SIGN UP

LOG IN

Top 2 Utilities Stocks That Could Lead To Your Biggest Gains In April

Benzinga·04/17/2025 11:48:42

Listen to the news

The most oversold stocks in the utilities sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Sunnova Energy International Inc (NYSE:NOVA)

- On April 11, Sunnova announced appointment of two independent directors. The company's stock fell around 44% over the past month and has a 52-week low of $0.18.

- RSI Value: 22.4

- NOVA Price Action: Shares of Sunnova Energy fell 18.3% to close at $0.19 on Wednesday.

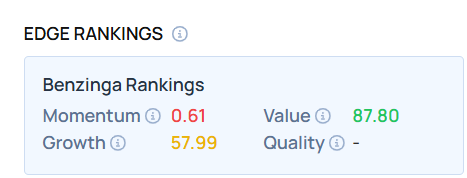

- Edge Stock Ratings: 0.61 Momentum score with Value at 87.80.

Pure Cycle Corp (NASDAQ:PCYO)

- On April 9, the company said revenues for the three and six months ended February 28, came in at $4.0 million and $9.7 million. “Despite typical winter slowdowns, Pure Cycle maintained positive net income in the quarter, leveraging its robust balance sheet and diversified asset portfolio. Our earnings showcased the strength of our oil and gas royalty portfolio through our royalty income and the strength of our water and wastewater infrastructure through our water and wastewater tap sales. We continue to see strong demand for our entry-level housing at Sky Ranch as we expand development across multiple subphases,” stated Marc Spezialy, CFO of Pure Cycle. The company's stock fell around 7% over the past month and has a 52-week low of $8.94.

- RSI Value: 19.7

- PCYO Price Action: Shares of Pure Cycle fell 0.1% to close at $10.00 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in PCYO stock.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Risk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.