Fu Shou Yuan International Group And 2 Other Global Penny Stocks To Watch

Amid heightened global trade tensions and economic uncertainty fueled by unexpected tariff announcements, investors are navigating a volatile market landscape. For those interested in exploring smaller or newer companies, penny stocks remain a relevant investment area despite their somewhat outdated moniker. These stocks can offer affordability and growth potential, particularly when paired with strong financials, making them worth watching for their potential to deliver impressive returns.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.365 | SGD147.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.45 | SEK258.7M | ✅ 4 ⚠️ 3 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.25 | MYR653.81M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.495 | MYR2.46B | ✅ 5 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.07 | HK$813.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.51 | £249.63M | ✅ 4 ⚠️ 5 View Analysis > |

| Warpaint London (AIM:W7L) | £3.40 | £274.68M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.14 | £355.76M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.774 | £2.09B | ✅ 5 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.31 | A$68.87M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,658 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fu Shou Yuan International Group Limited, with a market cap of HK$8.68 billion, operates in the People’s Republic of China providing burial and funeral services through its subsidiaries.

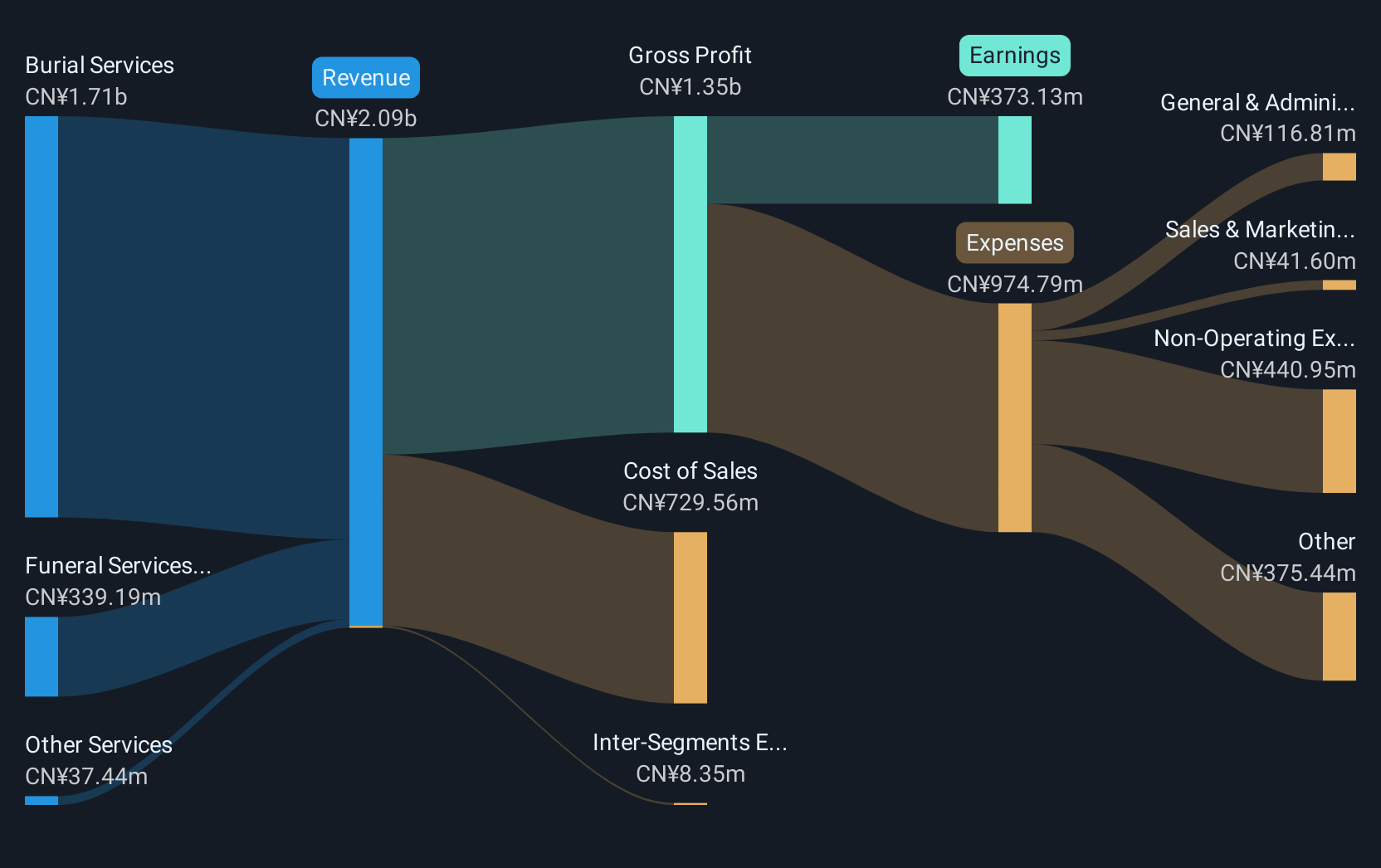

Operations: The company's revenue is primarily derived from burial services (CN¥1.71 billion) and funeral services (CN¥339.19 million), with additional income from other services (CN¥37.44 million).

