K Cash Fintech's (HKG:2483) Upcoming Dividend Will Be Larger Than Last Year's

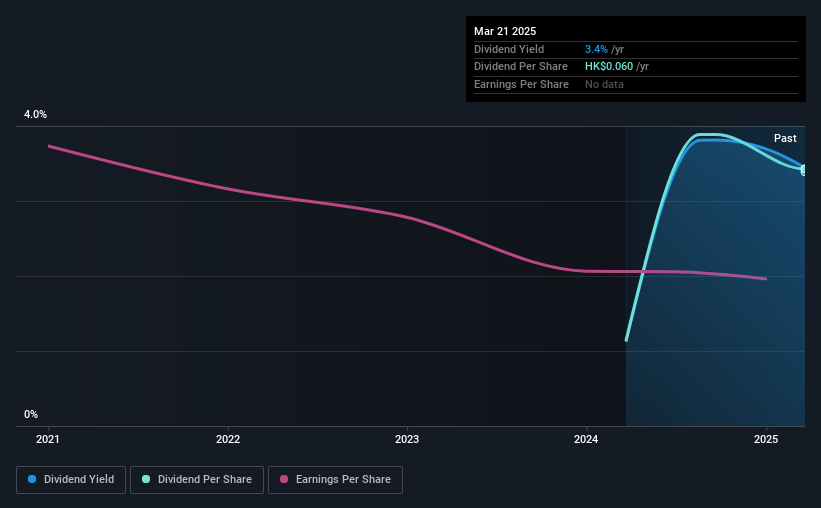

The board of K Cash Fintech Corporation Limited (HKG:2483) has announced that it will be paying its dividend of HK$0.055 on the 20th of June, an increased payment from last year's comparable dividend. This takes the annual payment to 3.4% of the current stock price, which unfortunately is below what the industry is paying.

K Cash Fintech's Projected Earnings Seem Likely To Cover Future Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Prior to this announcement, K Cash Fintech's earnings easily covered the dividend, but free cash flows were negative. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

If the company can't turn things around, EPS could fall by 12.1% over the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 79% in the next 12 months which is on the higher end of the range we would say is sustainable.

Check out our latest analysis for K Cash Fintech

K Cash Fintech Doesn't Have A Long Payment History

It is tough to make a judgement on how stable a dividend is when the company hasn't been paying one for very long. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Has Limited Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. K Cash Fintech's EPS has fallen by approximately 12% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for K Cash Fintech (of which 2 are concerning!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English