3 Asian Penny Stocks With Market Caps Below US$800M

Amid global economic uncertainty and inflation concerns, Asian markets have been navigating a complex landscape, with investors keeping a close eye on trade policies and consumer sentiment. Despite these challenges, the potential for growth remains, particularly in niche areas such as penny stocks. Although the term 'penny stocks' might seem outdated, it still signifies opportunities in smaller or newer companies that can offer significant upside when backed by strong financials and fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Interlink Telecom (SET:ITEL) | THB1.37 | THB1.9B | ✅ 4 ⚠️ 5 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.74 | THB1.73B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.355 | SGD143.88M | ✅ 4 ⚠️ 1 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.205 | SGD40.84M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.32 | SGD9.17B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$3.09 | HK$1.27B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.01 | HK$45.93B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.39 | HK$877.02M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.32 | HK$2.2B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.14 | CN¥3.64B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,115 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Lion Rock Group (SEHK:1127)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lion Rock Group Limited is an investment holding company that offers printing services to international book publishers and print media companies, with a market cap of HK$1.17 billion.

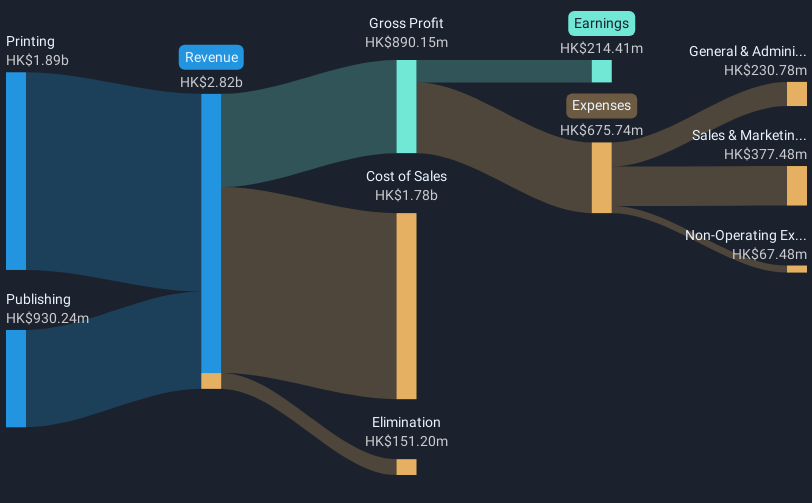

Operations: The company generates revenue from two main segments: Printing, which accounts for HK$1.89 billion, and Publishing, contributing HK$930.24 million.

Market Cap: HK$1.17B

Lion Rock Group Limited, with a market cap of HK$1.17 billion, has shown consistent financial growth. Its revenue from printing and publishing segments totaled HK$2.82 billion in 2024, up from the previous year. The company maintains strong liquidity, with short-term assets exceeding liabilities and cash surpassing total debt. Earnings have grown by 15.7% over the past year, outpacing its five-year average and industry growth rates. While the dividend track record is unstable, net profit margins improved to 8%. Despite trading below estimated fair value, Lion Rock's earnings quality remains high without significant shareholder dilution recently.

- Jump into the full analysis health report here for a deeper understanding of Lion Rock Group.

- Examine Lion Rock Group's past performance report to understand how it has performed in prior years.

SinoMedia Holding (SEHK:623)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SinoMedia Holding Limited is an investment holding company offering TV advertisement, creative content production, and digital marketing services across Hong Kong, Singapore, and the People's Republic of China with a market cap of approximately HK$1.08 billion.

Operations: No specific revenue segments are reported for SinoMedia Holding Limited, which provides TV advertisement, creative content production, and digital marketing services across Hong Kong, Singapore, and the People's Republic of China.

