Asian Growth Companies With Strong Insider Ownership

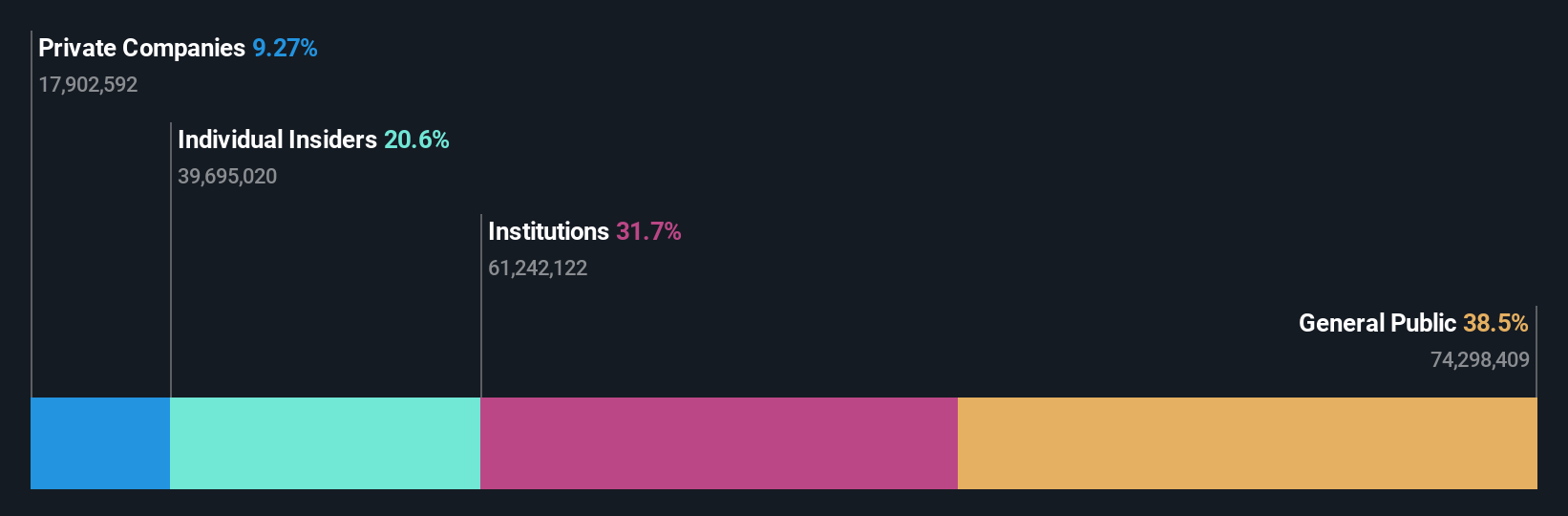

As global markets navigate a period of uncertainty, with trade policies and inflation rates drawing significant attention, Asian economies are also contending with their unique challenges and opportunities. In this environment, growth companies in Asia with strong insider ownership can offer potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 34.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 45.7% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 89.3% |

| Schooinc (TSE:264A) | 21.6% | 68.9% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.2% | 61.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

Let's review some notable picks from our screened stocks.

