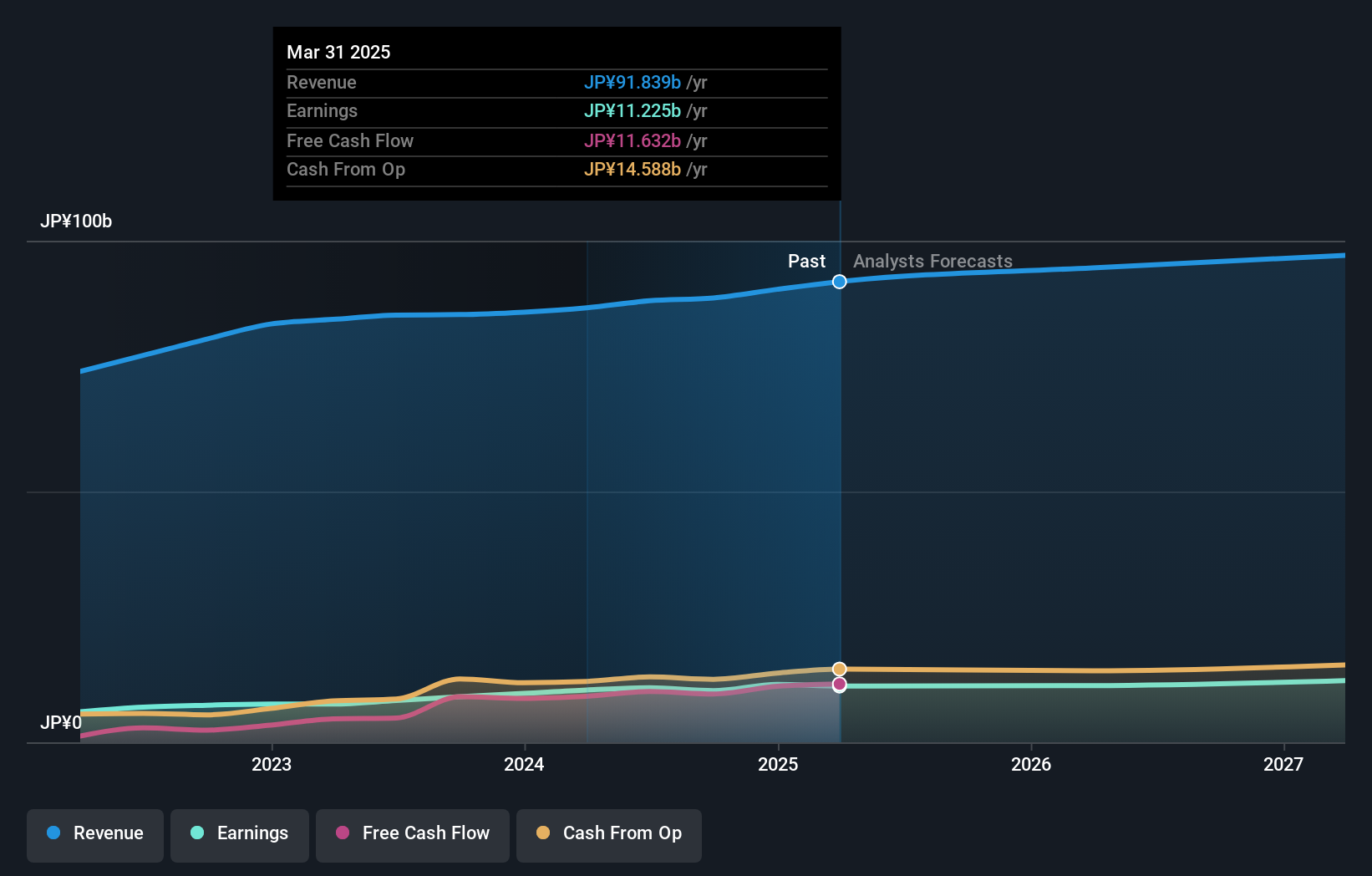

Max is making waves with its robust earnings growth of 18.7% over the past year, outpacing the Machinery industry’s 4%. Its debt-to-equity ratio has impressively shrunk from 2.6 to 0.9 over five years, indicating solid financial health. The company also trades at a compelling value, priced at 27.1% below estimated fair value, which may attract keen investors looking for opportunities in Asia's smaller markets. Recent guidance revisions suggest strong performance with net sales expected to rise to ¥91 billion and operating profit forecasted at ¥13.8 billion, reflecting confidence in continued momentum through fiscal year-end March 2025.

- Click here and access our complete health analysis report to understand the dynamics of Max.

Explore historical data to track Max's performance over time in our Past section.

Next Steps

- Click this link to deep-dive into the 2579 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English