Market Cap: HK$1.08B

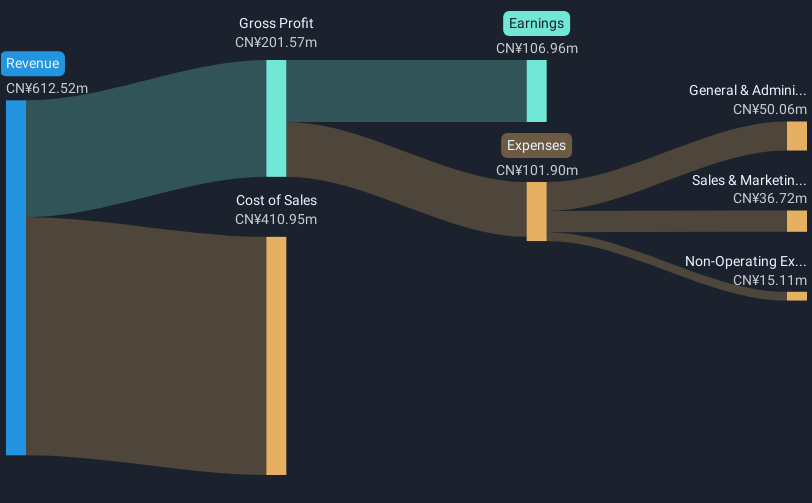

SinoMedia Holding Limited, with a market cap of HK$1.08 billion, demonstrates financial resilience despite challenges in the media sector. The company reported CNY 612.52 million in sales for 2024, although this was a decline from the previous year. Net income rose to CNY 106.96 million, reflecting improved profit margins from 12.7% to 17.5%. With no debt and substantial short-term assets (CN¥1.1 billion) covering liabilities, SinoMedia's financial structure is solid. Despite an unstable dividend history, recent announcements include increased dividends and a special payout proposal for shareholders in mid-2025 following executive board changes enhancing governance stability.

- Unlock comprehensive insights into our analysis of SinoMedia Holding stock in this financial health report.

- Review our historical performance report to gain insights into SinoMedia Holding's track record.

Heilongjiang Interchina Water TreatmentLtd (SHSE:600187)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Heilongjiang Interchina Water Treatment Co., Ltd operates in the construction and management of water treatment and environmental protection projects, as well as energy-saving and clean energy transformation initiatives in China, with a market capitalization of CN¥5.57 billion.

Operations: Heilongjiang Interchina Water Treatment Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥5.57B

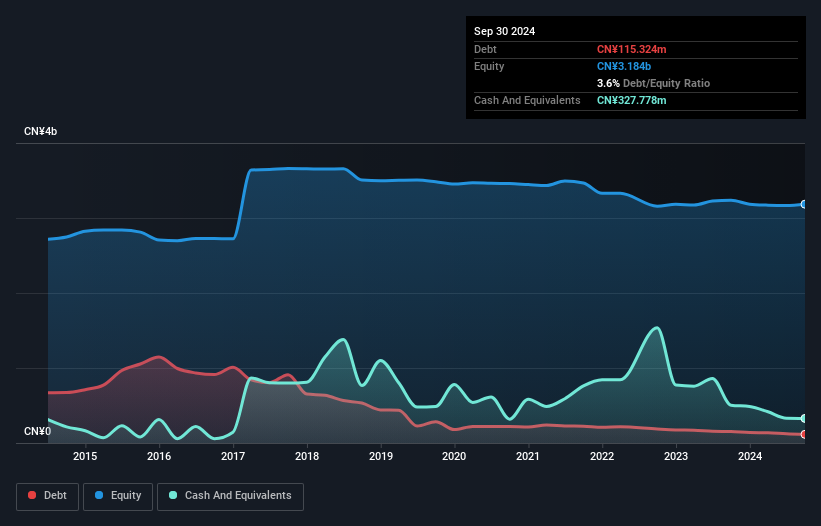

Heilongjiang Interchina Water Treatment Co., Ltd, with a market cap of CN¥5.57 billion, faces challenges as it remains unprofitable and has seen earnings decline by 19% annually over the past five years. Despite this, the company maintains a stable weekly volatility of 8% and has not diluted shareholders recently. Its short-term assets (CN¥925.5M) comfortably cover both short-term (CN¥179.2M) and long-term liabilities (CN¥205.5M), while cash exceeds total debt, indicating financial prudence despite negative operating cash flow. The experienced board with an average tenure of 7.6 years provides governance stability amid ongoing financial hurdles.

- Get an in-depth perspective on Heilongjiang Interchina Water TreatmentLtd's performance by reading our balance sheet health report here.

- Explore historical data to track Heilongjiang Interchina Water TreatmentLtd's performance over time in our past results report.

Taking Advantage

- Explore the 1,115 names from our Asian Penny Stocks screener here.

- Ready For A Different Approach? Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English