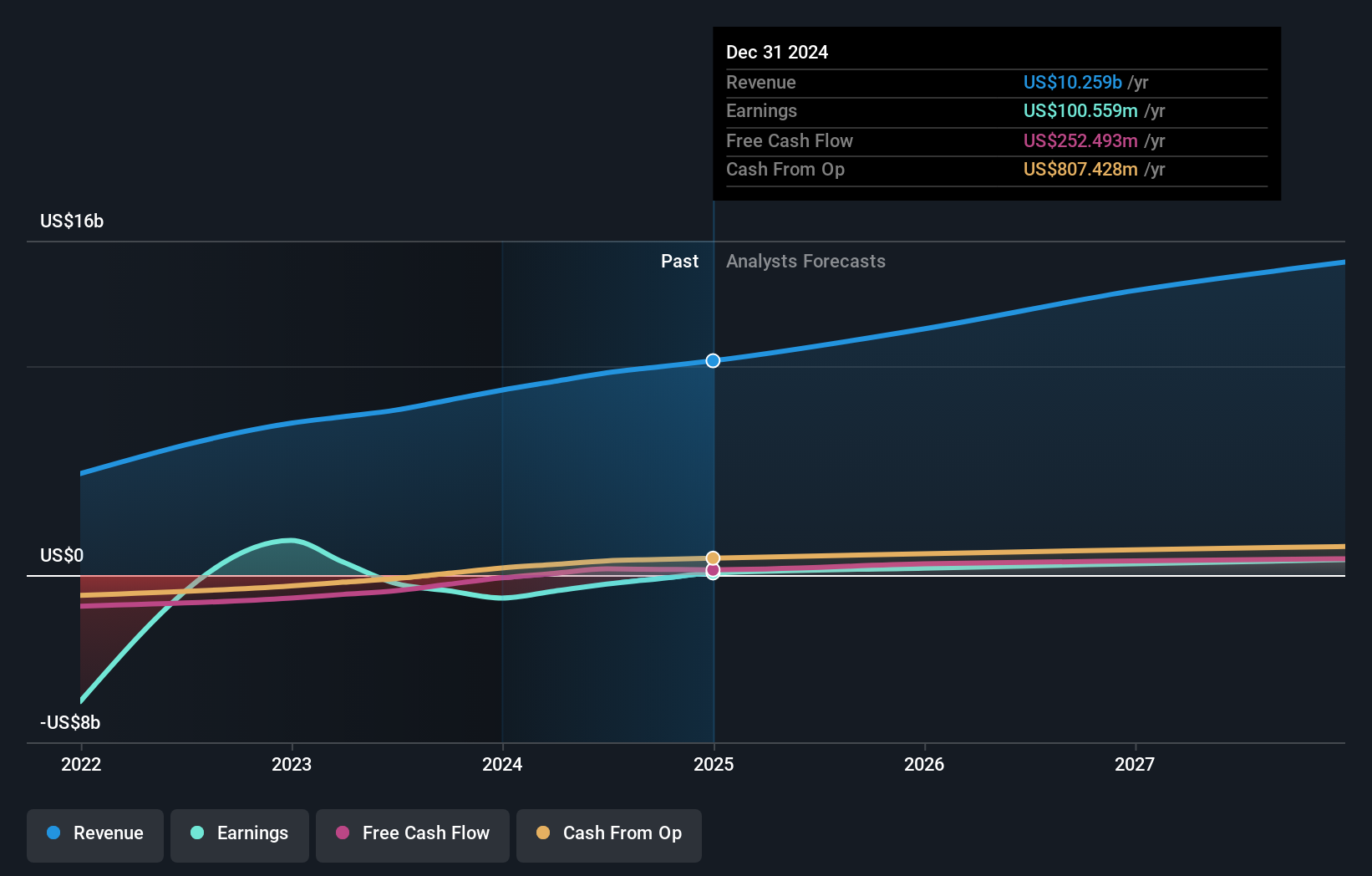

J&T Global Express (SEHK:1519)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J&T Global Express Limited, with a market cap of HK$54.55 billion, is an investment holding company that provides express delivery services.

Operations: The company's revenue segments include Transportation - Air Freight, which generated $10.26 billion.

Insider Ownership: 18.9%

Earnings Growth Forecast: 31.4% p.a.

J&T Global Express, trading at 57% below its estimated fair value, has demonstrated significant growth potential with earnings forecasted to increase 31.36% annually over the next three years, outpacing the Hong Kong market. The company recently turned profitable, reporting a net income of US$113.7 million for 2024 compared to a substantial loss in the prior year. Revenue growth is expected to continue at 10.4% per year, surpassing market averages despite low projected return on equity.

- Dive into the specifics of J&T Global Express here with our thorough growth forecast report.

- Our valuation report unveils the possibility J&T Global Express' shares may be trading at a premium.