Market Cap: HK$8.68B

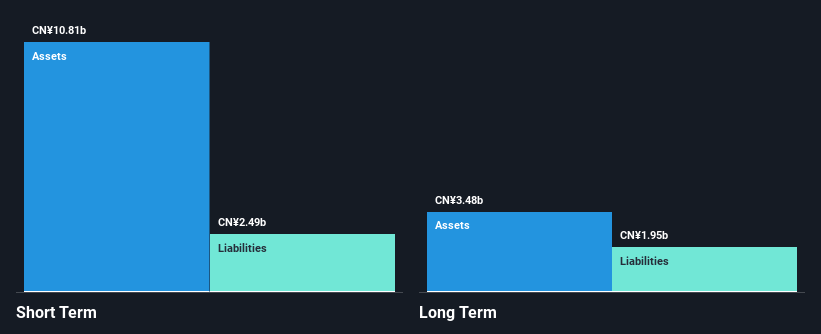

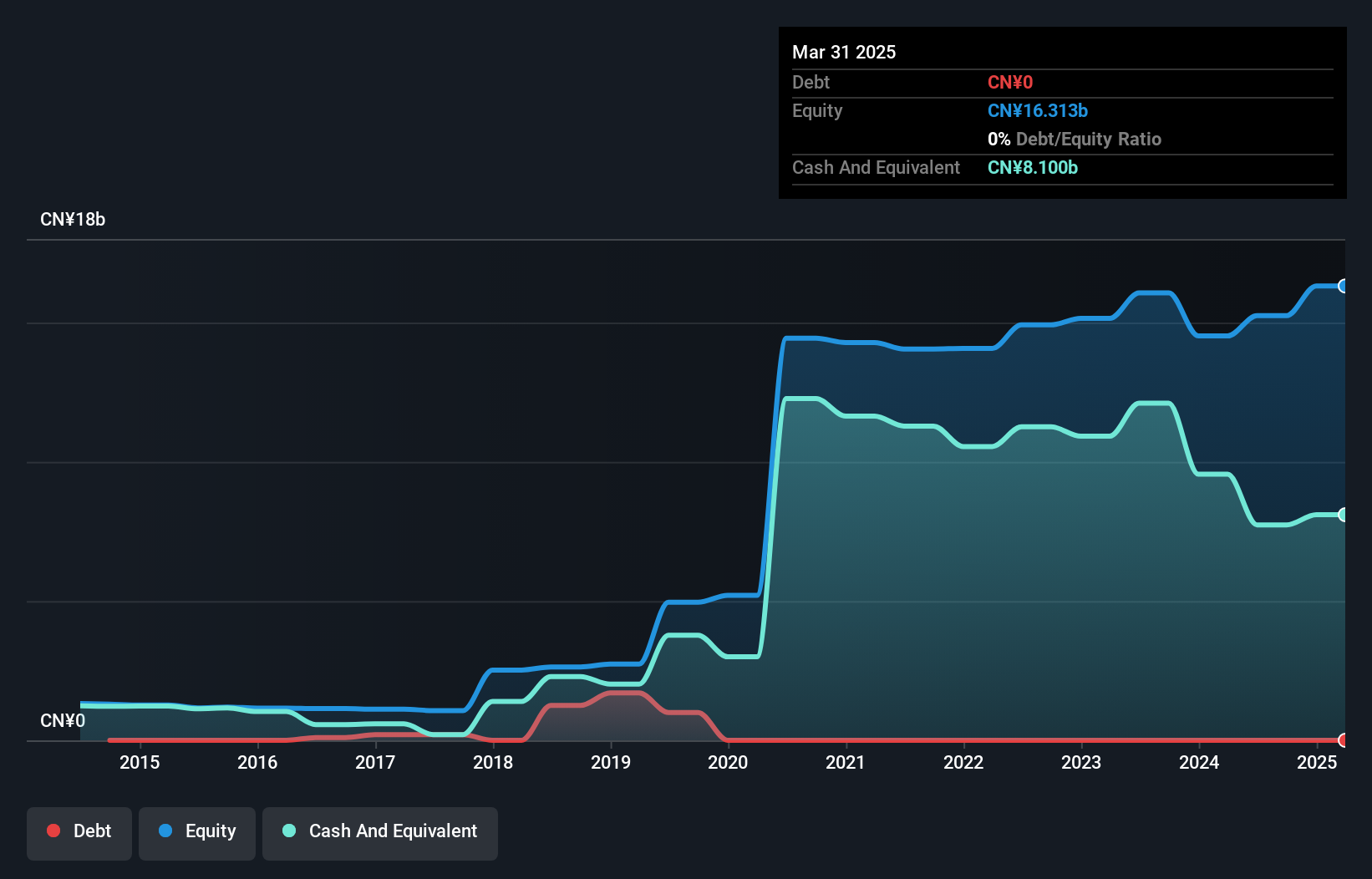

Fu Shou Yuan International Group, with a market cap of HK$8.68 billion, has shown mixed financial performance. Its short-term assets (CN¥3.6 billion) exceed both short and long-term liabilities, indicating solid liquidity. However, recent earnings have declined significantly due to decreased core business revenue and increased tax expenses, with net income dropping to CN¥373.13 million from CN¥791.24 million the previous year. Despite these challenges, the company maintains a strong cash position relative to its debt and has announced special dividends totaling approximately HKD 900 million for 2025 as part of its cash management strategy.

- Unlock comprehensive insights into our analysis of Fu Shou Yuan International Group stock in this financial health report.

- Assess Fu Shou Yuan International Group's future earnings estimates with our detailed growth reports.

Tong Ren Tang Technologies (SEHK:1666)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tong Ren Tang Technologies Co. Ltd. is engaged in the manufacturing and sale of Chinese medicine products both in Mainland China and internationally, with a market cap of HK$6.24 billion.

Operations: The company's revenue is primarily generated from its operations, with CN¥4.46 billion attributed to its core business and CN¥1.47 billion from Tong Ren Tang Chinese Medicine.

Market Cap: HK$6.24B

Tong Ren Tang Technologies, with a market cap of HK$6.24 billion, has demonstrated stable financial footing despite recent challenges. The company reported full-year sales of CN¥7.26 billion, an increase from the previous year, yet net income declined to CN¥521.8 million from CN¥590.19 million due to lower profit margins and negative earnings growth over the past year. While its short-term assets exceed liabilities and it maintains more cash than total debt, management's inexperience may pose risks. The company proposed a final dividend of RMB 0.18 per share for 2024, reflecting consistent shareholder returns amidst volatility concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Tong Ren Tang Technologies.

- Understand Tong Ren Tang Technologies' earnings outlook by examining our growth report.

Alibaba Health Information Technology (SEHK:241)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alibaba Health Information Technology Limited operates in pharmaceutical direct sales, e-commerce platforms, and healthcare and digital services in Mainland China and Hong Kong, with a market cap of approximately HK$76.55 billion.

Operations: The company generates revenue of CN¥28.34 billion from its distribution and development of pharmaceutical and healthcare business segment.

Market Cap: HK$76.55B

Alibaba Health Information Technology, with a market cap of HK$76.55 billion, operates in pharmaceutical direct sales and healthcare services across Mainland China and Hong Kong. The company is debt-free, with short-term assets (CN¥11.9 billion) comfortably exceeding both short-term (CN¥4.9 billion) and long-term liabilities (CN¥149.2 million). Earnings have grown significantly over the past five years but recently faced a large one-off loss of CN¥395.8 million impacting financial results to September 2024. Despite high volatility in its share price, earnings are forecast to grow by 19.44% annually, suggesting potential for future growth amidst current challenges.

- Dive into the specifics of Alibaba Health Information Technology here with our thorough balance sheet health report.

- Examine Alibaba Health Information Technology's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Dive into all 5,658 of the Global Penny Stocks we have identified here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English