Expert Outlook: Ocular Therapeutix Through The Eyes Of 5 Analysts

Across the recent three months, 5 analysts have shared their insights on Ocular Therapeutix (NASDAQ:OCUL), expressing a variety of opinions spanning from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 2 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

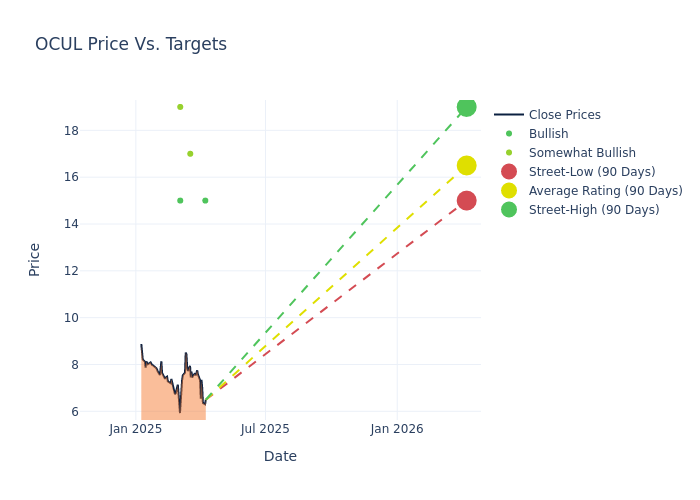

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $16.2, with a high estimate of $19.00 and a low estimate of $15.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 6.52%.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Ocular Therapeutix among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|------------------------|---------------|-----------------|--------------------|--------------------| |Serge Belanger |Needham |Maintains |Buy | $15.00|$15.00 | |Luca Issi |RBC Capital |Announces |Outperform | $17.00|- | |Serge Belanger |Needham |Announces |Buy | $15.00|- | |Jonathan Wolleben |Citizens Capital Markets|Lowers |Market Outperform| $19.00|$22.00 | |Yi Chen |HC Wainwright & Co. |Maintains |Buy | $15.00|$15.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Ocular Therapeutix. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Ocular Therapeutix compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Ocular Therapeutix's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Ocular Therapeutix analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Ocular Therapeutix

Ocular Therapeutix Inc is a biotechnology company that specializes in therapies for diseases and conditions of the eye. The company uses its proprietary hydrogel platform technology to deliver therapeutic agents to the eye. Its pipeline consists of eye medication that aims to overcome the limitations of current eye-drop-based therapies for ophthalmic diseases and conditions. Its pipeline product includes Dextenza, OTX-TIC, OTX-TKI, and OTX-IVT.

Ocular Therapeutix's Economic Impact: An Analysis

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3M period, Ocular Therapeutix showcased positive performance, achieving a revenue growth rate of 15.41% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Ocular Therapeutix's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -283.27%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Ocular Therapeutix's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -14.5%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Ocular Therapeutix's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -10.21%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Ocular Therapeutix's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.24.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English