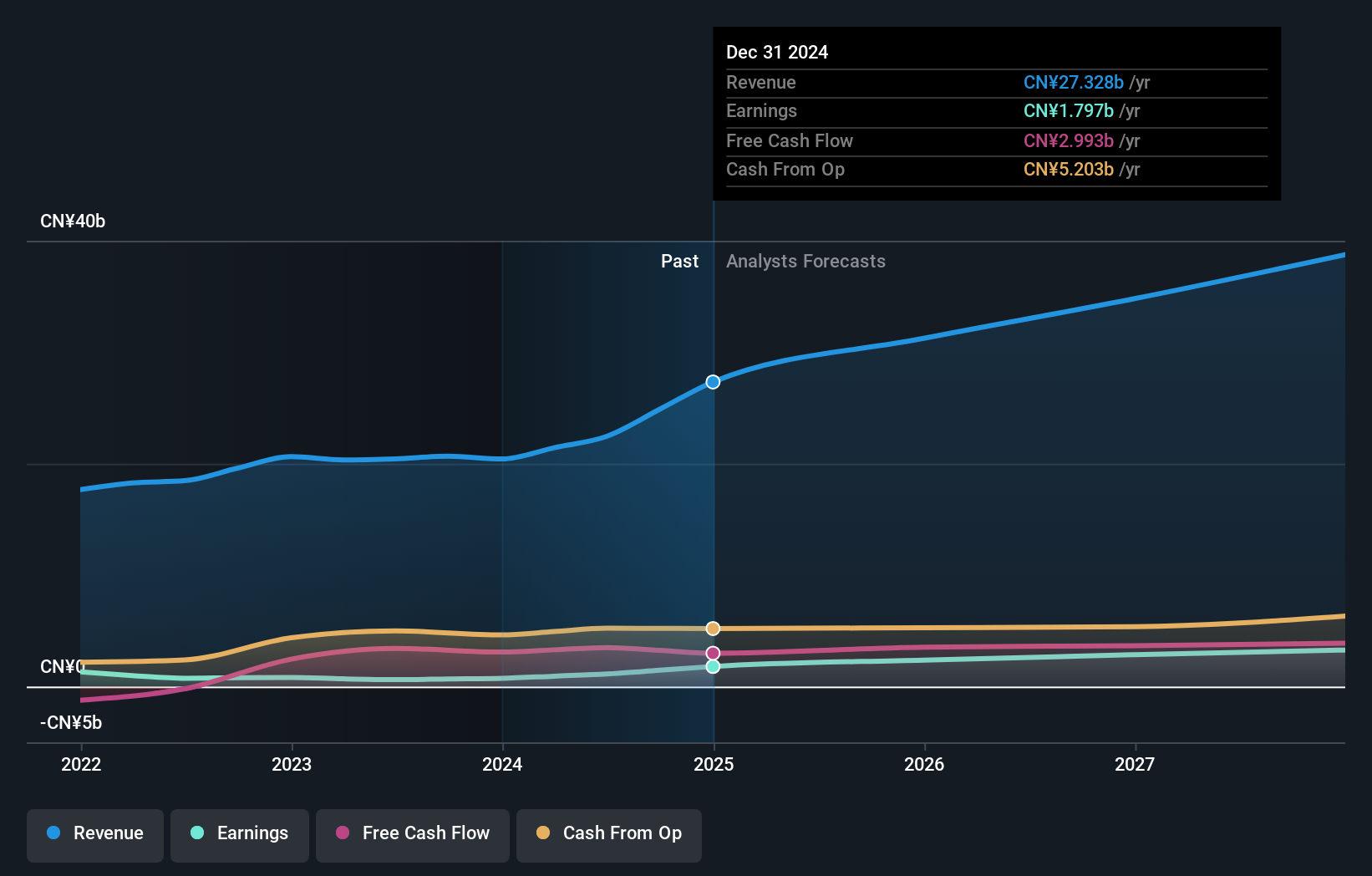

AAC Technologies Holdings (SEHK:2018)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AAC Technologies Holdings Inc. is an investment holding company that offers solutions for smart devices across various regions including Mainland China, Hong Kong, Taiwan, other Asian countries, the United States, and Europe with a market cap of HK$63.13 billion.

Operations: The company's revenue segments include CN¥8.28 billion from Electromagnetic Drives and Precision Mechanics, CN¥7.64 billion from Acoustics Products, CN¥4.07 billion from Optics Products, and CN¥920.28 million from Sensor and Semiconductor Products.

Insider Ownership: 37%

Earnings Growth Forecast: 20.6% p.a.

AAC Technologies Holdings, with substantial insider ownership, is positioned for significant growth, driven by a forecasted 20.6% annual earnings increase over the next three years, outpacing the Hong Kong market. Recent unaudited earnings guidance indicates a profit surge of up to 145% year-on-year for 2024. This growth is supported by advancements in optics and acoustics across various sectors like automotive and consumer electronics, enhancing product offerings and operational efficiency amid a recovering global smartphone market.

- Click here to discover the nuances of AAC Technologies Holdings with our detailed analytical future growth report.

- Our expertly prepared valuation report AAC Technologies Holdings implies its share price may be too high.

Eyebright Medical Technology (Beijing) (SHSE:688050)

Simply Wall St Growth Rating: ★★★★★★

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. operates in the medical technology sector, focusing on innovative healthcare solutions, with a market cap of CN¥18.51 billion.

Operations: The company generates its revenue from the Medical Products segment, amounting to CN¥1.41 billion.

Insider Ownership: 20.9%

Earnings Growth Forecast: 27.8% p.a.

Eyebright Medical Technology (Beijing) demonstrates robust growth potential, with earnings rising 27.4% last year and forecasted to grow at 27.8% annually, outpacing the Chinese market. The recent approval of its Loong Crystal PR intraocular lens highlights its commitment to innovation in ophthalmic solutions. Despite no substantial insider trading activity in the past three months, high insider ownership aligns interests with shareholders as the company continues expanding its domestic presence and enhancing brand recognition.

- Navigate through the intricacies of Eyebright Medical Technology (Beijing) with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Eyebright Medical Technology (Beijing)'s current price could be inflated.

Seize The Opportunity

- Access the full spectrum of 644 Fast Growing Asian Companies With High Insider Ownership by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English