Demystifying Samsara: Insights From 8 Analyst Reviews

In the latest quarter, 8 analysts provided ratings for Samsara (NYSE:IOT), showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 5 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 4 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

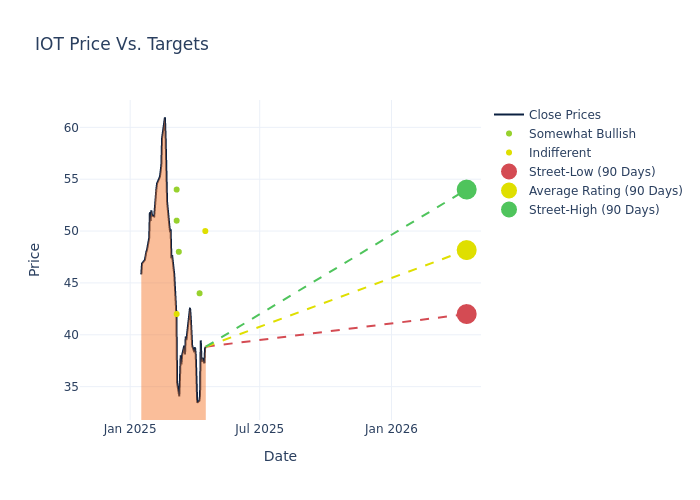

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $48.38, with a high estimate of $54.00 and a low estimate of $42.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 9.99%.

Investigating Analyst Ratings: An Elaborate Study

The standing of Samsara among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Keith Weiss |Morgan Stanley |Lowers |Equal-Weight | $50.00|$56.00 | |James Fish |Piper Sandler |Lowers |Overweight | $44.00|$50.00 | |Daniel Jester |BMO Capital |Maintains |Outperform | $48.00|$48.00 | |James Fish |Piper Sandler |Maintains |Overweight | $50.00|$50.00 | |Matthew Hedberg |RBC Capital |Lowers |Outperform | $54.00|$64.00 | |Junaid Siddiqui |Truist Securities |Lowers |Hold | $42.00|$50.00 | |Daniel Jester |BMO Capital |Lowers |Market Perform | $48.00|$57.00 | |Michael Turrin |Wells Fargo |Lowers |Overweight | $51.00|$55.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Samsara. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Samsara compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Samsara's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Samsara's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Samsara analyst ratings.

Get to Know Samsara Better

Samsara Inc provides an end-to-end solution for operations. The company's Connected Operations Platform consolidates data from its IoT devices and a growing ecosystem of connected assets and third-party systems, and makes it easy for organizations to access, analyze, and act on data insights using its cloud dashboard, custom alerts and reports, mobile apps, and workflows.. The company derives almost all of its revenue from subscription services. Geographically, it derives a majority of its revenue from the United States. The company's customers ranges from small and medium-sized businesses to state and local governments.

Understanding the Numbers: Samsara's Finances

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Samsara's revenue growth over a period of 3M has been noteworthy. As of 31 January, 2025, the company achieved a revenue growth rate of approximately 25.34%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -3.23%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Samsara's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -1.08%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Samsara's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -0.58%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Samsara's debt-to-equity ratio is below the industry average. With a ratio of 0.08, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English